Instructions For Preparing Recipients Share Of Capital Credit (Form K-Rcc) - Alabama

ADVERTISEMENT

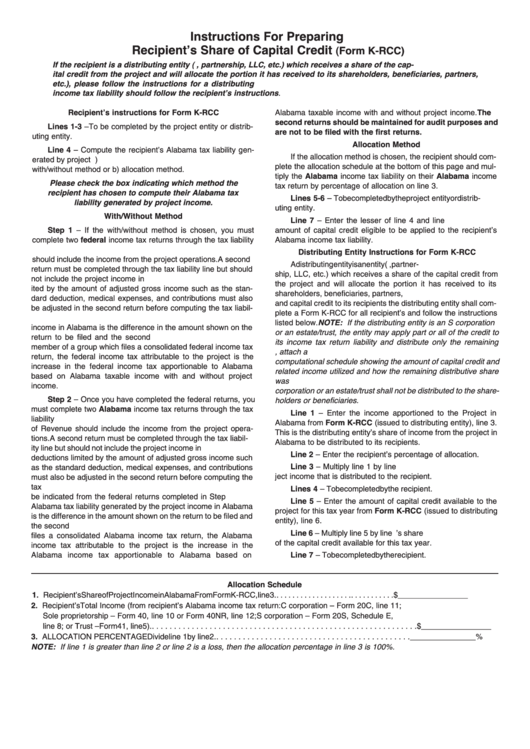

Instructions For Preparing

Recipientʼs Share of Capital Credit

(Form K-RCC)

If the recipient is a distributing entity (e.g. S corporation, partnership, LLC, etc.) which receives a share of the cap-

ital credit from the project and will allocate the portion it has received to its shareholders, beneficiaries, partners,

etc.), please follow the instructions for a distributing entity. All recipients applying the credit to their Alabama

income tax liability should follow the recipientʼs instructions.

Recipientʼs instructions for Form K-RCC

Alabama taxable income with and without project income. The

second returns should be maintained for audit purposes and

Lines 1-3 – To be completed by the project entity or distrib-

are not to be filed with the first returns.

Allocation Method

uting entity.

Line 4 – Compute the recipient’s Alabama tax liability gen-

If the allocation method is chosen, the recipient should com-

erated by project income. This may be computed using either a)

tiply the Alabama income tax liability on their Alabama income

plete the allocation schedule at the bottom of this page and mul-

with/without method or b) allocation method.

Please check the box indicating which method the

recipient has chosen to compute their Alabama tax

Lines 5-6 – To be completed by the project entity or distrib-

tax return by percentage of allocation on line 3.

liability generated by project income.

With/Without Method

Line 7 – Enter the lesser of line 4 and line 6. This is the

uting entity.

Step 1 – If the with/without method is chosen, you must

complete two federal income tax returns through the tax liability

amount of capital credit eligible to be applied to the recipient’s

Distributing Entity Instructions for Form K-RCC

Alabama income tax liability.

line. The return to be filed with the Internal Revenue Service

should include the income from the project operations. A second

A distributing entity is an entity (e.g. S corporation, partner-

return must be completed through the tax liability line but should

ship, LLC, etc.) which receives a share of the capital credit from

not include the project income in Alabama. Any deductions lim-

the project and will allocate the portion it has received to its

ited by the amount of adjusted gross income such as the stan-

shareholders, beneficiaries, partners, etc. To allocate the income

dard deduction, medical expenses, and contributions must also

and capital credit to its recipients the distributing entity shall com-

be adjusted in the second return before computing the tax liabil-

listed below. NOTE: If the distributing entity is an S corporation

plete a Form K-RCC for all recipient’s and follow the instructions

ity.

The federal income tax deduction related to the project

or an estate/trust, the entity may apply part or all of the credit to

income in Alabama is the difference in the amount shown on the

its income tax return liability and distribute only the remaining

return to be filed and the second return. If this taxpayer is a

credit. If only part of the capital credit has been applied, attach a

member of a group which files a consolidated federal income tax

computational schedule showing the amount of capital credit and

return, the federal income tax attributable to the project is the

related income utilized and how the remaining distributive share

increase in the federal income tax apportionable to Alabama

was computed. The amount applied to the tax liability of an S

based on Alabama taxable income with and without project

corporation or an estate/trust shall not be distributed to the share-

income.

Step 2 – Once you have completed the federal returns, you

holders or beneficiaries.

must complete two Alabama income tax returns through the tax

Line 1 – Enter the income apportioned to the Project in

Alabama from Form K-RCC (issued to distributing entity), line 3.

liability line. The return to be filed with the Alabama Department

of Revenue should include the income from the project opera-

This is the distributing entity’s share of income from the project in

tions. A second return must be completed through the tax liabil-

Line 2 – Enter the recipient’s percentage of allocation.

Alabama to be distributed to its recipients.

ity line but should not include the project income in Alabama. Any

Line 3 – Multiply line 1 by line 2. This is the amount of pro-

deductions limited by the amount of adjusted gross income such

as the standard deduction, medical expenses, and contributions

Lines 4 – To be completed by the recipient.

ject income that is distributed to the recipient.

must also be adjusted in the second return before computing the

tax liability. The applicable federal income tax deduction should

Line 5 – Enter the amount of capital credit available to the

be indicated from the federal returns completed in Step 1. The

project for this tax year from Form K-RCC (issued to distributing

Alabama tax liability generated by the project income in Alabama

is the difference in the amount shown on the return to be filed and

Line 6 – Multiply line 5 by line 2. This is the recipient’s share

entity), line 6.

the second return. If this taxpayer is a member of a group which

files a consolidated Alabama income tax return, the Alabama

Line 7 – To be completed by the recipient.

of the capital credit available for this tax year.

income tax attributable to the project is the increase in the

Alabama income tax apportionable to Alabama based on

Allocation Schedule

1. Recipient’s Share of Project Income in Alabama From Form K-RCC, line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $________________

2. Recipient’s Total Income (from recipient’s Alabama income tax return: C corporation – Form 20C, line 11;

Sole proprietorship – Form 40, line 10 or Form 40NR, line 12; S corporation – Form 20S, Schedule E,

3. ALLOCATION PERCENTAGE Divide line 1 by line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________%

line 8; or Trust – Form 41, line 5). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $________________

NOTE: If line 1 is greater than line 2 or line 2 is a loss, then the allocation percentage in line 3 is 100%.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1