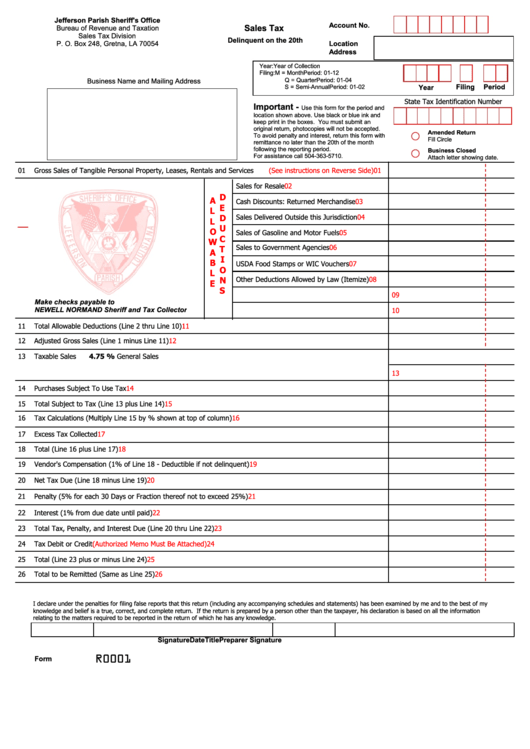

Form 0001 R - Sales Tax Form - Bureau Of Revenue And Taxation - Grenta - Louisiana

ADVERTISEMENT

Jefferson Parish Sheriff's Office

Account No.

Sales Tax

Bureau of Revenue and Taxation

Sales Tax Division

Delinquent on the 20th

P. O. Box 248, Gretna, LA 70054

Location

Address

Year:

Year of Collection

Filing:

M = Month

Period: 01-12

Q = Quarter

Period: 01-04

Business Name and Mailing Address

S = Semi-Annual

Period: 01-02

Filing

Period

Year

State Tax Identification Number

Important -

Use this form for the period and

location shown above. Use black or blue ink and

keep print in the boxes. You must submit an

original return, photocopies will not be accepted.

Amended Return

To avoid penalty and interest, return this form with

Fill Circle

remittance no later than the 20th of the month

following the reporting period.

Business Closed

For assistance call 504-363-5710.

Attach letter showing date.

01

Gross Sales of Tangible Personal Property, Leases, Rentals and Services

(See instructions on Reverse Side)

01

Sales for Resale

02

D

A

Cash Discounts: Returned Merchandise

03

E

L

Sales Delivered Outside this Jurisdiction

04

D

L

U

O

Sales of Gasoline and Motor Fuels

05

C

W

Sales to Government Agencies

06

T

A

I

B

USDA Food Stamps or WIC Vouchers

07

O

L

Other Deductions Allowed by Law (Itemize)

08

N

E

S

09

Make checks payable to

NEWELL NORMAND Sheriff and Tax Collector

10

11

Total Allowable Deductions (Line 2 thru Line 10)

11

12

Adjusted Gross Sales (Line 1 minus Line 11)

12

13

Taxable Sales

4.75 % General Sales

13

14

Purchases Subject To Use Tax

14

15

Total Subject to Tax (Line 13 plus Line 14)

15

16

Tax Calculations (Multiply Line 15 by % shown at top of column)

16

17

Excess Tax Collected

17

18

Total (Line 16 plus Line 17)

18

19

Vendor's Compensation (1% of Line 18 - Deductible if not delinquent)

19

20

Net Tax Due (Line 18 minus Line 19)

20

21

Penalty (5% for each 30 Days or Fraction thereof not to exceed 25%)

21

22

Interest (1% from due date until paid)

22

23

Total Tax, Penalty, and Interest Due (Line 20 thru Line 22)

23

24

Tax Debit or Credit

(Authorized Memo Must Be Attached)

24

25

Total (Line 23 plus or minus Line 24)

25

26

Total to be Remitted (Same as Line 25)

26

I declare under the penalties for filing false reports that this return (including any accompanying schedules and statements) has been examined by me and to the best of my

knowledge and belief is a true, correct, and complete return. If the return is prepared by a person other than the taxpayer, his declaration is based on all the information

relating to the matters required to be reported in the return of which he has any knowledge.

Date

Signature

Title

Preparer Signature

0001

R

Form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1