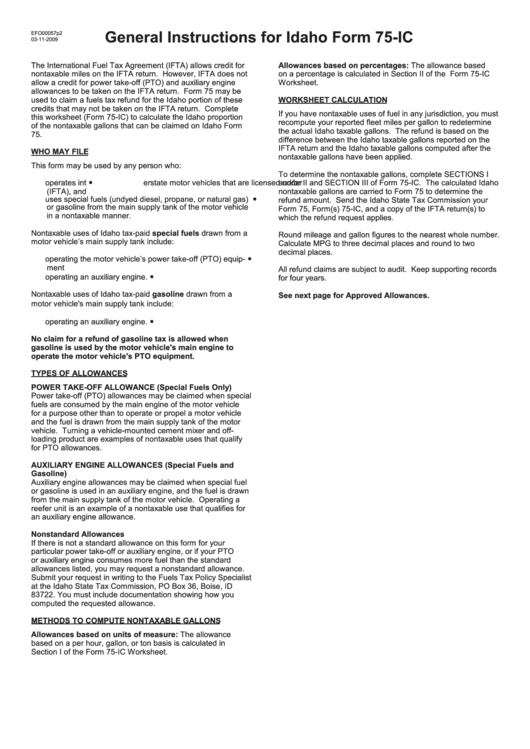

General Instructions For Idaho Form 75-Ic

ADVERTISEMENT

General Instructions for Idaho Form 75-IC

efo00057p2

03-11-2009

the international fuel tax agreement (ifta) allows credit for

Allowances based on percentages: the allowance based

nontaxable miles on the ifta return. however, ifta does not

on a percentage is calculated in section ii of the form 75-iC

allow a credit for power take-off (Pto) and auxiliary engine

Worksheet.

allowances to be taken on the ifta return. form 75 may be

used to claim a fuels tax refund for the idaho portion of these

WORKSHeeT CAlCulATIOn

credits that may not be taken on the ifta return. Complete

if you have nontaxable uses of fuel in any jurisdiction, you must

this worksheet (form 75-iC) to calculate the idaho proportion

recompute your reported fleet miles per gallon to redetermine

of the nontaxable gallons that can be claimed on idaho form

the actual idaho taxable gallons. the refund is based on the

75.

difference between the idaho taxable gallons reported on the

ifta return and the idaho taxable gallons computed after the

WHO MAY FIle

nontaxable gallons have been applied.

this form may be used by any person who:

to determine the nontaxable gallons, complete seCtions i

operates int

erstate motor vehicles that are licensed under

and/or ii and seCtion iii of form 75-iC. the calculated idaho

y

(ifta), and

nontaxable gallons are carried to form 75 to determine the

uses special fuels (undyed diesel, propane, or natural gas)

refund amount. send the idaho state tax Commission your

y

or gasoline from the main supply tank of the motor vehicle

form 75, form(s) 75-iC, and a copy of the ifta return(s) to

in a nontaxable manner.

which the refund request applies.

nontaxable uses of idaho tax-paid special fuels drawn from a

Round mileage and gallon figures to the nearest whole number.

motor vehicle’s main supply tank include:

Calculate MPG to three decimal places and round to two

decimal places.

operating the motor vehicle’s power take-off (Pto) equip-

y

ment

all refund claims are subject to audit. Keep supporting records

operating an auxiliary engine.

y

for four years.

nontaxable uses of idaho tax-paid gasoline drawn from a

See next page for Approved Allowances.

motor vehicle's main supply tank include:

operating an auxiliary engine.

y

no claim for a refund of gasoline tax is allowed when

gasoline is used by the motor vehicle's main engine to

operate the motor vehicle's PTO equipment.

TYPeS OF AllOWAnCeS

POWeR TAKe-OFF AllOWAnCe (Special Fuels Only)

Power take-off (Pto) allowances may be claimed when special

fuels are consumed by the main engine of the motor vehicle

for a purpose other than to operate or propel a motor vehicle

and the fuel is drawn from the main supply tank of the motor

vehicle. turning a vehicle-mounted cement mixer and off-

loading product are examples of nontaxable uses that qualify

for Pto allowances.

AuXIlIARY enGIne AllOWAnCeS (Special Fuels and

Gasoline)

auxiliary engine allowances may be claimed when special fuel

or gasoline is used in an auxiliary engine, and the fuel is drawn

from the main supply tank of the motor vehicle. operating a

reefer unit is an example of a nontaxable use that qualifies for

an auxiliary engine allowance.

nonstandard Allowances

if there is not a standard allowance on this form for your

particular power take-off or auxiliary engine, or if your Pto

or auxiliary engine consumes more fuel than the standard

allowances listed, you may request a nonstandard allowance.

submit your request in writing to the fuels tax Policy specialist

at the idaho state tax Commission, Po Box 36, Boise, id

83722. You must include documentation showing how you

computed the requested allowance.

MeTHODS TO COMPuTe nOnTAXABle GAllOnS

Allowances based on units of measure: the allowance

based on a per hour, gallon, or ton basis is calculated in

section i of the form 75-iC Worksheet.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2