TOB: STTFC

1/10

A

D

R

OFFICE USE ONLY

LABAMA

EPARTMENT OF

EVENUE

S

, U

& B

T

D

Reset

ALES

SE

USINESS

AX

IVISION

T

T

S

OBACCO

AX

ECTION

P.O. B

327556 • M

, AL 36132-7556 • (334) 242-9627

OX

ONTGOMERY

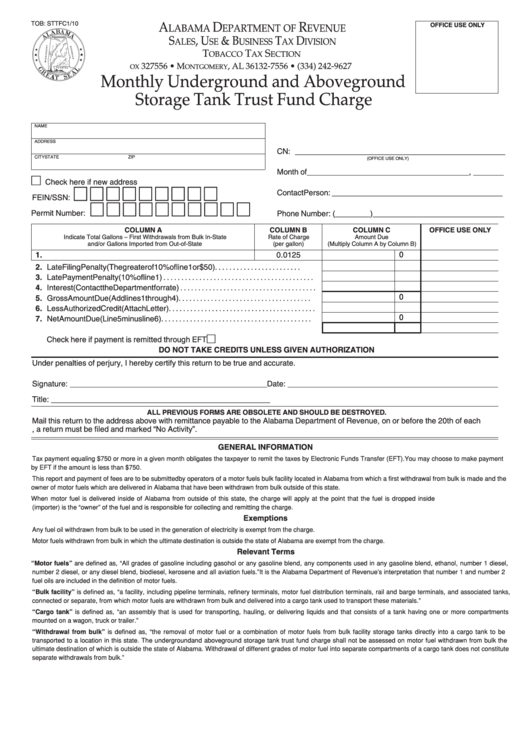

Monthly Underground and Aboveground

Storage Tank Trust Fund Charge

NAME

ADDRESS

CN: ________________________________________________

CITY

STATE

ZIP

(OFFICE USE ONLY)

Month of _____________________________________, _______

Check here if new address

Contact Person: _______________________________________

FEIN/SSN:

Permit Number:

Phone Number: (________)______________________________

COLUMN A

COLUMN B

COLUMN C

OFFICE USE ONLY

Indicate Total Gallons – First Withdrawals from Bulk In-State

Rate of Charge

Amount Due

and/or Gallons Imported from Out-of-State

(per gallon)

(Multiply Column A by Column B)

1.

0.0125

2. Late Filing Penalty (The greater of 10% of line 1 or $50) . . . . . . . . . . . . . . . . . . . . . . . .

3. Late Payment Penalty (10% of line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Interest (Contact the Department for rate) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Gross Amount Due (Add lines 1 through 4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Less Authorized Credit (Attach Letter) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Net Amount Due (Line 5 minus line 6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Amount Remitted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Check here if payment is remitted through EFT

DO NOT TAKE CREDITS UNLESS GIVEN AUTHORIZATION

Under penalties of perjury, I hereby certify this return to be true and accurate.

Signature: _____________________________________________

Date: ________________________________________________

Title: __________________________________________________

ALL PREVIOUS FORMS ARE OBSOLETE AND SHOULD BE DESTROYED.

Mail this return to the address above with remittance payable to the Alabama Department of Revenue, on or before the 20th of each

month. Even if there is no activity during the month, a return must be filed and marked “No Activity”.

GENERAL INFORMATION

Tax payment equaling $750 or more in a given month obligates the taxpayer to remit the taxes by Electronic Funds Transfer (EFT). You may choose to make payment

by EFT if the amount is less than $750.

This report and payment of fees are to be submitted by operators of a motor fuels bulk facility located in Alabama from which a first withdrawal from bulk is made and the

owner of motor fuels which are delivered in Alabama that have been withdrawn from bulk outside of this state.

When motor fuel is delivered inside of Alabama from outside of this state, the charge will apply at the point that the fuel is dropped inside Alabama. The deliverer

(importer) is the “owner” of the fuel and is responsible for collecting and remitting the charge.

Exemptions

Any fuel oil withdrawn from bulk to be used in the generation of electricity is exempt from the charge.

Motor fuels withdrawn from bulk in which the ultimate destination is outside the state of Alabama are exempt from the charge.

Relevant Terms

“Motor fuels” are defined as, “All grades of gasoline including gasohol or any gasoline blend, any components used in any gasoline blend, ethanol, number 1 diesel,

number 2 diesel, or any diesel blend, biodiesel, kerosene and all aviation fuels.” It is the Alabama Department of Revenue’s interpretation that number 1 and number 2

fuel oils are included in the definition of motor fuels.

“Bulk facility” is defined as, “a facility, including pipeline terminals, refinery terminals, motor fuel distribution terminals, rail and barge terminals, and associated tanks,

connected or separate, from which motor fuels are withdrawn from bulk and delivered into a cargo tank used to transport these materials.”

“Cargo tank” is defined as, “an assembly that is used for transporting, hauling, or delivering liquids and that consists of a tank having one or more compartments

mounted on a wagon, truck or trailer.”

“Withdrawal from bulk” is defined as, “the removal of motor fuel or a combination of motor fuels from bulk facility storage tanks directly into a cargo tank to be

transported to a location in this state. The underground and aboveground storage tank trust fund charge shall not be assessed on motor fuel withdrawn from bulk the

ultimate destination of which is outside the state of Alabama. Withdrawal of different grades of motor fuel into separate compartments of a cargo tank does not constitute

separate withdrawals from bulk.”

1

1