Clear This Page

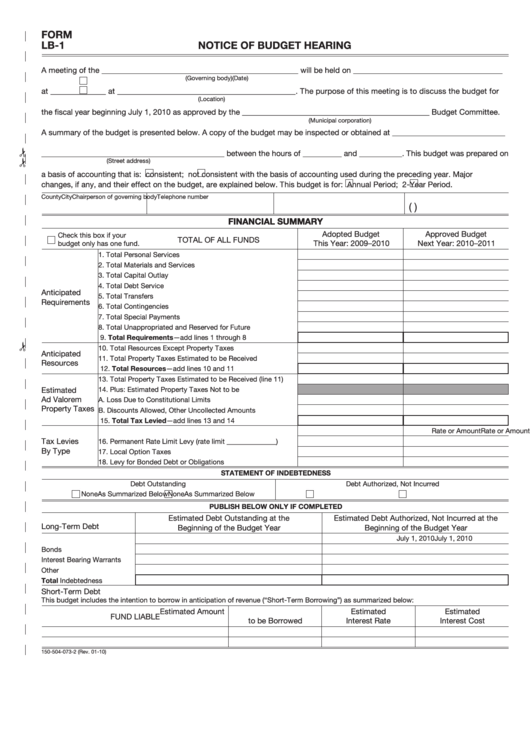

FORM

LB-1

NOTICE OF BUDGET HEARING

A meeting of the __________________________________________________ will be held on ______________________________________

(Governing body)

(Date)

A.M.

at ______________ at _____________________________________________. The purpose of this meeting is to discuss the budget for

P.M.

(Location)

the fiscal year beginning July 1, 2010 as approved by the ________________________________________________ Budget Committee.

(Municipal corporation)

A summary of the budget is presented below. A copy of the budget may be inspected or obtained at _____________________________

_______________________________________________ between the hours of __________ and ___________. This budget was prepared on

(Street address)

a basis of accounting that is:

consistent;

not consistent with the basis of accounting used during the preceding year. Major

changes, if any, and their effect on the budget, are explained below. This budget is for:

Annual Period;

2-Year Period.

County

City

Chairperson of governing body

Telephone number

(

)

FINANCIAL SUMMARY

FINANCIAL SUMMARY

Adopted Budget

Approved Budget

Check this box if your

TOTAL OF ALL FUNDS

This Year: 2009–2010

Next Year: 2010–2011

budget only has one fund.

1. Total Personal Services ........................................................

2. Total Materials and Services ................................................

3. Total Capital Outlay ..............................................................

4. Total Debt Service ................................................................

Anticipated

5. Total Transfers ......................................................................

Requirements

6. Total Contingencies ..............................................................

7. Total Special Payments ........................................................

8. Total Unappropriated and Reserved for Future Expenditure....

9. Total Requirements—add lines 1 through 8 .......................

10. Total Resources Except Property Taxes ...............................

Anticipated

11. Total Property Taxes Estimated to be Received ...................

Resources

12. Total Resources—add lines 10 and 11 ...............................

13. Total Property Taxes Estimated to be Received (line 11) .....

Estimated

14. Plus: Estimated Property Taxes Not to be Received............

Ad Valorem

A. Loss Due to Constitutional Limits ....................................

Property Taxes

B. Discounts Allowed, Other Uncollected Amounts .............

15. Total Tax Levied—add lines 13 and 14 ...............................

Rate or Amount

Rate or Amount

Tax Levies

16. Permanent Rate Limit Levy (rate limit ______________) .......

By Type

17. Local Option Taxes ...............................................................

18. Levy for Bonded Debt or Obligations ...................................

STATEMENT OF INDEBTEDNESS

Debt Outstanding

Debt Authorized, Not Incurred

None

As Summarized Below

None

As Summarized Below

PUBLISH BELOW ONLY IF COMPLETED

Estimated Debt Outstanding at the

Estimated Debt Authorized, Not Incurred at the

Long-Term Debt

Beginning of the Budget Year

Beginning of the Budget Year

July 1, 2010

July 1, 2010

Bonds ....................................

Interest Bearing Warrants ......

Other ......................................

Total Indebtedness ...............

Short-Term Debt

This budget includes the intention to borrow in anticipation of revenue (“Short-Term Borrowing”) as summarized below:

Estimated Amount

Estimated

Estimated

FUND LIABLE

to be Borrowed

Interest Rate

Interest Cost

150-504-073-2 (Rev. 01-10)

1

1