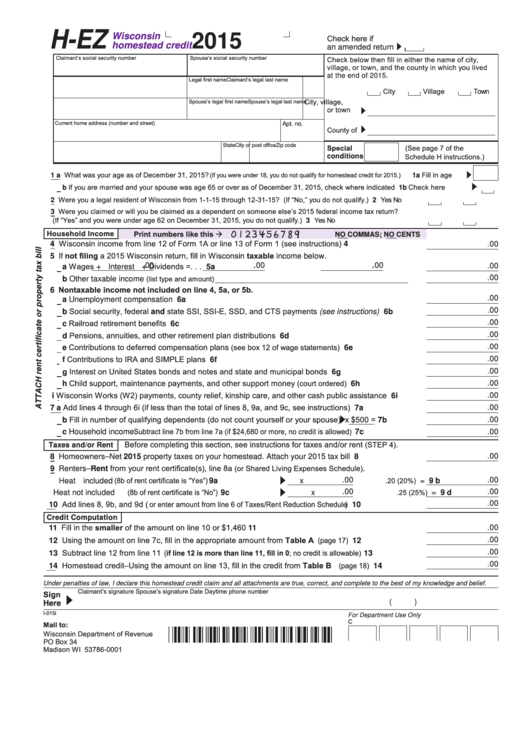

Schedule H-Ez - Wisconsin Homestead Credit Form - 2015

ADVERTISEMENT

H‑EZ

Wisconsin

2015

Check here if

homestead credit

an amended return

Claimant’s social security number

Spouse’s social security number

Check below then fill in either the name of city,

village, or town, and the county in which you lived

at the end of 2015.

M.I.

Claimant’s legal last name

Legal first name

City

Village

Town

City, village,

Spouse’s legal last name

Spouse’s legal first name

M.I.

or town

Current home address (number and street)

Apt. no.

County of

City or post office

State

Zip code

Special

(See page 7 of the

Schedule H instructions.)

conditions

1 a What was your age as of December 31, 2015?

Fill in age

(If you were under 18, you do not qualify for homestead credit for 2015.)

1a

b If you are married and your spouse was age 65 or over as of December 31, 2015, check where indicated . . . . 1b

Check here

Were you a legal resident of Wisconsin from 1-1-15 through 12-31-15? (If “No,” you do not qualify.) . . . . . . . . . 2

Yes

No

2

Were you claimed or will you be claimed as a dependent on someone else’s 2015 federal income tax return?

3

(If “Yes” and you were under age 62 on December 31, 2015, you do not qualify.) . . . . . . . . . . . . . . . . . . . . . . . . 3

Yes

No

Household Income

Print numbers like this

NO COMMAS; NO CENTS

Wisconsin income from line 12 of Form 1A or line 13 of Form 1 (see instructions) . . . . . . . . . . . . . . . 4

4

.00

If not filing a 2015 Wisconsin return, fill in Wisconsin taxable income below.

5

.

.

.

a Wages

Dividends

= . . . 5a

00

00

00

+

+

.00

Interest

(list type and amount)

.00

b Other taxable income

5b

Nontaxable income not included on line 4, 5a, or 5b.

6

.00

a Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a

b Social security, federal and state SSI, SSI-E, SSD, and CTS payments (see instructions) . . . . . . . . 6b

.00

c Railroad retirement benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6c

.00

d Pensions, annuities, and other retirement plan distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6d

.00

e Contributions to deferred compensation plans (see box 12 of wage statements) . . . . . . . . . . . . . . . . . 6e

.00

f Contributions to IRA and SIMPLE plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6f

.00

g Interest on United States bonds and notes and state and municipal bonds . . . . . . . . . . . . . . . . . . . . 6g

.00

h Child support, maintenance payments, and other support money (court ordered) . . . . . . . . . . . . . . . 6h

.00

i Wisconsin Works (W2) payments, county relief, kinship care, and other cash public assistance . . . . 6i

.00

7 a Add lines 4 through 6i (if less than the total of lines 8, 9a, and 9c, see instructions) . . . . . . . . . . . . . 7a

.00

b Fill in number of qualifying dependents (do not count yourself or your spouse)

x $500 = 7b

.00

c Household income. Subtract line 7b from line 7a (if $24,680 or more, no credit is allowed) . . . . . . . . . . . . . 7c

.00

Before completing this section, see instructions for taxes and/or rent (STEP 4) .

Taxes and/or Rent

.00

8

Homeowners – Net 2015 property taxes on your homestead. Attach your 2015 tax bill . . . . . . . . . . . . 8

Renters – Rent from your rent certificate(s), line 8a (or Shared Living Expenses Schedule) .

9

Heat included (8b of rent certificate is “Yes”) . . . . . . . . . . . . . 9a

.00

.20 (20%)

.00

x

=

9 b

Heat not included (8b of rent certificate is “No”) . . . . . . . . . . 9c

.00

.25 (25%)

.00

x

=

9 d

Add lines 8, 9b, and 9d ( or enter amount from line 6 of Taxes/Rent Reduction Schedule ) . . . . . . . . . . . . . 10

.00

10

Credit Computation

Fill in the smaller of the amount on line 10 or $1,460 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.00

11

Using the amount on line 7c, fill in the appropriate amount from Table A (page 17) . . . . . . . . . . . . . 12

.00

12

Subtract line 12 from line 11 (if line 12 is more than line 11, fill in 0; no credit is allowable) . . . . . . . . . . 13

.00

13

Homestead credit – Using the amount on line 13, fill in the credit from Table B (page 18) . . . . . . . . 14

.00

14

Under penalties of law, I declare this homestead credit claim and all attachments are true, correct, and complete to the best of my knowledge and belief.

Claimant’s signature

Spouse’s signature

Date

Daytime phone number

Sign

(

)

Here

I-015i

For Department Use Only

C

Mail to:

Wisconsin Department of Revenue

PO Box 34

Madison WI 53786-0001

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2