INLAND

GOVERNMENT OF THE VIRGIN ISLANDS

REVENUE

RETURN OF NOTIONAL REMUNERATION AND FINANCIAL STATEMENT

This Return must be submitted to the Commissioner of Inland Revenue, together with your Financial

Statement within ninety (90) days of the end of the Financial year to which it relates. Please mail to :-

Commissioner of lnland Revenue, Inland Revenue Department, Road Town, Tortola, British Virgin Islands.

Return for the year:______________________________

Name of business owner/Self-employed person:______________________________

Name of business:______________________________________________________

Nature or type of business:________________________________________________________________

Mailing address:__________________________________

Telephone no:____________________________

Fax no:_______________________

Number of Self-employed persons / deemed employees paid during this year: :____________________________

Notes For Completion Of This Return.

Notional remuneration is the fair and equitable valuation of the services rendered to the business by a self-employed

person or deemed employee. When assessing the notional remuneration of your deemed employees or yourself, if

you are self-employed, you are required to take the following factors into account:-

1.

The nature and extent of the services of the deemed employee or self-employed person to the business,

including any such services which directly or indirectly affect or influence the financial viability of the business.

2.

The deemed employee or self-employed person's experience and any special skill.

3.

The nature of the business.

4.

The emoluments of persons employed in your business or other businesses who render services similar to

those rendered by the deemed employee or self-employed person and of persons engaged in any other businesses.

5.

The financial records of the business which show the services of the deemed employee or self-employed

person which generate revenue for the business and the allocation to him of benefits from the business.

Please note that a self-employed person is a person who carries on a business, which is not incorporated as a

company and otherwise than as an employee benefits from the profits of that business otherwise than by way of or in

addition to being paid actual remuneration. Further a self-employed person is deemed to employ himself and pay

himself a deemed remuneration and his deemed remuneration is the greater of his actual remuneration or his notional

remuneration.

The answers to the following questions may assist you in making your assessments of notional remuneration:-

1. What is the value of the work that the self-employed person or deemed employee did in the business during this

period?

2. What would another person have been paid to do the work that the deemed employee or self-employed person did

in the business during this period?

3. What is the current market rate being paid for the job being done by the self-employed person

or deemed employee?

4. What is the gross remuneration paid to the highest paid employee in the business this period?

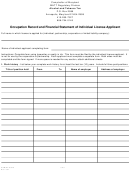

The first table on page 2 must be completed to show the gross amount of remuneration paid and/or assessed for all

deemed employees for all categories of remuneration during the year. The totals must be equal to the amount

recorded on the second table.

I certify that the information on this return is true and correct.

Signature__________________________________________

Name (please print)__________________________________

FORM P.11

Date______________________________________________

1

1 2

2