Form 101 - Exemption Certificate - Wyoming Sales Tax (2004)

ADVERTISEMENT

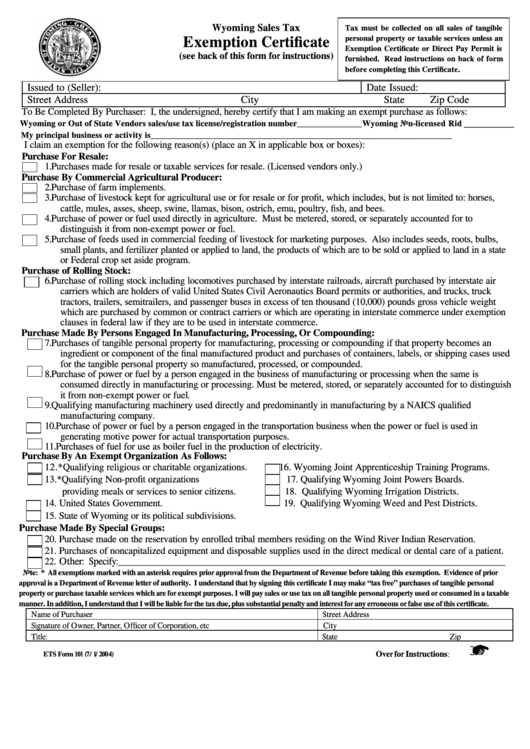

Wyoming Sales Tax

Tax must be collected on all sales of tangible

Exemption Certificate

personal property or taxable services unless an

Exemption Certificate or Direct Pay Permit is

(see back of this form for instructions)

furnished. Read instructions on back of form

before completing this Certificate.

Issued to (Seller):

Date Issued:

Street Address

City

State

Zip Code

To Be Completed By Purchaser: I, the undersigned, hereby certify that I am making an exempt purchase as follows:

___________

Wyoming or Out of State Vendors sales/use tax license/registration number_______________Wyoming Non-licensed Rid

My principal business or activity is_____________________________________________________________________

I claim an exemption for the following reason(s) (place an X in applicable box or boxes):

Purchase For Resale:

1. Purchases made for resale or taxable services for resale. (Licensed vendors only.)

Purchase By Commercial Agricultural Producer:

2. Purchase of farm implements.

3. Purchase of livestock kept for agricultural use or for resale or for profit, which includes, but is not limited to: horses,

cattle, mules, asses, sheep, swine, llamas, bison, ostrich, emu, poultry, fish, and bees.

4. Purchase of power or fuel used directly in agriculture. Must be metered, stored, or separately accounted for to

distinguish it from non-exempt power or fuel.

5. Purchase of feeds used in commercial feeding of livestock for marketing purposes. Also includes seeds, roots, bulbs,

small plants, and fertilizer planted or applied to land, the products of which are to be sold or applied to land in a state

or Federal crop set aside program.

Purchase of Rolling Stock:

6. Purchase of rolling stock including locomotives purchased by interstate railroads, aircraft purchased by interstate air

carriers which are holders of valid United States Civil Aeronautics Board permits or authorities, and trucks, truck

tractors, trailers, semitrailers, and passenger buses in excess of ten thousand (10,000) pounds gross vehicle weight

which are purchased by common or contract carriers or which are operating in interstate commerce under exemption

clauses in federal law if they are to be used in interstate commerce.

Purchase Made By Persons Engaged In Manufacturing, Processing, Or Compounding:

7. Purchases of tangible personal property for manufacturing, processing or compounding if that property becomes an

ingredient or component of the final manufactured product and purchases of containers, labels, or shipping cases used

for the tangible personal property so manufactured, processed, or compounded.

8. Purchase of power or fuel by a person engaged in the business of manufacturing or processing when the same is

consumed directly in manufacturing or processing. Must be metered, stored, or separately accounted for to distinguish

it from non-exempt power or fuel.

9. Qualifying manufacturing machinery used directly and predominantly in manufacturing by a NAICS qualified

manufacturing company.

10. Purchase of power or fuel by a person engaged in the transportation business when the power or fuel is used in

generating motive power for actual transportation purposes.

11. Purchases of fuel for use as boiler fuel in the production of electricity.

Purchase By An Exempt Organization As Follows :

12.*Qualifying religious or charitable organizations.

16. Wyoming Joint Apprenticeship Training Programs.

13.*Qualifying Non-profit organizations

17. Qualifying Wyoming Joint Powers Boards.

providing meals or services to senior citizens.

18. Qualifying Wyoming Irrigation Districts.

14. United States Government.

19. Qualifying Wyoming Weed and Pest Districts.

15. State of Wyoming or its political subdivisions.

Purchase Made By Special Groups:

20. Purchase made on the reservation by enrolled tribal members residing on the Wind River Indian Reservation.

21. Purchases of noncapitalized equipment and disposable supplies used in the direct medical or dental care of a patient.

. Other: Specify:_____________________________________________________________________________

22

Note: * All exemptions marked with an asterisk requires prior approval from the Department of Revenue before taking this exemption. Evidence of prior

approval is a Department of Revenue letter of authority. I understand that by signing this certificate I may make “tax free” purchases of tangible personal

property or purchase taxable services which are for exempt purposes. I will pay sales or use tax on all tangible personal property used or consumed in a taxable

manner. In addition, I understand that I will be liable for the tax due, plus substantial penalty and interest for any erroneous or false use of this certificate.

Name of Purchaser

Street Address

Signature of Owner, Partner, Officer of Corporation, etc

City

Title:

State

Zip

Over for Instructions:

ETS Form 101 (7/1/2004)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1