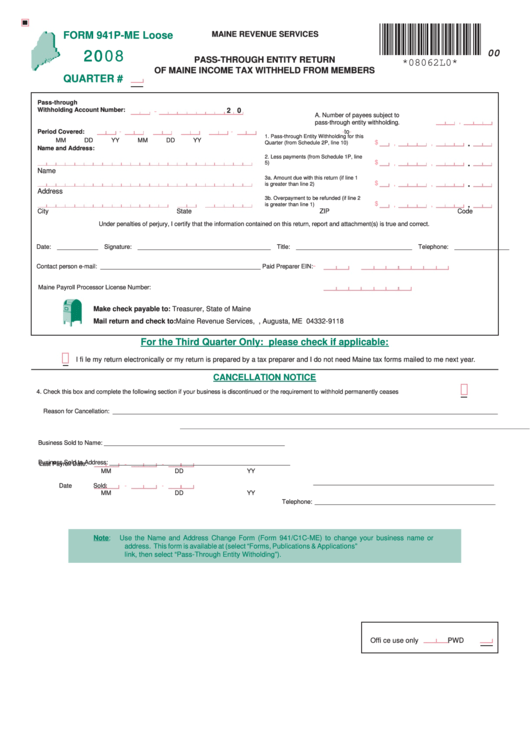

Form 941p-Me - Pass-Through Entity Return Of Maine Income Tax Withheld From Members - 2008

ADVERTISEMENT

FORM 941P-ME Loose

MAINE REVENUE SERVICES

2008

00

PASS-THROUGH ENTITY RETURN

*08062L0*

OF MAINE INCOME TAX WITHHELD FROM MEMBERS

QUARTER #

Pass-through

Withholding Account Number:

2 0

-

A. Number of payees subject to

,

pass-through entity withholding. ........ A.

Period Covered:

-

-

to

-

-

1.

Pass-through Entity Withholding for this

MM

DD

YY

MM

DD

YY

$

.

Quarter (from Schedule 2P, line 10) ....1.

,

,

Name and Address:

2.

Less payments (from Schedule 1P, line

$

.

5) .........................................................2.

,

,

Name

3a. Amount due with this return (if line 1

$

.

,

,

is greater than line 2) .........................3a.

Address

3b. Overpayment to be refunded (if line 2

$

.

is greater than line 1) .........................3b.

,

,

City

State

ZIP Code

Under penalties of perjury, I certify that the information contained on this return, report and attachment(s) is true and correct.

Date: ____________

Signature: _______________________________________

Title: __________________________________

Telephone: ________________

-

Contact person e-mail: _______________________________________________

Paid Preparer EIN:

Maine Payroll Processor License Number:

Make check payable to:

Treasurer, State of Maine

Mail return and check to:

Maine Revenue Services, P.O. Box 9118, Augusta, ME 04332-9118

For the Third Quarter Only: please check if applicable:

I fi le my return electronically or my return is prepared by a tax preparer and I do not need Maine tax forms mailed to me next year.

CANCELLATION NOTICE

4. Check this box and complete the following section if your business is discontinued or the requirement to withhold permanently ceases ...............................

Reason for Cancellation: _________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________

Business Sold to Name: _____________________________________________________

Business Sold to Address: _____________________________________________________

Last Payroll Date:

-

-

MM

DD

YY

_____________________________________________________

Date Sold:

-

-

MM

DD

YY

Telephone: _____________________________________________________

Note:

Use the Name and Address Change Form (Form 941/C1C-ME) to change your business name or

address. This form is available at (select “Forms, Publications & Applications”

link, then select “Pass-Through Entity Witholding”).

Offi ce use only

PWD

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3