Nc-4 Nra Allowance Worksheet With Important Information About New 2015 Filing Rules

ADVERTISEMENT

IMPORTANT INFORMATION ABOUT NEW FORM NC-4 NRA

The following information supplements information in NC-30, 2015 Withholding Tables and Instructions for

Employers, Form NC-4 NRA, Nonresident Alien Employee’s Withholding Allowance Certificate, and

Important Notice to Employers and Pension Payers That Withhold North Carolina Income Tax dated

December 22, 2014.

North Carolina’s wage bracket tables, percentage method, and annualized method of computing the amount

of income tax to be withheld incorporate the standard deduction allowed to most taxpayers in determining

the amount to be withheld.

However, nonresident aliens generally are not eligible for the standard

deduction. Form NC-4 NRA requires the nonresident alien employee to enter on line 2 an additional amount

of income tax to be withheld for each pay period to account for the inclusion of the standard deduction in the

wage bracket tables, percentage, and annualized methods of computing income tax withheld. The additional

tax to withhold per pay period is identified in a chart on page 2 of Form NC-4 NRA and represents the

income tax on the standard deduction for the single filing status ($7,500) divided by the number of payroll

periods during the year. For example, an employee paid monthly is required to enter $36 ($7,500 X 5.75% ÷

12).

The additional withholding properly addresses the tax impact of the ineligibility for the standard deduction

for most nonresident alien employees. However, the additional withholding results in overwithholding in

two instances - (1) employees that earn less than $7,500 per year, and (2) employees who are students or

business apprentices and residents of India. To prevent overwithholding in the first instance, an employer

should limit the additional withholding to the lesser of the amount reported by the employee on line 2 or

5.75% of the wages for that period if the amount of wages for that period multiplied by the number of

payroll periods during the year is $7,500 or less. The following chart lists the wages per period that qualify

for the 5.75% limitation. Wages exceeding the amounts in the chart are subject to the entire amount of

additional withholding.

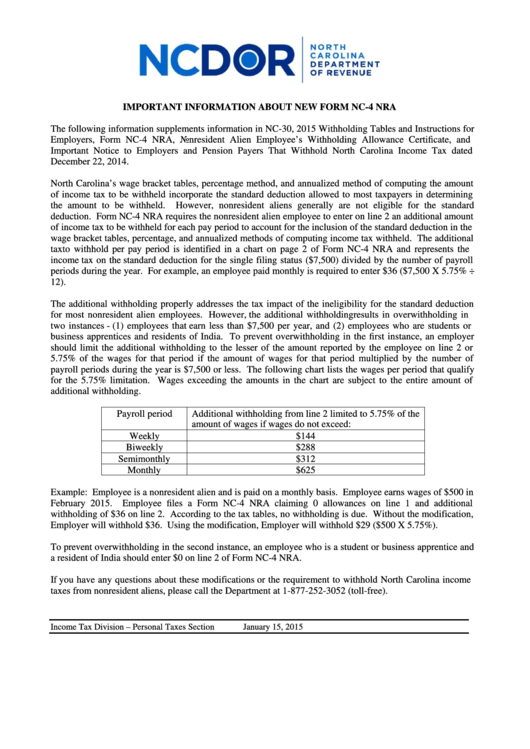

Payroll period

Additional withholding from line 2 limited to 5.75% of the

amount of wages if wages do not exceed:

Weekly

$144

Biweekly

$288

Semimonthly

$312

Monthly

$625

Example: Employee is a nonresident alien and is paid on a monthly basis. Employee earns wages of $500 in

February 2015. Employee files a Form NC-4 NRA claiming 0 allowances on line 1 and additional

withholding of $36 on line 2. According to the tax tables, no withholding is due. Without the modification,

Employer will withhold $36. Using the modification, Employer will withhold $29 ($500 X 5.75%).

To prevent overwithholding in the second instance, an employee who is a student or business apprentice and

a resident of India should enter $0 on line 2 of Form NC-4 NRA.

If you have any questions about these modifications or the requirement to withhold North Carolina income

taxes from nonresident aliens, please call the Department at 1-877-252-3052 (toll-free).

Income Tax Division – Personal Taxes Section

January 15, 2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4