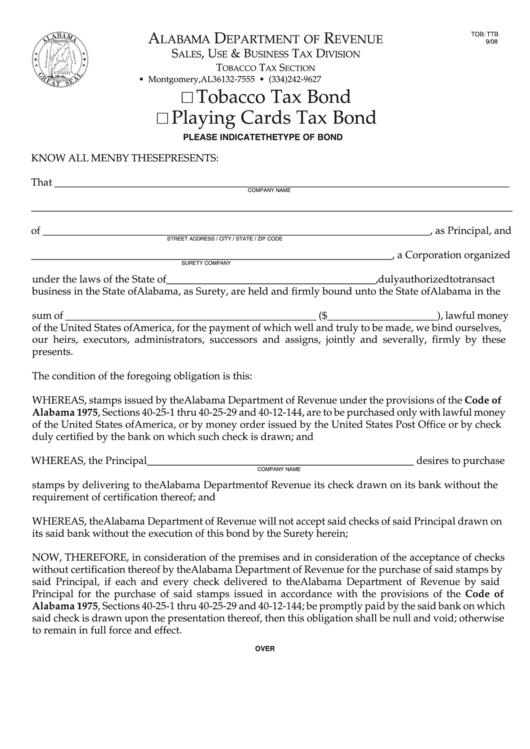

TOB: TTB

A

D

R

LABAMA

EPARTMENT OF

EVENUE

9/08

S

, U

& B

T

D

ALES

SE

USINESS

AX

IVISION

T

T

S

OBACCO

AX

ECTION

P.O. Box 327555 • Montgomery, AL 36132-7555 • (334) 242-9627

Tobacco Tax Bond

Reset

Playing Cards Tax Bond

PLEASE INDICATE THE TYPE OF BOND

KNOW ALL MEN BY THESE PRESENTS:

That _______________________________________________________________________________________

COMPANY NAME

____________________________________________________________________________________________

of __________________________________________________________________________, as Principal, and

STREET ADDRESS / CITY / STATE / ZIP CODE

_____________________________________________________________________, a Corporation organized

SURETY COMPANY

under the laws of the State of________________________________________, duly authorized to transact

business in the State of Alabama, as Surety, are held and firmly bound unto the State of Alabama in the

sum of ________________________________________________ ($_____________________), lawful money

of the United States of America, for the payment of which well and truly to be made, we bind ourselves,

our heirs, executors, administrators, successors and assigns, jointly and severally, firmly by these

presents.

The condition of the foregoing obligation is this:

WHEREAS, stamps issued by the Alabama Department of Revenue under the provisions of the Code of

Alabama 1975, Sections 40-25-1 thru 40-25-29 and 40-12-144, are to be purchased only with lawful money

of the United States of America, or by money order issued by the United States Post Office or by check

duly certified by the bank on which such check is drawn; and

WHEREAS, the Principal ___________________________________________________ desires to purchase

COMPANY NAME

stamps by delivering to the Alabama Department of Revenue its check drawn on its bank without the

requirement of certification thereof; and

WHEREAS, the Alabama Department of Revenue will not accept said checks of said Principal drawn on

its said bank without the execution of this bond by the Surety herein;

NOW, THEREFORE, in consideration of the premises and in consideration of the acceptance of checks

without certification thereof by the Alabama Department of Revenue for the purchase of said stamps by

said Principal, if each and every check delivered to the Alabama Department of Revenue by said

Principal for the purchase of said stamps issued in accordance with the provisions of the Code of

Alabama 1975, Sections 40-25-1 thru 40-25-29 and 40-12-144; be promptly paid by the said bank on which

said check is drawn upon the presentation thereof, then this obligation shall be null and void; otherwise

to remain in full force and effect.

OVER

1

1 2

2