Net Profit Tax Return Form - City Of Stow, Ohio - 2014

ADVERTISEMENT

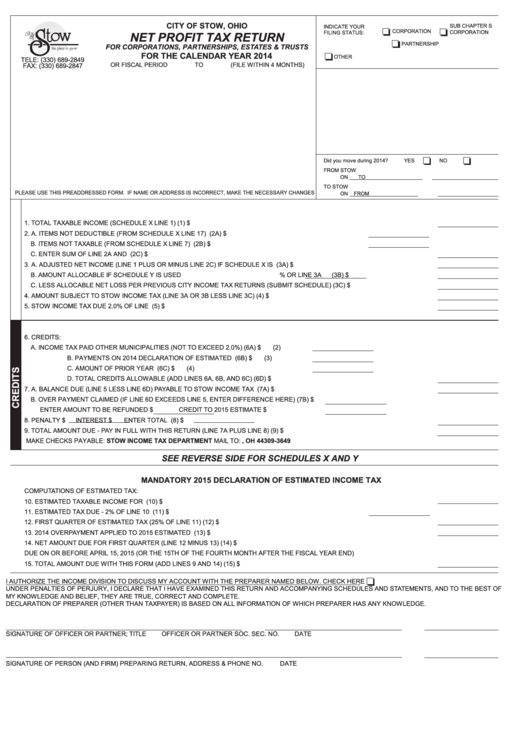

CITY OF STOW, OHIO

SUB CHAPTER S

INDICATE YOUR

CORPORATION

CORPORATION

NET PROFIT TAX RETURN

FILING STATUS:

PARTNERSHIP

FOR CORPORATIONS, PARTNERSHIPS, ESTATES & TRUSTS

FOR THE CALENDAR YEAR 2014

OTHER .....................................................................................................

TELE: (330) 689-2849

OR FISCAL PERIOD

TO

(FILE WITHIN 4 MONTHS)

FAX: (330) 689-2847

Did you move during 2014?

YES

NO

FROM STOW

ON

TO

TO STOW

PLEASE USE THIS PREADDRESSED FORM. IF NAME OR ADDRESS IS INCORRECT, MAKE THE NECESSARY CHANGES

ON

FROM

1. TOTAL TAXABLE INCOME (SCHEDULE X LINE 1)...............................................................................................................................................(1) $

2. A. ITEMS NOT DEDUCTIBLE (FROM SCHEDULE X LINE 17) ADD..........................................................................(2A) $

B. ITEMS NOT TAXABLE (FROM SCHEDULE X LINE 7) DEDUCT............................................................................(2B) $

C. ENTER SUM OF LINE 2A AND 2B...................................................................................................................................................................(2C) $

3. A. ADJUSTED NET INCOME (LINE 1 PLUS OR MINUS LINE 2C) IF SCHEDULE X IS USED..........................................................................(3A) $

B. AMOUNT ALLOCABLE IF SCHEDULE Y IS USED

% OR LINE 3A

(3B) $

C. LESS ALLOCABLE NET LOSS PER PREVIOUS CITY INCOME TAX RETURNS (SUBMIT SCHEDULE)....................................................(3C) $

4. AMOUNT SUBJECT TO STOW INCOME TAX (LINE 3A OR 3B LESS LINE 3C)..................................................................................................(4) $

5. STOW INCOME TAX DUE 2.0% OF LINE 4...........................................................................................................................................................(5) $

6. CREDITS:

A. INCOME TAX PAID OTHER MUNICIPALITIES (NOT TO EXCEED 2.0%)..............................(6A) $

(2)

B. PAYMENTS ON 2014 DECLARATION OF ESTIMATED TAX.............................(6B) $

(3)

C. AMOUNT OF PRIOR YEAR CREDIT..................................................................(6C) $

(4)

D. TOTAL CREDITS ALLOWABLE (ADD LINES 6A, 6B, AND 6C).................................................................................................(6D) $

7. A. BALANCE DUE (LINE 5 LESS LINE 6D) PAYABLE TO STOW INCOME TAX DEPARTMENT.......................................................................(7A) $

B. OVER PAYMENT CLAIMED (IF LINE 6D EXCEEDS LINE 5, ENTER DIFFERENCE HERE)

(7B) $

ENTER AMOUNT TO BE REFUNDED $

CREDIT TO 2015 ESTIMATE $

8. PENALTY $

INTEREST $

ENTER TOTAL HERE..............................................(8) $

9. TOTAL AMOUNT DUE - PAY IN FULL WITH THIS RETURN (LINE 7A PLUS LINE 8)..........................................................................................(9) $

MAKE CHECKS PAYABLE: STOW INCOME TAX DEPARTMENT MAIL TO: P.O. BOX 3649 AKRON, OH 44309-3649

SEE REVERSE SIDE FOR SCHEDULES X AND Y

MANDATORY 2015 DECLARATION OF ESTIMATED INCOME TAX

COMPUTATIONS OF ESTIMATED TAX:

10. ESTIMATED TAXABLE INCOME FOR YEAR.....................................................................................................................................................(10) $

11. ESTIMATED TAX DUE - 2% OF LINE 10 ....................................................................................................................(11) $

12. FIRST QUARTER OF ESTIMATED TAX (25% OF LINE 11)..............................................................................................................................(12) $

13. 2014 OVERPAYMENT APPLIED TO 2015 ESTIMATED TAX.............................................................................................................................(13) $

14. NET AMOUNT DUE FOR FIRST QUARTER (LINE 12 MINUS 13)....................................................................................................................(14) $

DUE ON OR BEFORE APRIL 15, 2015 (OR THE 15TH OF THE FOURTH MONTH AFTER THE FISCAL YEAR END)

15. TOTAL AMOUNT DUE WITH THIS FORM (ADD LINES 9 AND 14)...................................................................................................................(15) $

I AUTHORIZE THE INCOME DIVISION TO DISCUSS MY ACCOUNT WITH THE PREPARER NAMED BELOW. CHECK HERE

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF

MY KNOWLEDGE AND BELIEF, THEY ARE TRUE, CORRECT AND COMPLETE.

DECLARATION OF PREPARER (OTHER THAN TAXPAYER) IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

SIGNATURE OF OFFICER OR PARTNER; TITLE

OFFICER OR PARTNER SOC. SEC. NO.

DATE

SIGNATURE OF PERSON (AND FIRM) PREPARING RETURN, ADDRESS & PHONE NO.

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2