Form Ins-5 - Fire Investigation And Prevention Tax Annual Reconciliation/return - 2009

ADVERTISEMENT

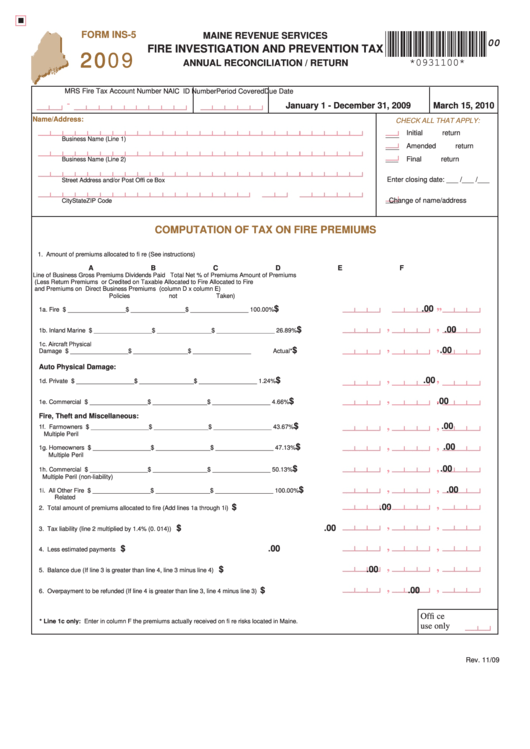

FORM INS-5

MAINE REVENUE SERVICES

00

2009

FIRE INVESTIGATION AND PREVENTION TAX

*0931100*

ANNUAL RECONCILIATION / RETURN

MRS Fire Tax Account Number

NAIC ID Number

Period Covered

Due Date

-

January 1 - December 31, 2009

March 15, 2010

Name/Address:

CHECK ALL THAT APPLY:

Initial return

Business Name (Line 1)

Amended return

Final return

Business Name (Line 2)

Enter closing date: ___ /___ /___

Street Address and/or Post Offi ce Box

Change of name/address

City

State

ZIP Code

COMPUTATION OF TAX ON FIRE PREMIUMS

1.

Amount of premiums allocated to fi re (See instructions)

A

B

C

D

E

F

Line of Business

Gross Premiums

Dividends Paid

Total Net

% of Premiums

Amount of Premiums

(Less Return Premiums

or Credited on

Taxable

Allocated to Fire

Allocated to Fire

and Premiums on

Direct Business

Premiums

(column D x column E)

Policies not Taken)

,

,

$

.00

1a. Fire ........................ $ _________________ $ ________________ $ _________________

100.00%

,

,

$

.00

1b. Inland Marine ........ $ _________________ $ ________________ $ _________________

26.89%

1c. Aircraft Physical

,

,

$

.00

Damage ................. $ _________________ $ ________________ $ _________________

Actual*

Auto Physical Damage:

,

,

$

.00

1d. Private ................... $ _________________ $ ________________ $ _________________

1.24%

,

,

$

.00

1e. Commercial ........... $ _________________ $ ________________ $ _________________

4.66%

Fire, Theft and Miscellaneous:

$

,

,

.00

1f. Farmowners .......... $ _________________ $ ________________ $ _________________

43.67%

Multiple Peril

,

,

$

.00

1g. Homeowners ......... $ _________________ $ ________________ $ _________________

47.13%

Multiple Peril

,

,

$

.00

1h. Commercial ........... $ _________________ $ ________________ $ _________________

50.13%

Multiple Peril (non-liability)

,

,

$

.00

1i. All Other Fire ......... $ _________________ $ ________________ $ _________________

100.00%

Related

,

,

$

.00

2. Total amount of premiums allocated to fi re (Add lines 1a through 1i) ....................................................2.

,

,

$

.00

3. Tax liability (line 2 multiplied by 1.4% (0. 014)) .....................................................................................3.

,

,

$

.00

4. Less estimated payments .....................................................................................................................4.

,

,

$

.00

5. Balance due (If line 3 is greater than line 4, line 3 minus line 4) ..........................................................5.

,

,

$

.00

6. Overpayment to be refunded (If line 4 is greater than line 3, line 4 minus line 3) ..................................6.

Offi ce

* Line 1c only: Enter in column F the premiums actually received on fi re risks located in Maine.

use only

Rev. 11/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2