Les Form Dwc-14 - Request For Social Security Disability Benefit Information - 1994

ADVERTISEMENT

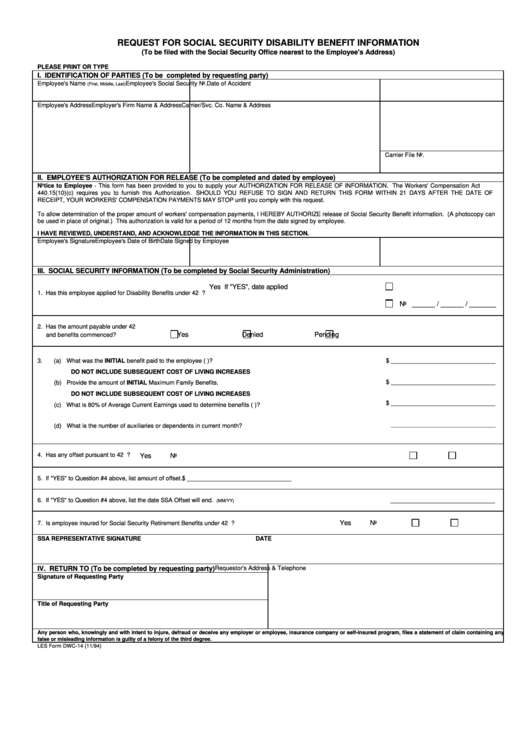

REQUEST FOR SOCIAL SECURITY DISABILITY BENEFIT INFORMATION

(To be filed with the Social Security Office nearest to the Employee's Address)

PLEASE PRINT OR TYPE

I. IDENTIFICATION OF PARTIES (To be completed by requesting party)

Employee's Name

Employee's Social Security No.

Date of Accident

(First, Middle, Last)

Employee's Address

Employer's Firm Name & Address

Carrier/Svc. Co. Name & Address

Carrier File No.

II. EMPLOYEE'S AUTHORIZATION FOR RELEASE (To be completed and dated by employee)

Notice to Employee - This form has been provided to you to supply your AUTHORIZATION FOR RELEASE OF INFORMATION. The Workers' Compensation Act F.S.

440.15(10)(c) requires you to furnish this Authorization. SHOULD YOU REFUSE TO SIGN AND RETURN THIS FORM WITHIN 21 DAYS AFTER THE DATE OF

RECEIPT, YOUR WORKERS' COMPENSATION PAYMENTS MAY STOP until you comply with this request.

To allow determination of the proper amount of workers' compensation payments, I HEREBY AUTHORIZE release of Social Security Benefit information. (A photocopy can

be used in place of original.) This authorization is valid for a period of 12 months from the date signed by employee.

I HAVE REVIEWED, UNDERSTAND, AND ACKNOWLEDGE THE INFORMATION IN THIS SECTION.

Employee's Signature

Employee's Date of Birth

Date Signed by Employee

III. SOCIAL SECURITY INFORMATION (To be completed by Social Security Administration)

Yes If "YES", date applied

1. Has this employee applied for Disability Benefits under 42 U.S.C. Section 423?

No ______ / ______ / _______

2. Has the amount payable under 42 U.S.C. Section 423 or 402 been determined

Yes

Denied

Pending

and benefits commenced?

3.

(a) What was the INITIAL benefit paid to the employee (P.I.A.)?

$ ________________________________

DO NOT INCLUDE SUBSEQUENT COST OF LIVING INCREASES

$ ________________________________

(b) Provide the amount of INITIAL Maximum Family Benefits.

DO NOT INCLUDE SUBSEQUENT COST OF LIVING INCREASES

$ ________________________________

(c) What is 80% of Average Current Earnings used to determine benefits (A.C.E.)?

________________________________

(d) What is the number of auxiliaries or dependents in current month?

4. Has any offset pursuant to 42 U.S.C. Section 424 been taken?

Yes

No

5. If "YES" to Question #4 above, list amount of offset.

$ ________________________________

6. If "YES" to Question #4 above, list the date SSA Offset will end.

________________________________

(MM/YY)

Yes

No

7. Is employee insured for Social Security Retirement Benefits under 42 U.S.C. Section 402 and 405?

SSA REPRESENTATIVE SIGNATURE

DATE

Requestor's Address & Telephone

IV. RETURN TO (To be completed by requesting party)

Signature of Requesting Party

Title of Requesting Party

Any person who, knowingly and with intent to injure, defraud or deceive any employer or employee, insurance company or self-insured program, files a statement of claim containing any

false or misleading information is guilty of a felony of the third degree.

LES Form DWC-14 (11/94)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1