Form Nc-478 - Summary Of Tax Credits Limited To 50% Of Tax November 2006

ADVERTISEMENT

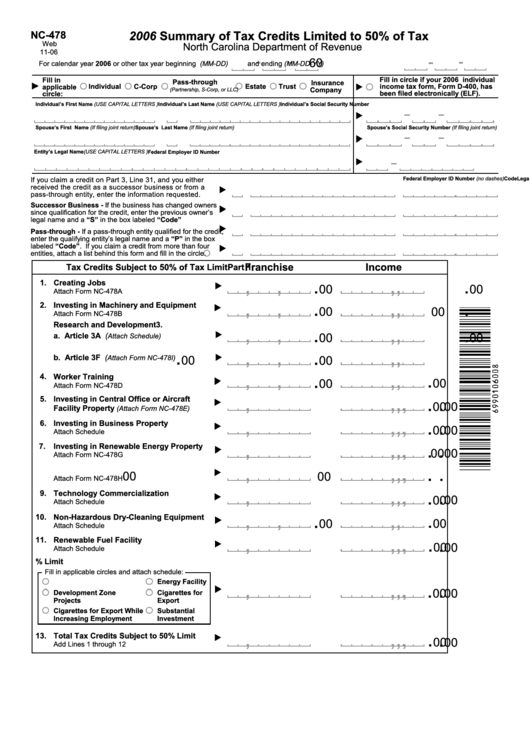

NC-478

2006 Summary of Tax Credits Limited to 50% of Tax

Web

North Carolina Department of Revenue

11-06

0

6

For calendar year 2006 or other tax year beginning (MM-DD)

and ending (MM-DD-YY)

Fill in circle if your 2006 individual

Fill in

Pass-through

Insurance

Individual

C-Corp

Estate

Trust

income tax form, Form D-400, has

applicable

Company

(Partnership, S-Corp, or LLC)

been filed electronically (ELF).

circle:

Individual’s First Name (USE CAPITAL LETTERS )

M.I.

Individual’s Last Name (USE CAPITAL LETTERS )

Individual’s Social Security Number

Spouse’s First Name (If filing joint return)

M.I.

Spouse’s Last Name (If filing joint return)

Spouse’s Social Security Number (If filing joint return)

Entity’s Legal Name (USE CAPITAL LETTERS )

Federal Employer ID Number

If you claim a credit on Part 3, Line 31, and you either

Code

Legal Name

Federal Employer ID Number (no dashes)

received the credit as a successor business or from a

pass-through entity, enter the information requested.

Successor Business - If the business has changed owners

since qualification for the credit, enter the previous owner’s

legal name and a “S” in the box labeled “Code”

Pass-through - If a pass-through entity qualified for the credit,

enter the qualifying entity’s legal name and a “P” in the box

labeled “Code”. If you claim a credit from more than four

entities, attach a list behind this form and fill in the circle.

Franchise

Income

Part 1.

Tax Credits Subject to 50% of Tax Limit

,

,

,

,

.

.

1. Creating Jobs

00

00

Attach Form NC-478A

,

,

,

,

.

.

2. Investing in Machinery and Equipment

00

00

Attach Form NC-478B

3.

Research and Development

,

,

,

,

.

.

00

00

a. Article 3A (

Attach Schedule)

,

,

,

,

.

.

b. Article 3F (

00

00

Attach Form NC-478I)

,

,

,

,

.

.

4.

Worker Training

00

00

Attach Form NC-478D

,

,

,

,

.

.

5.

Investing in Central Office or Aircraft

00

00

Facility Property

(Attach Form NC-478E)

,

,

,

,

.

.

6.

Investing in Business Property

00

00

Attach Schedule

,

,

,

,

.

.

7.

Investing in Renewable Energy Property

00

00

Attach Form NC-478G

,

,

,

,

.

.

8. Low-Income Housing

00

00

Attach Form NC-478H

,

,

,

,

.

.

9.

Technology Commercialization

00

00

Attach Schedule

,

,

,

,

.

.

10.

Non-Hazardous Dry-Cleaning Equipment

00

00

Attach Schedule

,

,

,

,

.

.

11.

Renewable Fuel Facility

00

00

Attach Schedule

12. Other Tax Credits Subject to 50% Limit

Fill in applicable circles and attach schedule:

,

,

,

,

.

.

N.C. Ports

Energy Facility

00

00

Development Zone

Cigarettes for

Projects

Export

Cigarettes for Export While

Substantial

Increasing Employment

Investment

,

,

,

,

.

.

13.

Total Tax Credits Subject to 50% Limit

00

00

Add Lines 1 through 12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2