Form E-500l Instructions - 911 Service Charge - Prepaid Wireless Telecommunications Return

ADVERTISEMENT

1-15

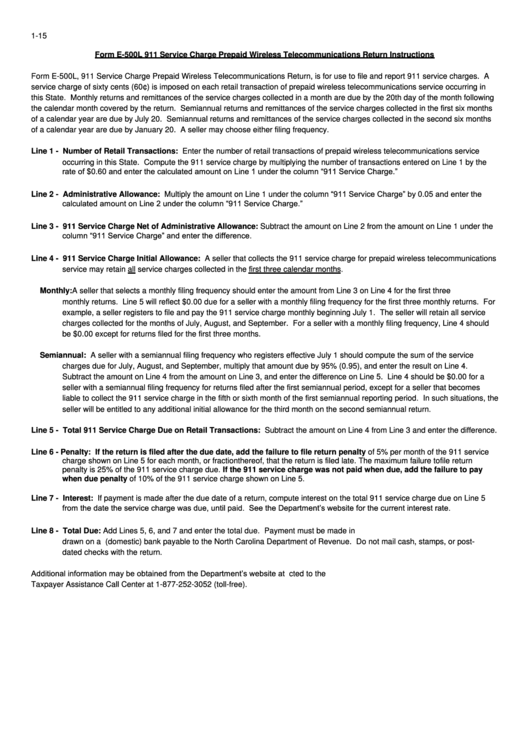

Form E-500L 911 Service Charge Prepaid Wireless Telecommunications Return Instructions

Form E-500L, 911 Service Charge Prepaid Wireless Telecommunications Return, is for use to file and report 911 service charges. A

service charge of sixty cents (60¢) is imposed on each retail transaction of prepaid wireless telecommunications service occurring in

this State. Monthly returns and remittances of the service charges collected in a month are due by the 20th day of the month following

the calendar month covered by the return. Semiannual returns and remittances of the service charges collected in the first six months

of a calendar year are due by July 20. Semiannual returns and remittances of the service charges collected in the second six months

of a calendar year are due by January 20. A seller may choose either filing frequency.

Line 1 - Number of Retail Transactions: Enter the number of retail transactions of prepaid wireless telecommunications service

occurring in this State. Compute the 911 service charge by multiplying the number of transactions entered on Line 1 by the

rate of $0.60 and enter the calculated amount on Line 1 under the column “911 Service Charge.”

Line 2 - Administrative Allowance: Multiply the amount on Line 1 under the column “911 Service Charge” by 0.05 and enter the

calculated amount on Line 2 under the column “911 Service Charge.”

Line 3 - 911 Service Charge Net of Administrative Allowance: Subtract the amount on Line 2 from the amount on Line 1 under the

column “911 Service Charge” and enter the difference.

Line 4 - 911 Service Charge Initial Allowance: A seller that collects the 911 service charge for prepaid wireless telecommunications

service may retain all service charges collected in the first three calendar months.

Monthly: A seller that selects a monthly filing frequency should enter the amount from Line 3 on Line 4 for the first three

monthly returns. Line 5 will reflect $0.00 due for a seller with a monthly filing frequency for the first three monthly returns. For

example, a seller registers to file and pay the 911 service charge monthly beginning July 1. The seller will retain all service

charges collected for the months of July, August, and September. For a seller with a monthly filing frequency, Line 4 should

be $0.00 except for returns filed for the first three months.

Semiannual: A seller with a semiannual filing frequency who registers effective July 1 should compute the sum of the service

charges due for July, August, and September, multiply that amount due by 95% (0.95), and enter the result on Line 4.

Subtract the amount on Line 4 from the amount on Line 3, and enter the difference on Line 5. Line 4 should be $0.00 for a

seller with a semiannual filing frequency for returns filed after the first semiannual period, except for a seller that becomes

liable to collect the 911 service charge in the fifth or sixth month of the first semiannual reporting period. In such situations, the

seller will be entitled to any additional initial allowance for the third month on the second semiannual return.

Line 5 - Total 911 Service Charge Due on Retail Transactions: Subtract the amount on Line 4 from Line 3 and enter the difference.

Line 6 - Penalty: If the return is filed after the due date, add the failure to file return penalty of 5% per month of the 911 service

charge shown on Line 5 for each month, or fraction thereof, that the return is filed late. The maximum failure to file return

penalty is 25% of the 911 service charge due. If the 911 service charge was not paid when due, add the failure to pay

when due penalty of 10% of the 911 service charge shown on Line 5.

Line 7 - Interest: If payment is made after the due date of a return, compute interest on the total 911 service charge due on Line 5

from the date the service charge was due, until paid. See the Department’s website for the current interest rate.

Line 8 - Total Due: Add Lines 5, 6, and 7 and enter the total due. Payment must be made in U.S. dollars by check or money order

drawn on a U.S. (domestic) bank payable to the North Carolina Department of Revenue. Do not mail cash, stamps, or post-

dated checks with the return.

Additional information may be obtained from the Department’s website at Questions should be directed to the

Taxpayer Assistance Call Center at 1-877-252-3052 (toll-free).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6