Income Calculation Worksheet - South Dakota Department Of Revenue & Regulation - 2007

ADVERTISEMENT

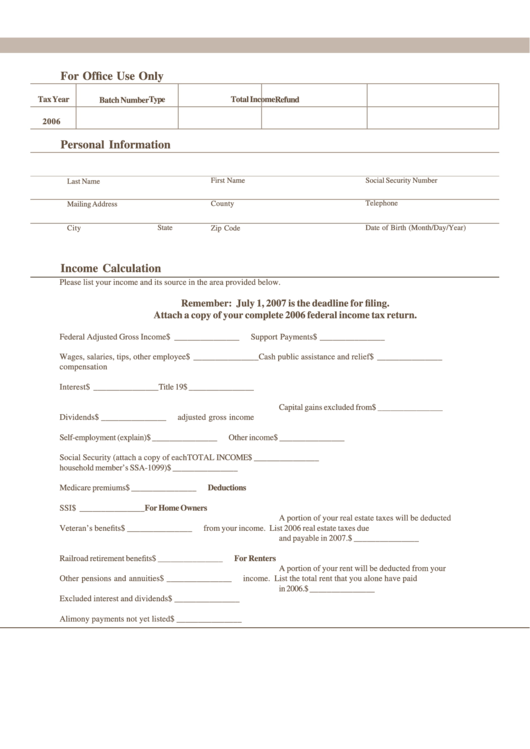

For Office Use Only

Tax Year

Type

Total Income

Batch Number

Refund

2006

Personal Information

First Name

Social Security Number

Last Name

Telephone

County

Mailing Address

State

Date of Birth (Month/Day/Year)

City

Zip Code

Income Calculation

Please list your income and its source in the area provided below.

Remember: July 1, 2007 is the deadline for filing.

Attach a copy of your complete 2006 federal income tax return.

Federal Adjusted Gross Income

$ _______________

Support Payments

$ _______________

Wages, salaries, tips, other employee

$ _______________

Cash public assistance and relief

$ _______________

compensation

Interest

$ _______________

Title 19

$ _______________

Capital gains excluded from

$ _______________

Dividends

$ _______________

adjusted gross income

Self-employment (explain)

$ _______________

Other income

$ _______________

Social Security (attach a copy of each

TOTAL INCOME

$ _______________

household member’s SSA-1099)

$ _______________

Medicare premiums

$ _______________

Deductions

SSI

$ _______________

For Home Owners

A portion of your real estate taxes will be deducted

Veteran’s benefits

$ _______________

from your income. List 2006 real estate taxes due

and payable in 2007.

$ _______________

Railroad retirement benefits

$ _______________

For Renters

A portion of your rent will be deducted from your

Other pensions and annuities

$ _______________

income. List the total rent that you alone have paid

in 2006.

$ _______________

Excluded interest and dividends

$ _______________

Alimony payments not yet listed

$ _______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2