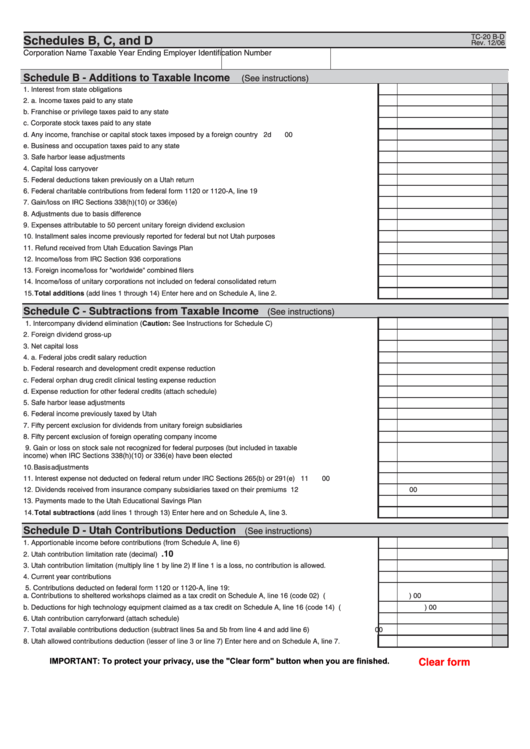

TC-20 B-D

Schedules B, C, and D

Rev. 12/06

Corporation Name

Taxable Year Ending

Employer Identification Number

Schedule B - Additions to Taxable Income

(See instructions)

1. Interest from state obligations ............................................................................................................................. 1

00

2. a.

Income taxes paid to any state ................................................................................................................... 2a

00

b.

Franchise or privilege taxes paid to any state ............................................................................................ 2b

00

c.

Corporate stock taxes paid to any state ...................................................................................................... 2c

00

d.

Any income, franchise or capital stock taxes imposed by a foreign country ................................................ 2d

00

e.

Business and occupation taxes paid to any state ....................................................................................... 2e

00

3. Safe harbor lease adjustments ........................................................................................................................... 3

00

4. Capital loss carryover .......................................................................................................................................... 4

00

5. Federal deductions taken previously on a Utah return ........................................................................................ 5

00

6. Federal charitable contributions from federal form 1120 or 1120-A, line 19 ......................................................... 6

00

7. Gain/loss on IRC Sections 338(h)(10) or 336(e) ................................................................................................. 7

00

8. Adjustments due to basis difference ................................................................................................................... 8

00

9. Expenses attributable to 50 percent unitary foreign dividend exclusion .............................................................. 9

00

10. Installment sales income previously reported for federal but not Utah purposes ................................................ 10

00

11. Refund received from Utah Education Savings Plan .......................................................................................... 11

00

12. Income/loss from IRC Section 936 corporations ................................................................................................ 12

00

13. Foreign income/loss for "worldwide" combined filers .......................................................................................... 13

00

14. Income/loss of unitary corporations not included on federal consolidated return ............................................... 14

00

15. Total additions (add lines 1 through 14) Enter here and on Schedule A, line 2. ................................................ 15

00

Schedule C - Subtractions from Taxable Income

(See instructions)

1. Intercompany dividend elimination (Caution: See Instructions for Schedule C)

............................................... 1

00

2. Foreign dividend gross-up .................................................................................................................................. 2

00

3. Net capital loss .................................................................................................................................................... 3

00

4. a.

Federal jobs credit salary reduction ............................................................................................................ 4a

00

b.

Federal research and development credit expense reduction .................................................................... 4b

00

c.

Federal orphan drug credit clinical testing expense reduction ................................................................... 4c

00

d.

Expense reduction for other federal credits (attach schedule) ................................................................... 4d

00

5. Safe harbor lease adjustments ........................................................................................................................... 5

00

6. Federal income previously taxed by Utah ........................................................................................................... 6

00

7. Fifty percent exclusion for dividends from unitary foreign subsidiaries .............................................................. 7

00

8. Fifty percent exclusion of foreign operating company income

........................................................................... 8

00

9. Gain or loss on stock sale not recognized for federal purposes (but included in taxable

income) when IRC Sections 338(h)(10) or 336(e) have been elected ................................................................ 9

00

10. Basis adjustments ............................................................................................................................................... 10

00

11. Interest expense not deducted on federal return under IRC Sections 265(b) or 291(e) ...................................... 11

00

12. Dividends received from insurance company subsidiaries taxed on their premiums .......................................... 12

00

13. Payments made to the Utah Educational Savings Plan ...................................................................................... 13

00

14. Total subtractions (add lines 1 through 13) Enter here and on Schedule A, line 3. ........................................... 14

00

Schedule D - Utah Contributions Deduction

(See instructions)

1. Apportionable income before contributions (from Schedule A, line 6) ................................................................. 1

00

.10

2. Utah contribution limitation rate (decimal) ........................................................................................................... 2

3. Utah contribution limitation (multiply line 1 by line 2) If line 1 is a loss, no contribution is allowed. ..................... 3

00

4. Current year contributions ..................................................................................................................................... 4

00

5. Contributions deducted on federal form 1120 or 1120-A, line 19:

a.

Contributions to sheltered workshops claimed as a tax credit on Schedule A, line 16 (code 02) ................ 5a

(

) 00

b.

Deductions for high technology equipment claimed as a tax credit on Schedule A, line 16 (code 14) ....... 5b

(

) 00

6. Utah contribution carryforward (attach schedule)

............................................................................................. 6

00

7. Total available contributions deduction (subtract lines 5a and 5b from line 4 and add line 6)

........................... 7

00

8. Utah allowed contributions deduction (lesser of line 3 or line 7) Enter here and on Schedule A, line 7. ............. 8

00

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1