Form R-7004 - Tax Information Authorizatio Form - 2004 - Louisiana Department Of Revenue

ADVERTISEMENT

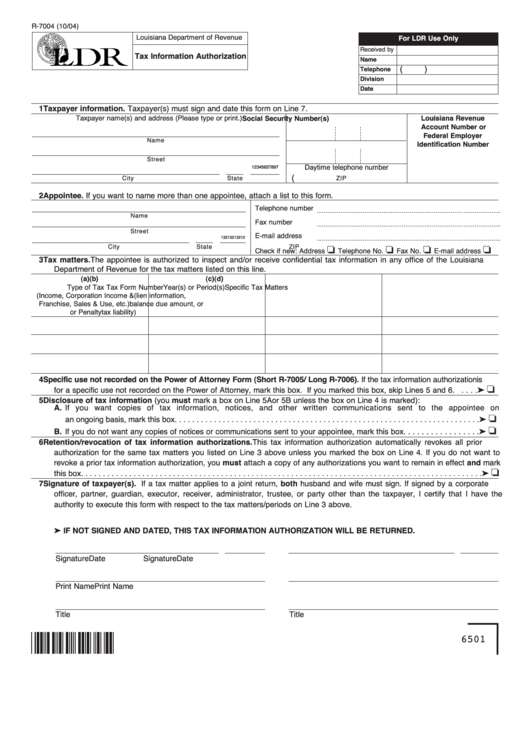

R-7004 (10/04)

Louisiana Department of Revenue

For LDR Use Only

Received by

Tax Information Authorization

Name

(

)

Telephone

Division

Date

1

Taxpayer information. Taxpayer(s) must sign and date this form on Line 7.

Taxpayer name(s) and address (Please type or print.)

Louisiana Revenue

Social Security Number(s)

Account Number or

Federal Employer

Name

Identification Number

Street

Daytime telephone number

12345657897

(

City

State

ZIP

2

Appointee. If you want to name more than one appointee, attach a list to this form.

Telephone number

Name

Fax number

Street

E-mail address

13213213212

J

J

J

J

City

State

ZIP

Check if new: Address

Telephone No.

Fax No.

E-mail address

3

Tax matters. The appointee is authorized to inspect and/or receive confidential tax information in any office of the Louisiana

Department of Revenue for the tax matters listed on this line.

(a)

(b)

(c)

(d)

Type of Tax

Tax Form Number

Year(s) or Period(s)

Specific Tax Matters

(Income, Corporation Income &

(lien information,

Franchise, Sales & Use, etc.)

balance due amount, or

or Penalty

tax liability)

4

Specific use not recorded on the Power of Attorney Form (Short R-7005/ Long R-7006). If the tax information authorization is

J

for a specific use not recorded on the Power of Attorney, mark this box. If you marked this box, skip Lines 5 and 6.

. . . .®

5

Disclosure of tax information (you must mark a box on Line 5A or 5B unless the box on Line 4 is marked):

A. If you want copies of tax information, notices, and other written communications sent to the appointee on

J

an ongoing basis, mark this box. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .®

J

B. If you do not want any copies of notices or communications sent to your appointee, mark this box. . . . . . . . . . . . . . . . .®

6

Retention/revocation of tax information authorizations. This tax information authorization automatically revokes all prior

authorization for the same tax matters you listed on Line 3 above unless you marked the box on Line 4. If you do not want to

revoke a prior tax information authorization, you must attach a copy of any authorizations you want to remain in effect and mark

J

this box. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .®

7

Signature of taxpayer(s). If a tax matter applies to a joint return, both husband and wife must sign. If signed by a corporate

officer, partner, guardian, executor, receiver, administrator, trustee, or party other than the taxpayer, I certify that I have the

authority to execute this form with respect to the tax matters/periods on Line 3 above.

® IF NOT SIGNED AND DATED, THIS TAX INFORMATION AUTHORIZATION WILL BE RETURNED.

Signature

Date

Signature

Date

Print Name

Print Name

Title

Title

6501

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1