Form Dr-1 - Application To Collect And/or Report Tax In Florida (2001)

ADVERTISEMENT

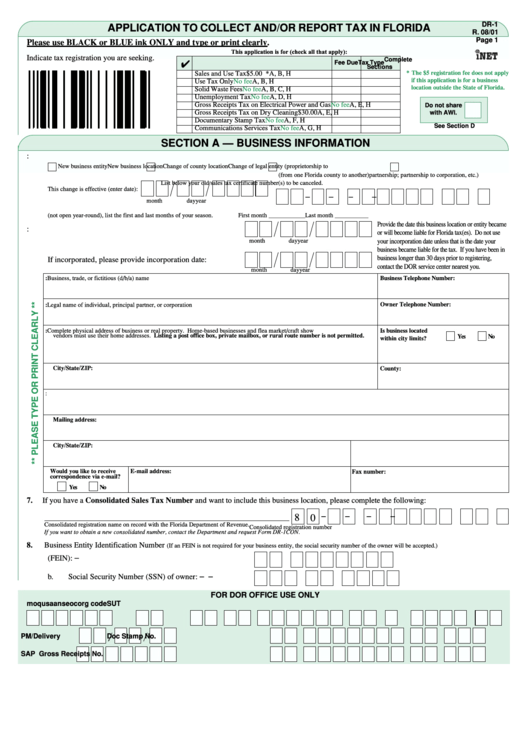

DR-1

APPLICATION TO COLLECT AND/OR REPORT TAX IN FLORIDA

R. 08/01

Page 1

Please use BLACK or BLUE ink ONLY and type or print clearly.

This application is for (check all that apply):

Indicate tax registration you are seeking.

✔

Complete

Tax Type

Fee Due

Sections

* The $5 registration fee does not apply

Sales and Use Tax

$5.00 * A, B, H

if this application is for a business

Use Tax Only

No fee

A, B, H

location outside the State of Florida.

Solid Waste Fees

No fee

A, B, C, H

Unemployment Tax

No fee

A, D, H

Gross Receipts Tax on Electrical Power and Gas

No fee

A, E, H

Do not share

Gross Receipts Tax on Dry Cleaning

$30.00

A, E, H

with AWI.

Documentary Stamp Tax

No fee

A, F, H

See Section D

Communications Services Tax

No fee

A, G, H

SECTION A — BUSINESS INFORMATION

1.

Check the box that applies:

New business entity

New business location

Change of county location

Change of legal entity (proprietorship to

(from one Florida county to another)

partnership; partnership to corporation, etc.)

List below your old sales tax certificate number(s) to be canceled.

This change is effective (enter date):

–

–

–

–

month

day

year

a.

If this is a seasonal business (not open year-round), list the first and last months of your season.

First month ____________

Last month ___________

Provide the date this business location or entity became

2.

Beginning date of business activity for this location or entity:

or will become liable for Florida tax(es). Do not use

month

day

year

your incorporation date unless that is the date your

business became liable for the tax. If you have been in

business longer than 30 days prior to registering,

If incorporated, please provide incorporation date:

contact the DOR service center nearest you.

month

day

year

3. Business name: Business, trade, or fictitious (d/b/a) name

Business Telephone Number:

4. Owner name: Legal name of individual, principal partner, or corporation

Owner Telephone Number:

5. Business location: Complete physical address of business or real property. Home-based businesses and flea market/craft show

Is business located

vendors must use their home addresses. Listing a post office box, private mailbox, or rural route number is not permitted.

Yes

No

within city limits?

City/State/ZIP:

County:

6. Mail to the attention of:

Mailing address:

City/State/ZIP:

Would you like to receive

E-mail address:

Fax number:

correspondence via e-mail?

Yes

No

7.

If you have a Consolidated Sales Tax Number and want to include this business location, please complete the following:

–

–

–

–

8 0

Consolidated registration name on record with the Florida Department of Revenue.

Consolidated registration number

If you want to obtain a new consolidated number, contact the Department and request Form DR-1CON.

8.

Business Entity Identification Number

(If an FEIN is not required for your business entity, the social security number of the owner will be accepted.)

–

a.

Federal Employer Identification Number (FEIN):

b.

Social Security Number (SSN) of owner:

–

–

FOR DOR OFFICE USE ONLY

mo qu

sa

an se oc

org code

SUT No.

kind

sic

office code

PM/Delivery

Doc Stamp No.

SAP B.P. No.

Gross Receipts No.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5