Form Nd-1v - Electronic Return Payment Voucher Form (2001) - North Dakota Office Of State Tax Commissioner

ADVERTISEMENT

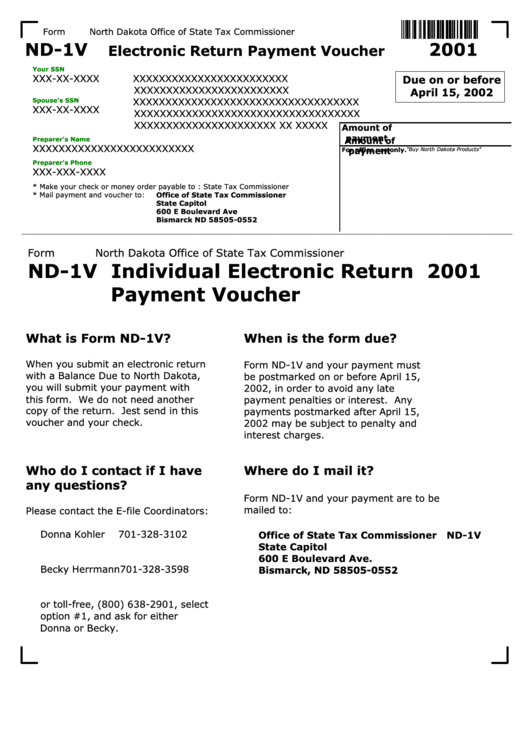

Form

North Dakota Office of State Tax Commissioner

ND-1V

2001

Electronic Return Payment Voucher

Your SSN

XXX-XX-XXXX

XXXXXXXXXXXXXXXXXXXXXXXX

Due on or before

XXXXXXXXXXXXXXXXXXXXXXXX

April 15, 2002

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Spouse's SSN

XXX-XX-XXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

XXXXXXXXXXXXXXXXXXXXXX XX XXXXX

Amount of

payment

Preparer's Name

Amount of

XXXXXXXXXXXXXXXXXXXXXXXXX

payment

For office use only.

"Buy North Dakota Products"

Preparer's Phone

XXX-XXX-XXXX

* Make your check or money order payable to : State Tax Commissioner

* Mail payment and voucher to:

Office of State Tax Commissioner

State Capitol

600 E Boulevard Ave

Bismarck ND 58505-0552

Form

North Dakota Office of State Tax Commissioner

ND-1V Individual Electronic Return 2001

Payment Voucher

What is Form ND-1V?

When is the form due?

When you submit an electronic return

Form ND-1V and your payment must

with a Balance Due to North Dakota,

be postmarked on or before April 15,

you will submit your payment with

2002, in order to avoid any late

this form. We do not need another

payment penalties or interest. Any

copy of the return. Jest send in this

payments postmarked after April 15,

voucher and your check.

2002 may be subject to penalty and

interest charges.

Who do I contact if I have

Where do I mail it?

any questions?

Form ND-1V and your payment are to be

mailed to:

Please contact the E-file Coordinators:

Donna Kohler

701-328-3102

Office of State Tax Commissioner ND-1V

dkohler@state.nd.us

State Capitol

600 E Boulevard Ave.

Becky Herrmann

701-328-3598

Bismarck, ND 58505-0552

bherrman@state.nd.us

or toll-free, (800) 638-2901, select

option #1, and ask for either

Donna or Becky.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1