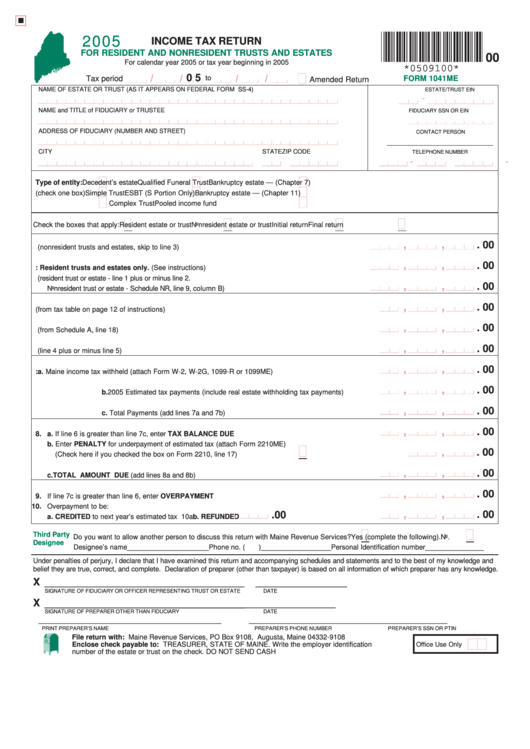

Form 1041me - Income Tax Return For Resident And Nonresident Trusts And Estates - 2005

ADVERTISEMENT

2005

INCOME TAX RETURN

FOR RESIDENT AND NONRESIDENT TRUSTS AND ESTATES

00

For calendar year 2005 or tax year beginning in 2005

*0509100*

0 5

/

/

/

/

to

Tax period

FORM 1041ME

Amended Return

NAME OF ESTATE OR TRUST (AS IT APPEARS ON FEDERAL FORM SS-4)

ESTATE/TRUST EIN

-

NAME and TITLE of FIDUCIARY or TRUSTEE

FIDUCIARY SSN OR EIN

ADDRESS OF FIDUCIARY (NUMBER AND STREET)

CONTACT PERSON

CITY

STATE

ZIP CODE

TELEPHONE NUMBER

-

-

Type of entity:

Decedent’s estate

Qualified Funeral Trust

Bankruptcy estate — (Chapter 7)

(check one box)

Simple Trust

ESBT (S Portion Only)

Bankruptcy estate — (Chapter 11)

Complex Trust

Pooled income fund

Check the boxes that apply:

Resident estate or trust

Nonresident estate or trust

Initial return

Final return

,

,

. 00

1. Federal taxable income (nonresident trusts and estates, skip to line 3) ............................................. 1

,

,

. 00

2. Fiduciary Adjustment: Resident trusts and estates only. (See instructions) .................................... 2

3. Maine taxable income (resident trust or estate - line 1 plus or minus line 2.

,

,

. 00

Nonresident trust or estate - Schedule NR, line 9, column B) ................................................................... 3

,

,

. 00

4. Maine income tax (from tax table on page 12 of instructions) ................................................................... 4

,

,

. 00

5. Adjustments to tax (from Schedule A, line 18) .......................................................................................... 5

,

,

. 00

6. Adjusted Maine income tax (line 4 plus or minus line 5) .......................................................................... 6

,

,

. 00

7. Tax payments: a. Maine income tax withheld (attach Form W-2, W-2G, 1099-R or 1099ME) ............. 7a

,

,

. 00

b. 2005 Estimated tax payments (include real estate withholding tax payments) ........ 7b

,

,

. 00

c. Total Payments (add lines 7a and 7b) ....................................................................... 7c

,

,

. 00

8. a. If line 6 is greater than line 7c, enter TAX BALANCE DUE .................................................................. 8a

b. Enter PENALTY for underpayment of estimated tax (attach Form 2210ME)

,

. 00

(Check here if you checked the box on Form 2210, line 17) ...............................

........................................... 8b

,

,

. 00

c. TOTAL AMOUNT DUE (add lines 8a and 8b) ..................................................................................... 8c

,

,

. 00

9. If line 7c is greater than line 6, enter OVERPAYMENT ............................................................................... 9

10. Overpayment to be:

,

.00

,

,

. 00

a. CREDITED to next year’s estimated tax 10a

b. REFUNDED ..... 10b

Third Party

Do you want to allow another person to discuss this return with Maine Revenue Services?

Yes (complete the following).

No.

Designee

Designee’s name _____________________ Phone no. (

) __________________ Personal Identification number _______________

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge and

belief they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

X ___________________________________

________________

SIGNATURE OF FIDUCIARY OR OFFICER REPRESENTING TRUST OR ESTATE

DATE

X ___________________________________

________________

SIGNATURE OF PREPARER OTHER THAN FIDUCIARY

DATE

_______________________________________________

___________________________

________________________

PRINT PREPARER’S NAME

PREPARER’S PHONE NUMBER

PREPARER’S SSN OR PTIN

File return with: Maine Revenue Services, PO Box 9108, Augusta, Maine 04332-9108

Enclose check payable to: TREASURER, STATE OF MAINE. Write the employer identification

Office Use Only

number of the estate or trust on the check. DO NOT SEND CASH

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2