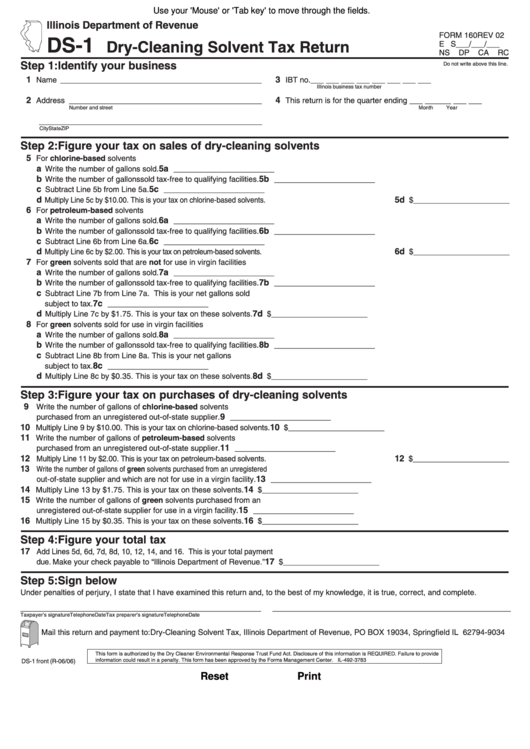

Use your 'Mouse' or 'Tab key' to move through the fields.

Illinois Department of Revenue

FORM 160 REV 02

DS-1

E S

___/___/___

Dry-Cleaning Solvent Tax Return

NS

DP

CA

RC

Step 1: Identify your business

Do not write above this line.

1

3

Name ______________________________________________

IBT no. ___ ___ ___ ___ ___ ___ ___ ___

Illinois business tax number

2

4

Address ____________________________________________

This return is for the quarter ending ___ ___ ___ ___ ___

Number and street

Month

Year

___________________________________________________

City

State

ZIP

Step 2: Figure your tax on sales of dry-cleaning solvents

5

For chlorine-based solvents

a

5a

Write the number of gallons sold.

_______________________

b

5b

Write the number of gallons sold tax-free to qualifying facilities.

_______________________

c

5c

Subtract Line 5b from Line 5a.

_______________________

d

5d

Multiply Line 5c by $10.00. This is your tax on chlorine-based solvents.

$______________________

6

For petroleum-based solvents

a

6a

Write the number of gallons sold.

_______________________

b

6b

Write the number of gallons sold tax-free to qualifying facilities.

_______________________

c

6c

Subtract Line 6b from Line 6a.

_______________________

d

6d

Multiply Line 6c by $2.00. This is your tax on petroleum-based solvents.

$______________________

7

For green solvents sold that are not for use in virgin facilities

a

7a

Write the number of gallons sold.

_______________________

b

7b

Write the number of gallons sold tax-free to qualifying facilities.

_______________________

c

Subtract Line 7b from Line 7a. This is your net gallons sold

7c

subject to tax.

_______________________

d

7d

Multiply Line 7c by $1.75. This is your tax on these solvents.

$______________________

8

For green solvents sold for use in virgin facilities

a

8a

Write the number of gallons sold.

_______________________

b

8b

Write the number of gallons sold tax-free to qualifying facilities.

_______________________

c

Subtract Line 8b from Line 8a. This is your net gallons

8c

subject to tax.

_______________________

d

8d

Multiply Line 8c by $0.35. This is your tax on these solvents.

$______________________

Step 3: Figure your tax on purchases of dry-cleaning solvents

9

Write the number of gallons of chlorine-based solvents

9

purchased from an unregistered out-of-state supplier.

_______________________

10

10

Multiply Line 9 by $10.00. This is your tax on chlorine-based solvents.

$______________________

11

Write the number of gallons of petroleum-based solvents

11

purchased from an unregistered out-of-state supplier.

_______________________

12

12

Multiply Line 11 by $2.00. This is your tax on petroleum-based solvents.

$______________________

13

Write the number of gallons of green solvents purchased from an unregistered

13

out-of-state supplier and which are not for use in a virgin facility.

_______________________

14

14

Multiply Line 13 by $1.75. This is your tax on these solvents.

$______________________

15

Write the number of gallons of green solvents purchased from an

15

unregistered out-of-state supplier for use in a virgin facility.

_______________________

16

16

Multiply Line 15 by $0.35. This is your tax on these solvents.

$______________________

Step 4: Figure your total tax

17

Add Lines 5d, 6d, 7d, 8d, 10, 12, 14, and 16. This is your total payment

17

due. Make your check payable to “Illinois Department of Revenue.”

$______________________

Step 5: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________

______________________________________________________

Taxpayer's signature

Telephone

Date

Tax preparer's signature

Telephone

Date

Mail this return and payment to: Dry-Cleaning Solvent Tax, Illinois Department of Revenue, PO BOX 19034, Springfield IL 62794-9034

This form is authorized by the Dry Cleaner Environmental Response Trust Fund Act. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-3783

DS-1 front (R-06/06)

Reset

Print

1

1 2

2