Reset Form

Print Form

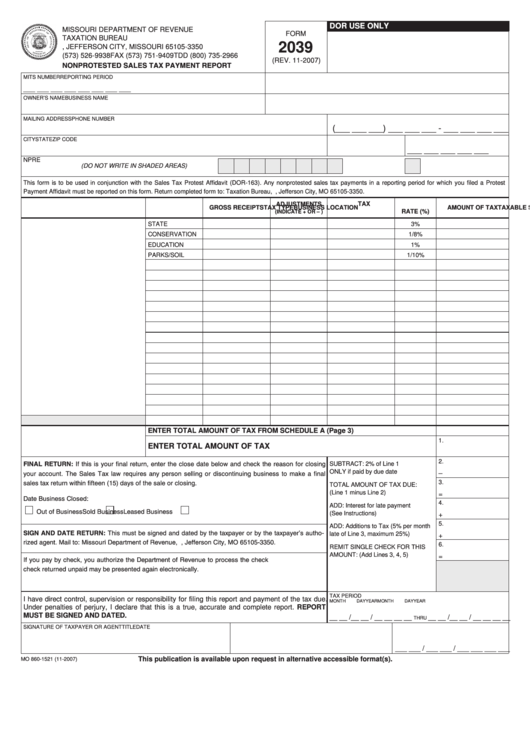

DOR USE ONLY

MISSOURI DEPARTMENT OF REVENUE

FORM

TAXATION BUREAU

2039

P.O. BOX 3350, JEFFERSON CITY, MISSOURI 65105-3350

(573) 526-9938

FAX (573) 751-9409

TDD (800) 735-2966

(REV. 11-2007)

NONPROTESTED SALES TAX PAYMENT REPORT

MITS NUMBER

REPORTING PERIOD

___ ___ ___ ___ ___ ___ ___ ___

OWNER’S NAME

BUSINESS NAME

MAILING ADDRESS

PHONE NUMBER

(___ ___ ___) ___ ___ ___ - ___ ___ ___ ___

CITY

STATE

ZIP CODE

___ ___ ___ ___ ___

NPRE

(DO NOT WRITE IN SHADED AREAS)

This form is to be used in conjunction with the Sales Tax Protest Affidavit (DOR-163). Any nonprotested sales tax payments in a reporting period for which you filed a Protest

Payment Affidavit must be reported on this form. Return completed form to: Taxation Bureau, P.O. Box 3350, Jefferson City, MO 65105-3350.

ADJUSTMENTS

TAX

BUSINESS LOCATION

TAX TYPE

GROSS RECEIPTS

TAXABLE SALES

AMOUNT OF TAX

RATE (%)

(INDICATE + OR – )

STATE

3%

CONSERVATION

1/8%

EDUCATION

1%

PARKS/SOIL

1/10%

Reset This Section Only

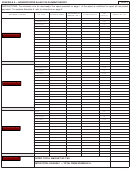

ENTER TOTAL AMOUNT OF TAX FROM SCHEDULE A (Page 3)

1.

ENTER TOTAL AMOUNT OF TAX

2.

FINAL RETURN: If this is your final return, enter the close date below and check the reason for closing

SUBTRACT: 2% of Line 1

ONLY if paid by due date

your account. The Sales Tax law requires any person selling or discontinuing business to make a final

–

sales tax return within fifteen (15) days of the sale or closing.

3.

TOTAL AMOUNT OF TAX DUE:

(Line 1 minus Line 2)

=

Date Business Closed:

4.

ADD: Interest for late payment

Out of Business

Sold Business

Leased Business

(See Instructions)

+

5.

ADD: Additions to Tax (5% per month

SIGN AND DATE RETURN: This must be signed and dated by the taxpayer or by the taxpayer’s autho-

late of Line 3, maximum 25%)

+

rized agent. Mail to: Missouri Department of Revenue, P.O. Box 3350, Jefferson City, MO 65105-3350.

6.

REMIT SINGLE CHECK FOR THIS

AMOUNT: (Add Lines 3, 4, 5)

=

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any

check returned unpaid may be presented again electronically.

TAX PERIOD

I have direct control, supervision or responsibility for filing this report and payment of the tax due.

MONTH

DAY

YEAR

MONTH

DAY

YEAR

Under penalties of perjury, I declare that this is a true, accurate and complete report. REPORT

MUST BE SIGNED AND DATED.

__ __ /__ __ / __ __ __ __

__ __ /__ __ / __ __ __ __

THRU

SIGNATURE OF TAXPAYER OR AGENT

TITLE

DATE

___ ___ / ___ ___ / ___ ___ ___ ___

This publication is available upon request in alternative accessible format(s).

MO 860-1521 (11-2007)

1

1 2

2