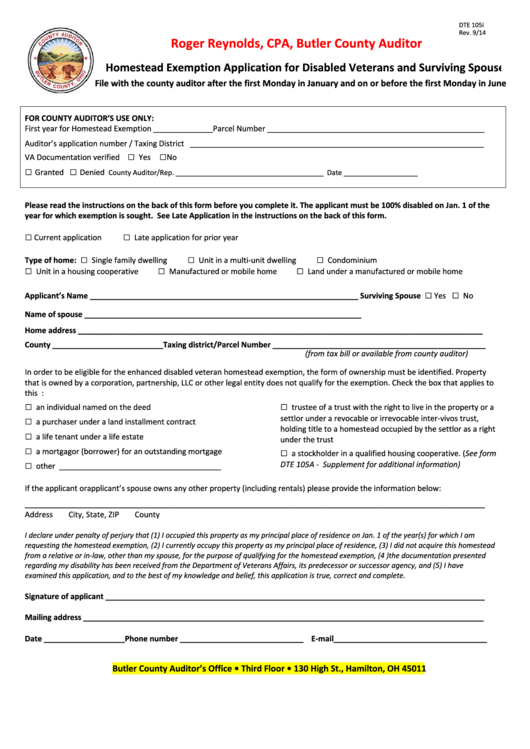

DTE 105I

Rev. 9/14

Roger Reynolds, CPA, Butler County Auditor

Homestead Exemption Application for Disabled Veterans and Surviving Spouses

File with the county auditor after the first Monday in January and on or before the first Monday in June

FOR COUNTY AUDITOR’S USE ONLY:

First year for Homestead Exemption ______________Parcel Number ___________________________________________________

Auditor’s application number / Taxing District _____________________________________________________________________

□

□

VA Documentation verified

Yes

No

□

□

Granted

Denied

County Auditor/Rep. ______________________________________ Date ___________________

Please read the instructions on the back of this form before you complete it. The applicant must be 100% disabled on Jan. 1 of the

year for which exemption is sought. See Late Application in the instructions on the back of this form.

□

□

Current application

Late application for prior year

□

□

□

Type of home:

Single family dwelling

Unit in a multi-unit dwelling

Condominium

□

□

□

Unit in a housing cooperative

Manufactured or mobile home

Land under a manufactured or mobile home

□

□

Applicant’s Name _______________________________________________________________

Surviving Spouse

Yes

No

Name of spouse _________________________________________________________________

Home address _______________________________________________________________________________________________

County __________________________Taxing district/Parcel Number __________________________________________________

(from tax bill or available from county auditor)

In order to be eligible for the enhanced disabled veteran homestead exemption, the form of ownership must be identified. Property

that is owned by a corporation, partnership, LLC or other legal entity does not qualify for the exemption. Check the box that applies to

this property. The applicant is:

□

□

an individual named on the deed

trustee of a trust with the right to live in the property or a

settlor under a revocable or irrevocable inter-vivos trust,

□

a purchaser under a land installment contract

holding title to a homestead occupied by the settlor as a right

□

a life tenant under a life estate

under the trust

□

□

a mortgagor (borrower) for an outstanding mortgage

a stockholder in a qualified housing cooperative. (See form

□

DTE 105A - Supplement for additional information)

other ______________________________________

If the applicant or applicant’s spouse owns any other property (including rentals) please provide the information below:

____________________________________________________________________________________________________________

Address

City, State, ZIP

County

I declare under penalty of perjury that (1) I occupied this property as my principal place of residence on Jan. 1 of the year(s) for which I am

requesting the homestead exemption, (2) I currently occupy this property as my principal place of residence, (3) I did not acquire this homestead

from a relative or in-law, other than my spouse, for the purpose of qualifying for the homestead exemption, (4 )the documentation presented

regarding my disability has been received from the Department of Veterans Affairs, its predecessor or successor agency, and (5) I have

examined this application, and to the best of my knowledge and belief, this application is true, correct and complete.

Signature of applicant _________________________________________________________________________________________

Mailing address ______________________________________________________________________________________________

Date ___________________Phone number _____________________________ E-mail____________________________________

Butler County Auditor’s Office • Third Floor • 130 High St., Hamilton, OH 45011

1

1 2

2