Instructions For Schedule L Carryback Of Current Year Loss Form

ADVERTISEMENT

Line 7a

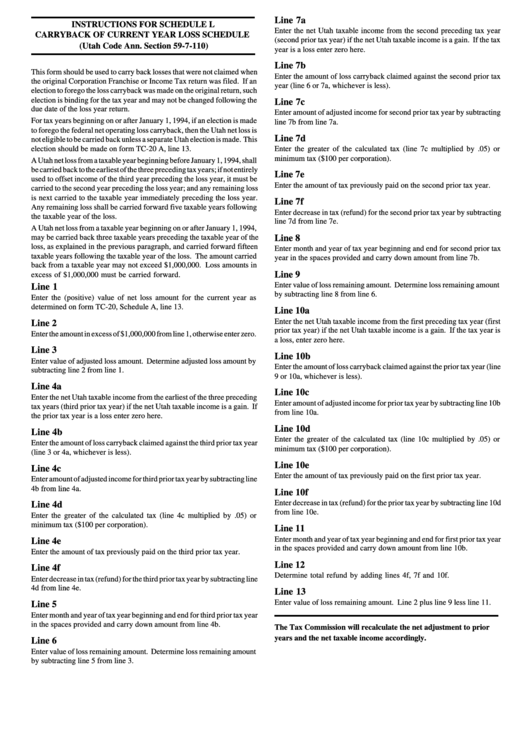

INSTRUCTIONS FOR SCHEDULE L

Enter the net Utah taxable income from the second preceding tax year

CARRYBACK OF CURRENT YEAR LOSS SCHEDULE

(second prior tax year) if the net Utah taxable income is a gain. If the tax

(Utah Code Ann. Section 59-7-110)

year is a loss enter zero here.

Line 7b

This form should be used to carry back losses that were not claimed when

Enter the amount of loss carryback claimed against the second prior tax

the original Corporation Franchise or Income Tax return was filed. If an

year (line 6 or 7a, whichever is less).

election to forego the loss carryback was made on the original return, such

election is binding for the tax year and may not be changed following the

Line 7c

due date of the loss year return.

Enter amount of adjusted income for second prior tax year by subtracting

For tax years beginning on or after January 1, 1994, if an election is made

line 7b from line 7a.

to forego the federal net operating loss carryback, then the Utah net loss is

Line 7d

not eligible to be carried back unless a separate Utah election is made. This

election should be made on form TC-20 A, line 13.

Enter the greater of the calculated tax (line 7c multiplied by .05) or

minimum tax ($100 per corporation).

A Utah net loss from a taxable year beginning before January 1, 1994, shall

be carried back to the earliest of the three preceding tax years; if not entirely

Line 7e

used to offset income of the third year preceding the loss year, it must be

Enter the amount of tax previously paid on the second prior tax year.

carried to the second year preceding the loss year; and any remaining loss

is next carried to the taxable year immediately preceding the loss year.

Line 7f

Any remaining loss shall be carried forward five taxable years following

Enter decrease in tax (refund) for the second prior tax year by subtracting

the taxable year of the loss.

line 7d from line 7e.

A Utah net loss from a taxable year beginning on or after January 1, 1994,

may be carried back three taxable years preceding the taxable year of the

Line 8

loss, as explained in the previous paragraph, and carried forward fifteen

Enter month and year of tax year beginning and end for second prior tax

taxable years following the taxable year of the loss. The amount carried

year in the spaces provided and carry down amount from line 7b.

back from a taxable year may not exceed $1,000,000. Loss amounts in

Line 9

excess of $1,000,000 must be carried forward.

Enter value of loss remaining amount. Determine loss remaining amount

Line 1

by subtracting line 8 from line 6.

Enter the (positive) value of net loss amount for the current year as

determined on form TC-20, Schedule A, line 13.

Line 10a

Enter the net Utah taxable income from the first preceding tax year (first

Line 2

prior tax year) if the net Utah taxable income is a gain. If the tax year is

Enter the amount in excess of $1,000,000 from line 1, otherwise enter zero.

a loss, enter zero here.

Line 3

Line 10b

Enter value of adjusted loss amount. Determine adjusted loss amount by

Enter the amount of loss carryback claimed against the prior tax year (line

subtracting line 2 from line 1.

9 or 10a, whichever is less).

Line 4a

Line 10c

Enter the net Utah taxable income from the earliest of the three preceding

Enter amount of adjusted income for prior tax year by subtracting line 10b

tax years (third prior tax year) if the net Utah taxable income is a gain. If

from line 10a.

the prior tax year is a loss enter zero here.

Line 10d

Line 4b

Enter the greater of the calculated tax (line 10c multiplied by .05) or

Enter the amount of loss carryback claimed against the third prior tax year

minimum tax ($100 per corporation).

(line 3 or 4a, whichever is less).

Line 10e

Line 4c

Enter the amount of tax previously paid on the first prior tax year.

Enter amount of adjusted income for third prior tax year by subtracting line

4b from line 4a.

Line 10f

Enter decrease in tax (refund) for the prior tax year by subtracting line 10d

Line 4d

from line 10e.

Enter the greater of the calculated tax (line 4c multiplied by .05) or

minimum tax ($100 per corporation).

Line 11

Enter month and year of tax year beginning and end for first prior tax year

Line 4e

in the spaces provided and carry down amount from line 10b.

Enter the amount of tax previously paid on the third prior tax year.

Line 12

Line 4f

Determine total refund by adding lines 4f, 7f and 10f.

Enter decrease in tax (refund) for the third prior tax year by subtracting line

4d from line 4e.

Line 13

Enter value of loss remaining amount. Line 2 plus line 9 less line 11.

Line 5

Enter month and year of tax year beginning and end for third prior tax year

in the spaces provided and carry down amount from line 4b.

The Tax Commission will recalculate the net adjustment to prior

years and the net taxable income accordingly.

Line 6

Enter value of loss remaining amount. Determine loss remaining amount

by subtracting line 5 from line 3.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1