Instructions For Form Dtf-14.1 Requirement Of Power Of Attorney

ADVERTISEMENT

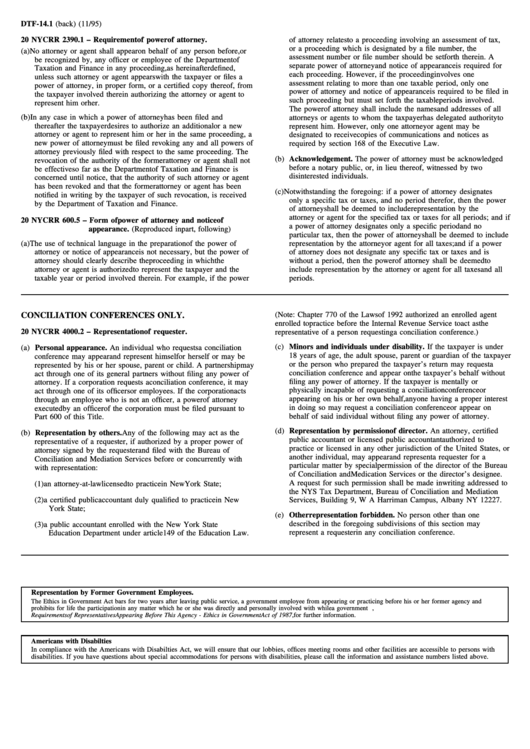

DTF-14.1 (back) (11/95)

20 NYCRR 2390.1 – Requirement of power of attorney.

of attorney relates to a proceeding involving an assessment of tax,

or a proceeding which is designated by a file number, the

(a) No attorney or agent shall appear on behalf of any person before, or

assessment number or file number should be set forth therein. A

be recognized by, any officer or employee of the Department of

separate power of attorney and notice of appearance is required for

Taxation and Finance in any proceeding, as hereinafter defined,

each proceeding. However, if the proceeding involves one

unless such attorney or agent appears with the taxpayer or files a

assessment relating to more than one taxable period, only one

power of attorney, in proper form, or a certified copy thereof, from

power of attorney and notice of appearance is required to be filed in

the taxpayer involved therein authorizing the attorney or agent to

such proceeding but must set forth the taxable periods involved.

represent him or her.

The power of attorney shall include the names and addresses of all

(b) In any case in which a power of attorney has been filed and

attorneys or agents to whom the taxpayer has delegated authority to

thereafter the taxpayer desires to authorize an additional or a new

represent him. However, only one attorney or agent may be

attorney or agent to represent him or her in the same proceeding, a

designated to receive copies of communications and notices as

new power of attorney must be filed revoking any and all powers of

required by section 168 of the Executive Law.

attorney previously filed with respect to the same proceeding. The

(b) Acknowledgement. The power of attorney must be acknowledged

revocation of the authority of the former attorney or agent shall not

before a notary public, or, in lieu thereof, witnessed by two

be effective so far as the Department of Taxation and Finance is

disinterested individuals.

concerned until notice, that the authority of such attorney or agent

has been revoked and that the former attorney or agent has been

(c) Notwithstanding the foregoing: if a power of attorney designates

notified in writing by the taxpayer of such revocation, is received

only a specific tax or taxes, and no period therefor, then the power

by the Department of Taxation and Finance.

of attorney shall be deemed to include representation by the

attorney or agent for the specified tax or taxes for all periods; and if

20 NYCRR 600.5 – Form of power of attorney and notice of

a power of attorney designates only a specific period and no

appearance. (Reproduced in part, following)

particular tax, then the power of attorney shall be deemed to include

(a) The use of technical language in the preparation of the power of

representation by the attorney or agent for all taxes; and if a power

attorney or notice of appearance is not necessary, but the power of

of attorney does not designate any specific tax or taxes and is

attorney should clearly describe the proceeding in which the

without a period, then the power of attorney shall be deemed to

attorney or agent is authorized to represent the taxpayer and the

include representation by the attorney or agent for all taxes and all

taxable year or period involved therein. For example, if the power

periods.

(Note: Chapter 770 of the Laws of 1992 authorized an enrolled agent

CONCILIATION CONFERENCES ONLY.

enrolled to practice before the Internal Revenue Service to act as the

20 NYCRR 4000.2 – Representation of requester.

representative of a person requesting a conciliation conference.)

(c) Minors and individuals under disability. If the taxpayer is under

(a) Personal appearance. An individual who requests a conciliation

18 years of age, the adult spouse, parent or guardian of the taxpayer

conference may appear and represent himself or herself or may be

or the person who prepared the taxpayer’s return may request a

represented by his or her spouse, parent or child. A partnership may

conciliation conference and appear on the taxpayer’s behalf without

act through one of its general partners without filing any power of

filing any power of attorney. If the taxpayer is mentally or

attorney. If a corporation requests a conciliation conference, it may

physically incapable of requesting a conciliation conference or

act through one of its officers or employees. If the corporation acts

appearing on his or her own behalf, anyone having a proper interest

through an employee who is not an officer, a power of attorney

in doing so may request a conciliation conference or appear on

executed by an officer of the corporation must be filed pursuant to

behalf of said individual without filing any power of attorney.

Part 600 of this Title.

(d) Representation by permission of director. An attorney, certified

(b) Representation by others. Any of the following may act as the

public accountant or licensed public accountant authorized to

representative of a requester, if authorized by a proper power of

practice or licensed in any other jurisdiction of the United States, or

attorney signed by the requester and filed with the Bureau of

another individual, may appear and represent a requester for a

Conciliation and Mediation Services before or concurrently with

particular matter by special permission of the director of the Bureau

with representation:

of Conciliation and Medication Services or the director’s designee.

A request for such permission shall be made in writing addressed to

(1) an attorney-at-law licensed to practice in New York State;

the NYS Tax Department, Bureau of Conciliation and Mediation

(2) a certified public accountant duly qualified to practice in New

Services, Building 9, W A Harriman Campus, Albany NY 12227.

York State;

(e) Other representation forbidden. No person other than one

described in the foregoing subdivisions of this section may

(3) a public accountant enrolled with the New York State

represent a requester in any conciliation conference.

Education Department under article 149 of the Education Law.

Representation by Former Government Employees.

The Ethics in Government Act bars for two years after leaving public service, a government employee from appearing or practicing before his or her former agency and

prohibits for life the participation in any matter which he or she was directly and personally involved with while a government employee. Request publication N-89-7,

Requirements of Representatives Appearing Before This Agency - Ethics in Government Act of 1987, for further information.

Americans with Disabilties

In compliance with the Americans with Disabilties Act, we will ensure that our lobbies, offices meeting rooms and other facilities are accessible to persons with

disabilities. If you have questions about special accommodations for persons with disabilities, please call the information and assistance numbers listed above.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1