2015 Business Income & Expense Organizer Form

ADVERTISEMENT

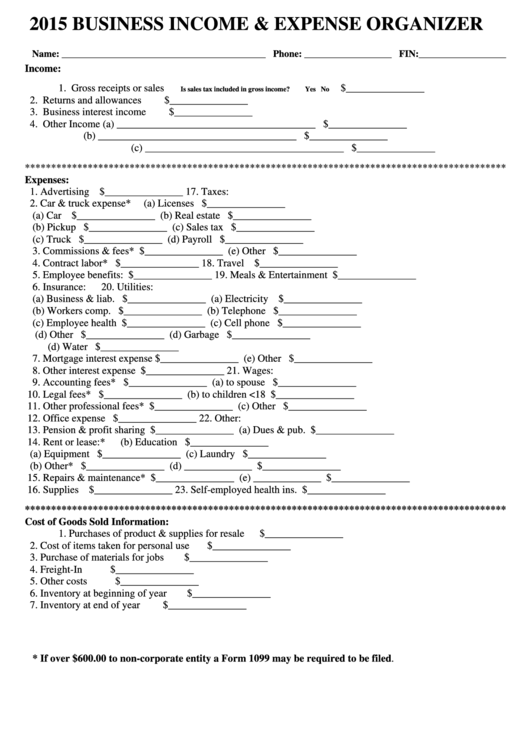

2015 BUSINESS INCOME & EXPENSE ORGANIZER

Name: __________________________________________ Phone: __________________ FIN:__________________

Income:

1. Gross receipts or sales

$_______________

Is sales tax included in gross income?

Yes No

2. Returns and allowances

$_______________

3. Business interest income

$_______________

4. Other Income (a) ______________________________________

$_______________

(b) ______________________________________

$_______________

(c) ______________________________________

$_______________

********************************************************************************************

Expenses:

1. Advertising

$_______________ 17. Taxes:

2. Car & truck expense*

(a) Licenses

$_______________

(a) Car

$_______________

(b) Real estate

$_______________

(b) Pickup

$_______________

(c) Sales tax

$_______________

(c) Truck

$_______________

(d) Payroll

$_______________

3. Commissions & fees*

$_______________

(e) Other

$_______________

4. Contract labor*

$_______________ 18. Travel

$_______________

5. Employee benefits:

$_______________ 19. Meals & Entertainment

$_______________

6. Insurance:

20. Utilities:

(a) Business & liab.

$_______________

(a) Electricity

$_______________

(b) Workers comp.

$_______________

(b) Telephone

$_______________

(c) Employee health

$_______________

(c) Cell phone

$_______________

(d) Other

$_______________

(d) Garbage

$_______________

(d) Water

$_______________

7. Mortgage interest expense $_______________

(e) Other

$_______________

8. Other interest expense

$_______________ 21. Wages:

9. Accounting fees*

$_______________

(a) to spouse

$_______________

10. Legal fees*

$_______________

(b) to children <18

$_______________

11. Other professional fees* $_______________

(c) Other

$_______________

12. Office expense

$_______________ 22. Other:

13. Pension & profit sharing $_______________

(a) Dues & pub.

$_______________

14. Rent or lease:*

(b) Education

$_______________

(a) Equipment

$_______________

(c) Laundry

$_______________

(b) Other*

$_______________

(d) _____________

$_______________

15. Repairs & maintenance* $_______________

(e) _____________

$_______________

16. Supplies

$_______________ 23. Self-employed health ins. $_______________

********************************************************************************************

Cost of Goods Sold Information:

1. Purchases of product & supplies for resale

$_______________

2. Cost of items taken for personal use

$_______________

3. Purchase of materials for jobs

$_______________

4. Freight-In

$_______________

5. Other costs

$_______________

6. Inventory at beginning of year

$_______________

7. Inventory at end of year

$_______________

* If over $600.00 to non-corporate entity a Form 1099 may be required to be filed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1