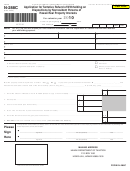

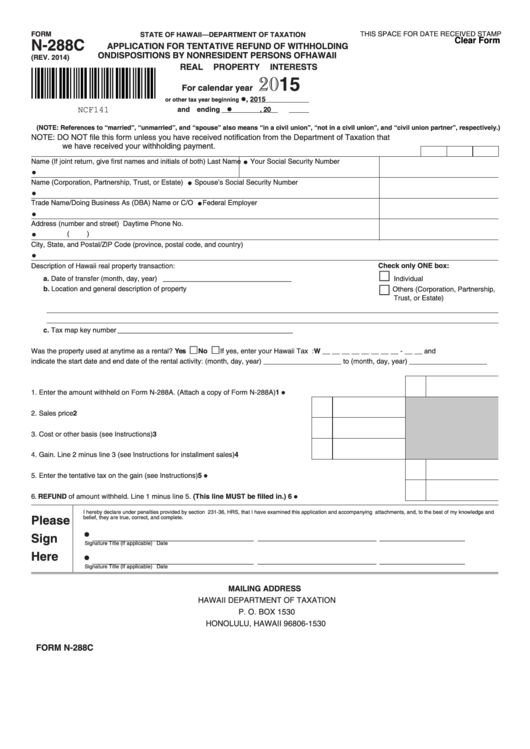

FORM

STATE OF HAWAII—DEPARTMENT OF TAXATION

THIS SPACE FOR DATE RECEIVED STAMP

N-288C

Clear Form

APPLICATION FOR TENTATIVE REFUND OF WITHHOLDING

ON DISPOSITIONS BY NONRESIDENT PERSONS OF HAWAII

(REV. 2014)

REAL PROPERTY INTERESTS

2015

For calendar year

or other tax year beginning

, 2015

NCF141

and ending

, 20

(NOTE: References to “married”, “unmarried”, and “spouse” also means “in a civil union”, “not in a civil union”, and “civil union partner”, respectively.)

NOTE: DO NOT file this form unless you have received notification from the Department of Taxation that

we have received your withholding payment.

Name (If joint return, give first names and initials of both)

Last Name

Your Social Security Number

Name (Corporation, Partnership, Trust, or Estate)

Spouse’s Social Security Number

Trade Name/Doing Business As (DBA) Name or C/O

Federal Employer I.D. No.

Address (number and street)

Daytime Phone No.

(

)

City, State, and Postal/ZIP Code (province, postal code, and country)

Check only ONE box:

Description of Hawaii real property transaction:

a. Date of transfer (month, day, year) _________________________________

Individual

b. Location and general description of property

Others (Corporation, Partnership,

Trust, or Estate)

c. Tax map key number _____________________________________________

Was the property used at anytime as a rental? Yes

No

If yes, enter your Hawaii Tax I.D. Number: W __ __ __ __ __ __ __ __ - __ __ and

indicate the start date and end date of the rental activity: (month, day, year) ____________________ to (month, day, year) ____________________

1

•

1. Enter the amount withheld on Form N-288A. (Attach a copy of Form N-288A) ...............................................................

2

2. Sales price .......................................................................................................................

3

3. Cost or other basis (see Instructions) ..............................................................................

4

4. Gain. Line 2 minus line 3 (see Instructions for installment sales) ....................................

5

•

5. Enter the tentative tax on the gain (see Instructions) .......................................................................................................

6. REFUND of amount withheld. Line 1 minus line 5. (This line MUST be filled in.) ........................................................

6

•

I hereby declare under penalties provided by section 231-36, HRS, that I have examined this application and accompanying attachments, and, to the best of my knowledge and

Please

belief, they are true, correct, and complete.

Sign

__________________________________

_________________________

__________________

Signature

Title (If applicable)

Date

Here

__________________________________

_________________________

__________________

Signature

Title (If applicable)

Date

MAILING ADDRESS

HAWAII DEPARTMENT OF TAXATION

P. O. BOX 1530

HONOLULU, HAWAII 96806-1530

FORM N-288C

1

1