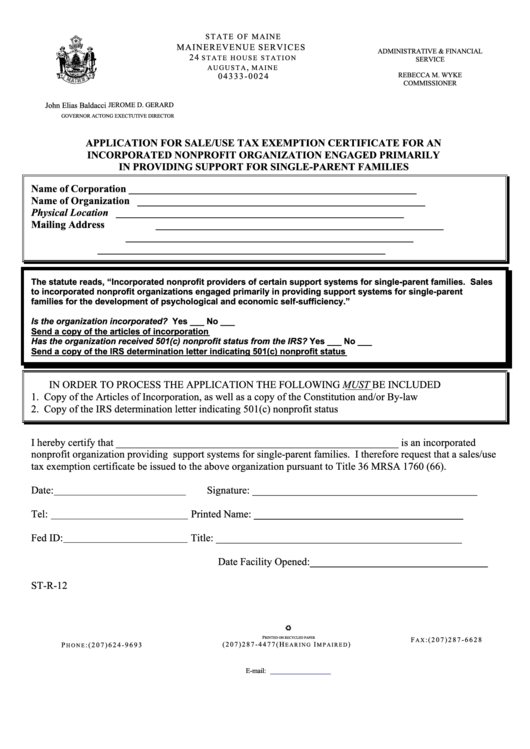

Form St-R-12 - Application For Sale/use Tax Exemption Certificate For An Incorporated Nonprofit Organization Engaged Primarily In Providing Support For Single-Parent Families

ADVERTISEMENT

S T A T E O F M A I N E

M A I N E R E V E N U E S E R V I C E S

ADMINISTRATIVE & FINANCIAL

2 4

S T A T E H O U S E S T A T I O N

SERVICE

,

A U G U S T A

M A I N E

REBECCA M. WYKE

0 4 3 3 3 - 0 0 24

COMMISSIONER

John Elias Baldacci

JEROME D. GERARD

GOVERNOR

ACTONG EXECTUTIVE DIRECTOR

APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE FOR AN

INCORPORATED NONPROFIT ORGANIZATION ENGAGED PRIMARILY

IN PROVIDING SUPPORT FOR SINGLE-PARENT FAMILIES

Name of Corporation

_______________________________________________________

Name of Organization

_______________________________________________________

Physical Location

_______________________________________________________

Mailing Address

_______________________________________________________

_______________________________________________________

_______________________________________________________

The statute reads, “Incorporated nonprofit providers of certain support systems for single-parent families. Sales

to incorporated nonprofit organizations engaged primarily in providing support systems for single-parent

families for the development of psychological and economic self-sufficiency.”

Is the organization incorporated? Yes ___ No ___

Send a copy of the articles of incorporation

Has the organization received 501(c) nonprofit status from the IRS? Yes ___ No ___

Send a copy of the IRS determination letter indicating 501(c) nonprofit status

IN ORDER TO PROCESS THE APPLICATION THE FOLLOWING MUST BE INCLUDED

1. Copy of the Articles of Incorporation, as well as a copy of the Constitution and/or By-law

2. Copy of the IRS determination letter indicating 501(c) nonprofit status

I hereby certify that ______________________________________________________ is an incorporated

nonprofit organization providing support systems for single-parent families. I therefore request that a sales/use

tax exemption certificate be issued to the above organization pursuant to Title 36 MRSA 1760 (66).

Date:

Signature: ___________________________________________

Tel:

Printed Name: ________________________________________

Fed ID:

Title: _______________________________________________

Date Facility Opened:__________________________________

ST-R-12

P

RINTED ON RECYCLED PAPER

F

: ( 2 0 7 ) 2 8 7 - 6 6 2 8

A X

( 2 0 7 ) 2 8 7 - 4 4 7 7 ( H

I

)

P

: ( 2 0 7 ) 6 2 4 - 9 6 9 3

E A R I N G

M P A I R E D

H O N E

E-mail:

sales.tax@state.me.us

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1