Magnetic Media Filing Requirements Form - Indiana Department Of Revenue

ADVERTISEMENT

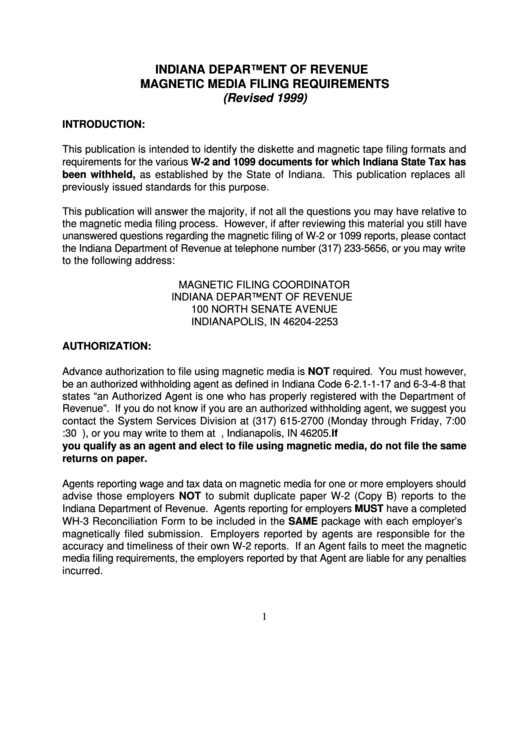

INDIANA DEPARTMENT OF REVENUE

MAGNETIC MEDIA FILING REQUIREMENTS

(Revised 1999)

INTRODUCTION:

This publication is intended to identify the diskette and magnetic tape filing formats and

requirements for the various W-2 and 1099 documents for which Indiana State Tax has

been withheld, as established by the State of Indiana. This publication replaces all

previously issued standards for this purpose.

This publication will answer the majority, if not all the questions you may have relative to

the magnetic media filing process. However, if after reviewing this material you still have

unanswered questions regarding the magnetic filing of W-2 or 1099 reports, please contact

the Indiana Department of Revenue at telephone number (317) 233-5656, or you may write

to the following address:

MAGNETIC FILING COORDINATOR

INDIANA DEPARTMENT OF REVENUE

100 NORTH SENATE AVENUE

INDIANAPOLIS, IN 46204-2253

AUTHORIZATION:

Advance authorization to file using magnetic media is NOT required. You must however,

be an authorized withholding agent as defined in Indiana Code 6-2.1-1-17 and 6-3-4-8 that

states “an Authorized Agent is one who has properly registered with the Department of

Revenue”. If you do not know if you are an authorized withholding agent, we suggest you

contact the System Services Division at (317) 615-2700 (Monday through Friday, 7:00

A.M. to 4:30 P.M.), or you may write to them at P.O. Box 6197, Indianapolis, IN 46205. If

you qualify as an agent and elect to file using magnetic media, do not file the same

returns on paper.

Agents reporting wage and tax data on magnetic media for one or more employers should

advise those employers NOT to submit duplicate paper W-2 (Copy B) reports to the

Indiana Department of Revenue. Agents reporting for employers MUST have a completed

WH-3 Reconciliation Form to be included in the SAME package with each employer’s

magnetically filed submission. Employers reported by agents are responsible for the

accuracy and timeliness of their own W-2 reports. If an Agent fails to meet the magnetic

media filing requirements, the employers reported by that Agent are liable for any penalties

incurred.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24