Form E-555 Filing Instructions - Boat And Aircraft Use Tax Return

ADVERTISEMENT

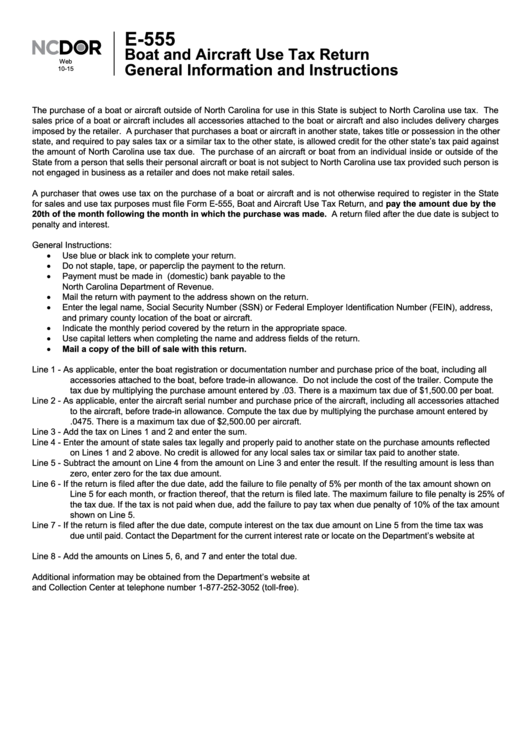

E-555

Boat and Aircraft Use Tax Return

Web

General Information and Instructions

10-15

The purchase of a boat or aircraft outside of North Carolina for use in this State is subject to North Carolina use tax. The

sales price of a boat or aircraft includes all accessories attached to the boat or aircraft and also includes delivery charges

imposed by the retailer. A purchaser that purchases a boat or aircraft in another state, takes title or possession in the other

state, and required to pay sales tax or a similar tax to the other state, is allowed credit for the other state’s tax paid against

the amount of North Carolina use tax due. The purchase of an aircraft or boat from an individual inside or outside of the

State from a person that sells their personal aircraft or boat is not subject to North Carolina use tax provided such person is

not engaged in business as a retailer and does not make retail sales.

A purchaser that owes use tax on the purchase of a boat or aircraft and is not otherwise required to register in the State

for sales and use tax purposes must file Form E-555, Boat and Aircraft Use Tax Return, and pay the amount due by the

20th of the month following the month in which the purchase was made. A return filed after the due date is subject to

penalty and interest.

General Instructions:

•

Use blue or black ink to complete your return.

•

Do not staple, tape, or paperclip the payment to the return.

•

Payment must be made in U.S. dollars by check or money order drawn on a U.S. (domestic) bank payable to the

North Carolina Department of Revenue.

•

Mail the return with payment to the address shown on the return.

•

Enter the legal name, Social Security Number (SSN) or Federal Employer Identification Number (FEIN), address,

and primary county location of the boat or aircraft.

•

Indicate the monthly period covered by the return in the appropriate space.

•

Use capital letters when completing the name and address fields of the return.

•

Mail a copy of the bill of sale with this return.

Line 1 - As applicable, enter the boat registration or documentation number and purchase price of the boat, including all

accessories attached to the boat, before trade-in allowance. Do not include the cost of the trailer. Compute the

tax due by multiplying the purchase amount entered by .03. There is a maximum tax due of $1,500.00 per boat.

Line 2 - As applicable, enter the aircraft serial number and purchase price of the aircraft, including all accessories attached

to the aircraft, before trade-in allowance. Compute the tax due by multiplying the purchase amount entered by

.0475. There is a maximum tax due of $2,500.00 per aircraft.

Line 3 - Add the tax on Lines 1 and 2 and enter the sum.

Line 4 - Enter the amount of state sales tax legally and properly paid to another state on the purchase amounts reflected

on Lines 1 and 2 above. No credit is allowed for any local sales tax or similar tax paid to another state.

Line 5 - Subtract the amount on Line 4 from the amount on Line 3 and enter the result. If the resulting amount is less than

zero, enter zero for the tax due amount.

Line 6 - If the return is filed after the due date, add the failure to file penalty of 5% per month of the tax amount shown on

Line 5 for each month, or fraction thereof, that the return is filed late. The maximum failure to file penalty is 25% of

the tax due. If the tax is not paid when due, add the failure to pay tax when due penalty of 10% of the tax amount

shown on Line 5.

Line 7 - If the return is filed after the due date, compute interest on the tax due amount on Line 5 from the time tax was

due until paid. Contact the Department for the current interest rate or locate on the Department’s website at www.

.

Line 8 - Add the amounts on Lines 5, 6, and 7 and enter the total due.

Additional information may be obtained from the Department’s website at or from the Taxpayer Assistance

and Collection Center at telephone number 1-877-252-3052 (toll-free).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1