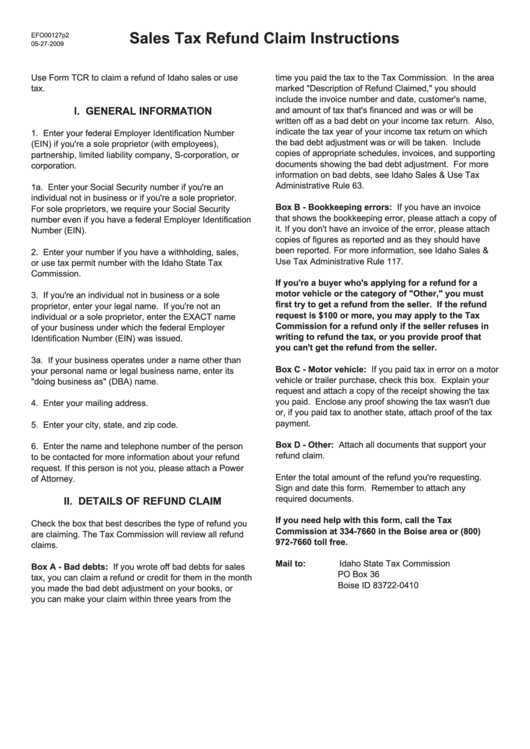

Sales Tax Refund Claim Instructions

ADVERTISEMENT

sales tax refund Claim Instructions

EFO00127p2

05-27-2009

Use Form TCR to claim a refund of Idaho sales or use

time you paid the tax to the Tax Commission. In the area

tax.

marked "Description of Refund Claimed," you should

include the invoice number and date, customer's name,

I. General InformatIon

and amount of tax that's financed and was or will be

written off as a bad debt on your income tax return. Also,

indicate the tax year of your income tax return on which

1. Enter your federal Employer Identification Number

the bad debt adjustment was or will be taken. Include

(EIN) if you're a sole proprietor (with employees),

copies of appropriate schedules, invoices, and supporting

partnership, limited liability company, S-corporation, or

documents showing the bad debt adjustment. For more

corporation.

information on bad debts, see Idaho Sales & Use Tax

Administrative Rule 63.

1a. Enter your Social Security number if you're an

individual not in business or if you're a sole proprietor.

Box B - Bookkeeping errors: If you have an invoice

For sole proprietors, we require your Social Security

that shows the bookkeeping error, please attach a copy of

number even if you have a federal Employer Identification

it. If you don't have an invoice of the error, please attach

Number (EIN).

copies of figures as reported and as they should have

been reported. For more information, see Idaho Sales &

2. Enter your number if you have a withholding, sales,

Use Tax Administrative Rule 117.

or use tax permit number with the Idaho State Tax

Commission.

If you're a buyer who's applying for a refund for a

motor vehicle or the category of "other," you must

3. If you're an individual not in business or a sole

first try to get a refund from the seller. If the refund

proprietor, enter your legal name. If you're not an

request is $100 or more, you may apply to the tax

individual or a sole proprietor, enter the EXACT name

Commission for a refund only if the seller refuses in

of your business under which the federal Employer

writing to refund the tax, or you provide proof that

Identification Number (EIN) was issued.

you can't get the refund from the seller.

3a. If your business operates under a name other than

Box C - motor vehicle: If you paid tax in error on a motor

your personal name or legal business name, enter its

vehicle or trailer purchase, check this box. Explain your

"doing business as" (DBA) name.

request and attach a copy of the receipt showing the tax

you paid. Enclose any proof showing the tax wasn't due

4. Enter your mailing address.

or, if you paid tax to another state, attach proof of the tax

payment.

5. Enter your city, state, and zip code.

Box D - other: Attach all documents that support your

6. Enter the name and telephone number of the person

refund claim.

to be contacted for more information about your refund

request. If this person is not you, please attach a Power

Enter the total amount of the refund you're requesting.

of Attorney.

Sign and date this form. Remember to attach any

required documents.

II. DetaIls of refunD ClaIm

If you need help with this form, call the tax

Check the box that best describes the type of refund you

Commission at 334-7660 in the Boise area or (800)

are claiming. The Tax Commission will review all refund

972-7660 toll free.

claims.

mail to:

Idaho State Tax Commission

Box a - Bad debts: If you wrote off bad debts for sales

PO Box 36

tax, you can claim a refund or credit for them in the month

Boise ID 83722-0410

you made the bad debt adjustment on your books, or

you can make your claim within three years from the

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1