General Information For Form M-7e

ADVERTISEMENT

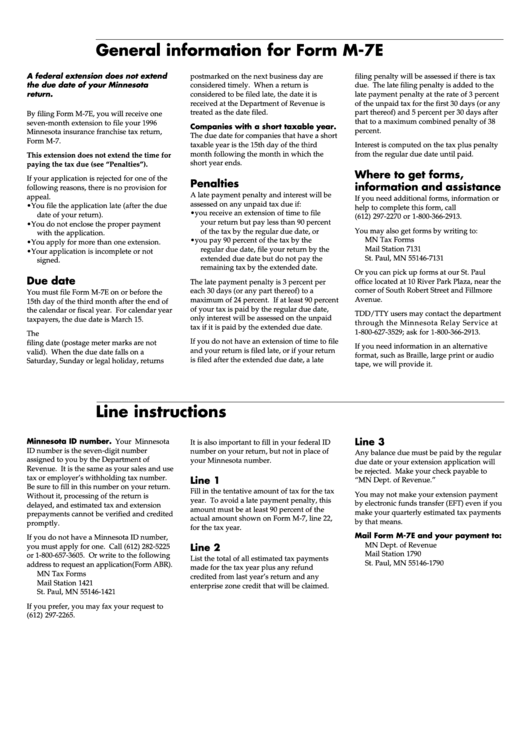

General information for Form M-7E

A federal extension does not extend

postmarked on the next business day are

filing penalty will be assessed if there is tax

the due date of your Minnesota

considered timely. When a return is

due. The late filing penalty is added to the

return.

considered to be filed late, the date it is

late payment penalty at the rate of 3 percent

received at the Department of Revenue is

of the unpaid tax for the first 30 days (or any

treated as the date filed.

part thereof) and 5 percent per 30 days after

By filing Form M-7E, you will receive one

that to a maximum combined penalty of 38

seven-month extension to file your 1996

Companies with a short taxable year.

percent.

Minnesota insurance franchise tax return,

The due date for companies that have a short

Form M-7.

taxable year is the 15th day of the third

Interest is computed on the tax plus penalty

month following the month in which the

from the regular due date until paid.

This extension does not extend the time for

short year ends.

paying the tax due (see “Penalties”).

Where to get forms,

If your application is rejected for one of the

Penalties

information and assistance

following reasons, there is no provision for

A late payment penalty and interest will be

appeal.

If you need additional forms, information or

assessed on any unpaid tax due if:

• You file the application late (after the due

help to complete this form, call

• you receive an extension of time to file

date of your return).

(612) 297-2270 or 1-800-366-2913.

your return but pay less than 90 percent

• You do not enclose the proper payment

You may also get forms by writing to:

of the tax by the regular due date, or

with the application.

MN Tax Forms

• you pay 90 percent of the tax by the

• You apply for more than one extension.

Mail Station 7131

regular due date, file your return by the

• Your application is incomplete or not

St. Paul, MN 55146-7131

extended due date but do not pay the

signed.

remaining tax by the extended date.

Or you can pick up forms at our St. Paul

Due date

office located at 10 River Park Plaza, near the

The late payment penalty is 3 percent per

corner of South Robert Street and Fillmore

each 30 days (or any part thereof) to a

You must file Form M-7E on or before the

Avenue.

maximum of 24 percent. If at least 90 percent

15th day of the third month after the end of

of your tax is paid by the regular due date,

the calendar or fiscal year. For calendar year

TDD/TTY users may contact the department

only interest will be assessed on the unpaid

taxpayers, the due date is March 15.

through the Minnesota Relay Service at

tax if it is paid by the extended due date.

1-800-627-3529; ask for 1-800-366-2913.

The U.S. postmark date is considered the

If you do not have an extension of time to file

filing date (postage meter marks are not

If you need information in an alternative

and your return is filed late, or if your return

valid). When the due date falls on a

format, such as Braille, large print or audio

is filed after the extended due date, a late

Saturday, Sunday or legal holiday, returns

tape, we will provide it.

Line instructions

Minnesota ID number. Your Minnesota

Line 3

It is also important to fill in your federal ID

ID number is the seven-digit number

number on your return, but not in place of

Any balance due must be paid by the regular

assigned to you by the Department of

your Minnesota number.

due date or your extension application will

Revenue. It is the same as your sales and use

be rejected. Make your check payable to

tax or employer’s withholding tax number.

Line 1

“MN Dept. of Revenue.”

Be sure to fill in this number on your return.

Fill in the tentative amount of tax for the tax

You may not make your extension payment

Without it, processing of the return is

year. To avoid a late payment penalty, this

by electronic funds transfer (EFT) even if you

delayed, and estimated tax and extension

amount must be at least 90 percent of the

make your quarterly estimated tax payments

prepayments cannot be verified and credited

actual amount shown on Form M-7, line 22,

by that means.

promptly.

for the tax year.

Mail Form M-7E and your payment to:

If you do not have a Minnesota ID number,

MN Dept. of Revenue

Line 2

you must apply for one. Call (612) 282-5225

Mail Station 1790

or 1-800-657-3605. Or write to the following

List the total of all estimated tax payments

St. Paul, MN 55146-1790

address to request an application(Form ABR).

made for the tax year plus any refund

MN Tax Forms

credited from last year’s return and any

Mail Station 1421

enterprise zone credit that will be claimed.

St. Paul, MN 55146-1421

If you prefer, you may fax your request to

(612) 297-2265.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1