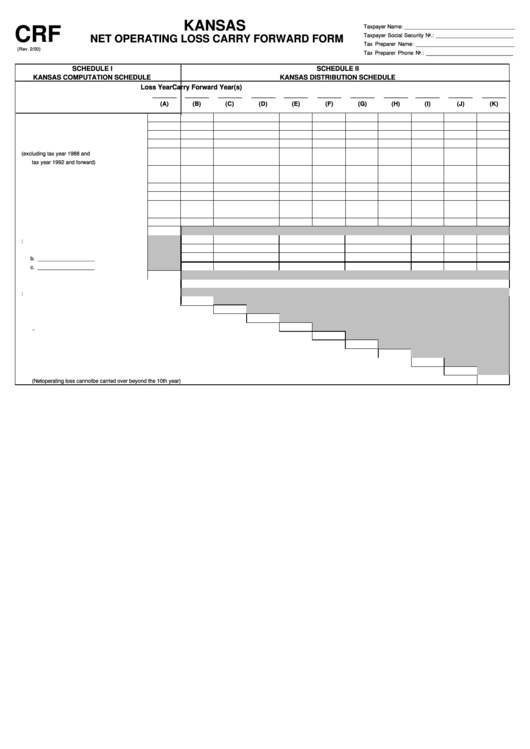

Form Crf - Net Operating Loss Carry Forward Form

ADVERTISEMENT

KANSAS

Taxpayer Name: _____________________________________

CRF

Taxpayer Social Security No.: __________________________

NET OPERATING LOSS CARRY FORWARD FORM

Tax Preparer Name: _________________________________

(Rev. 2/00)

Tax Preparer Phone No.: _____________________________

SCHEDULE I

SCHEDULE II

KANSAS COMPUTATION SCHEDULE

KANSAS DISTRIBUTION SCHEDULE

Loss Year

Carry Forward Year(s)

_______

_______

_______

_______

_______

_______

_______

_______

_______

_______

_______

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

(I)

(J)

(K)

1.

Federal adjusted gross income ........................

2.

Modifications ....................................................

3.

Kansas adjusted gross income ........................

4.

Less standard or itemized deductions .............

5.

Less federal tax (excluding tax year 1988 and

tax year 1992 and forward) ..............................

6.

Less personal exemption .................................

7.

Total deductions ..............................................

8.

Taxable income per Kansas return ..................

9.

Net operating loss included in line 3 ................

10. Net capital loss ................................................

11. Nontaxable capital gain ...................................

12. Exemptions ......................................................

13. Excess nonbusiness deductions ......................

14. Other adjustments:

a. Charitable contributions ................................

b. ___________________

c. ___________________

15. Net operating loss ............................................

16. Modified taxable income ........................................................

17. Net operating loss carry forward:

a. NOL carried to 1st succeeding year .................................

b. NOL carried to 2nd succeeding year ......................................................

c. NOL carried to 3rd succeeding year .............................................................................

d. NOL carried to 4th succeeding year ..................................................................................................

e. NOL carried to 5th succeeding year .........................................................................................................................

f. NOL carried to 6th succeeding year ...............................................................................................................................................

g. NOL carried to 7th succeeding year ......................................................................................................................................................................

h. NOL carried to 8th succeeding year .............................................................................................................................................................................................

i. NOL carried to 9th succeeding year ...................................................................................................................................................................................................................

j. NOL carried to 10th succeeding year (Net operating loss cannot be carried over beyond the 10th year) ................................................................................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2