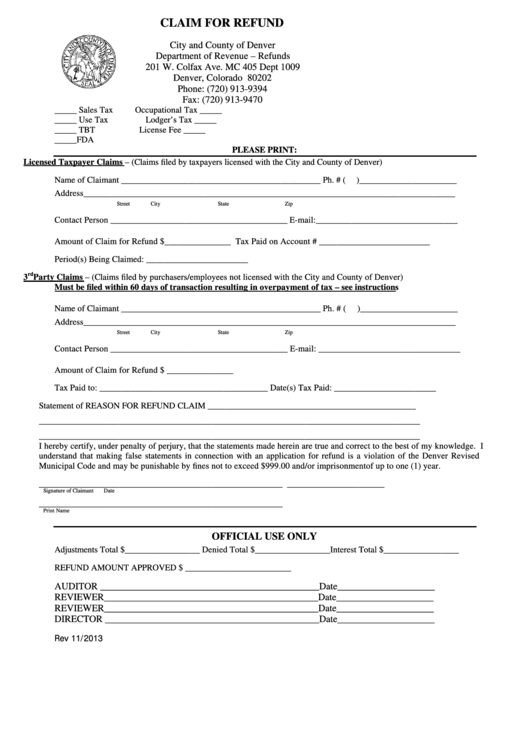

CLAIM FOR REFUND

City and County of Denver

Department of Revenue – Refunds

201 W. Colfax Ave. MC 405 Dept 1009

Denver, Colorado 80202

Phone: (720) 913-9394

Fax: (720) 913-9470

_____ Sales Tax

Occupational Tax _____

_____ Use Tax

Lodger’s Tax _____

_____ TBT

License Fee _____

_____ FDA

PLEASE PRINT:

Licensed Taxpayer Claims – (Claims filed by taxpayers licensed with the City and County of Denver)

Name of Claimant _____________________________________________ Ph. # (

)______________________

Address ____________________________________________________________________________________

Street

City

State

Zip

Contact Person ________________________________________ E-mail:________________________________

Amount of Claim for Refund $ _______________ Tax Paid on Account # _________________________

Period(s) Being Claimed: _______________________

rd

3

Party Claims – (Claims filed by purchasers/employees not licensed with the City and County of Denver)

Must be filed within 60 days of transaction resulting in overpayment of tax – see instructions

Name of Claimant _____________________________________________ Ph. # (

)______________________

Address ____________________________________________________________________________________

Street

City

State

Zip

Contact Person ________________________________________ E-mail: ________________________________

Amount of Claim for Refund $ _______________

Tax Paid to: ______________________________________ Date(s) Tax Paid: _______________________

Statement of REASON FOR REFUND CLAIM _______________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

I hereby certify, under penalty of perjury, that the statements made herein are true and correct to the best of my knowledge. I

understand that making false statements in connection with an application for refund is a violation of the Denver Revised

Municipal Code and may be punishable by fines not to exceed $999.00 and/or imprisonment of up to one (1) year.

_______________________________________________________

______________________

Signature of Claimant

Date

_______________________________________________________

Print Name

OFFICIAL USE ONLY

Adjustments Total $_________________ Denied Total $_________________Interest Total $_________________

REFUND AMOUNT APPROVED $ ________________________

AUDITOR _____________________________________________Date____________________

REVIEWER____________________________________________Date____________________

REVIEWER____________________________________________Date____________________

DIRECTOR ____________________________________________Date____________________

Rev 11/2013

1

1