Tax Organizer Form - North Dakota

ADVERTISEMENT

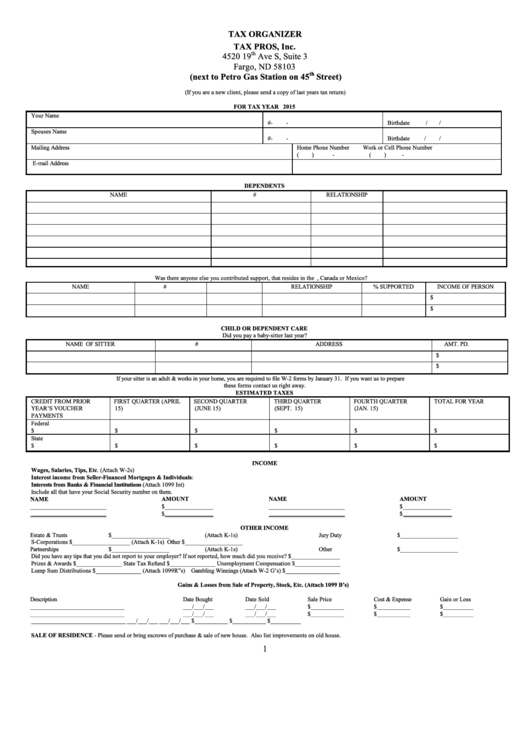

TAX ORGANIZER

TAX PROS, Inc.

th

4520 19

Ave S, Suite 3

Fargo, ND 58103

th

(next to Petro Gas Station on 45

Street)

(If you are a new client, please send a copy of last years tax return)

FOR TAX YEAR 2015

Your Name

S.S. #

-

-

Birthdate

/

/

Spouses Name

S.S. #

-

-

Birthdate

/

/

Mailing Address

Home Phone Number

Work or Cell Phone Number

(

)

-

(

)

-

E-mail Address

DEPENDENTS

NAME

S.S. #

D.O.B.

RELATIONSHIP

Was there anyone else you contributed support, that resides in the U.S., Canada or Mexico?

NAME

S.S. #

D.O.B.

RELATIONSHIP

% SUPPORTED

INCOME OF PERSON

$

$

CHILD OR DEPENDENT CARE

Did you pay a baby-sitter last year?

NAME OF SITTER

S.S. #

ADDRESS

AMT. PD.

$

$

If your sitter is an adult & works in your home, you are required to file W-2 forms by January 31. If you want us to prepare

these forms contact us right away.

ESTIMATED TAXES

CREDIT FROM PRIOR

FIRST QUARTER (APRIL

SECOND QUARTER

THIRD QUARTER

FOURTH QUARTER

TOTAL FOR YEAR

YEAR’S VOUCHER

15)

(JUNE 15)

(SEPT. 15)

(JAN. 15)

PAYMENTS

Federal

$

$

$

$

$

$

State

$

$

$

$

$

$

INCOME

Wages, Salaries, Tips, Etc. (Attach W-2s)

Interest income from Seller-Financed Mortgages & Individuals:

Interests from Banks & Financial Institutions (Attach 1099 Int)

Include all that have your Social Security number on them.

NAME

AMOUNT

NAME

AMOUNT

_________________________

$________________

_________________________

$________________

_________________________

$

________________

_________________________

$

________________

OTHER INCOME

Estate & Trusts

$___________________

(Attach K-1s)

Jury Duty

$___________________

S-Corporations

$___________________

(Attach K-1s)

Other

$___________________

Partnerships

$___________________

(Attach K-1s)

Other

$___________________

Did you have any tips that you did not report to your employer? If not reported, how much did you receive? $________________

Prizes & Awards $_______________ State Tax Refund $_______________ Unemployment Compensation $_______________

Lump Sum Distributions $_______________ (Attach 1099R”s) Gambling Winnings (Attach W-2 G’s) $__________________

Gains & Losses from Sale of Property, Stock, Etc. (Attach 1099 B’s)

Description

Date Bought

Date Sold

Sale Price

Cost & Expense

Gain or Loss

_______________________________

___/___/___

___/___/___

$___________

$___________

$__________

_______________________________

___/___/___

___/___/___

$___________

$___________

$__________

_______________________________

___/___/___

___/___/___

$___________

$___________

$__________

SALE OF RESIDENCE - Please send or bring escrows of purchase & sale of new house. Also list improvements on old house.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4