Form 895 - Notice Of Statute Expiration

ADVERTISEMENT

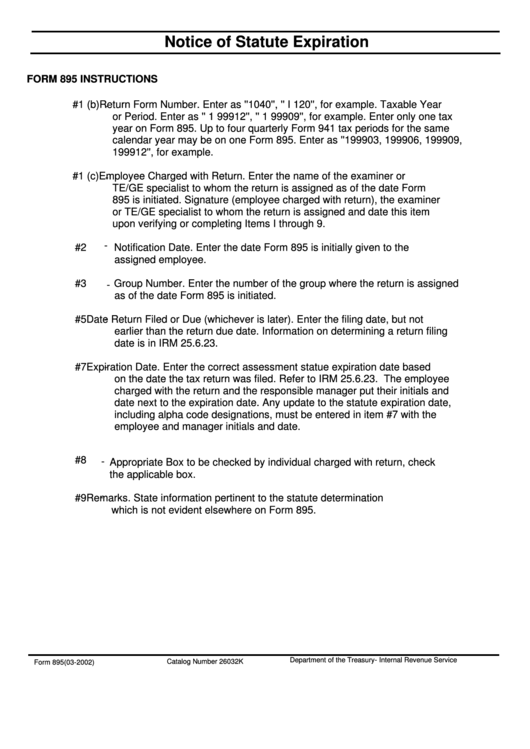

Notice of Statute Expiration

FORM 895 INSTRUCTIONS

#1 (b)

Return Form Number. Enter as ''1040'', '' I 120'', for example. Taxable Year

-

or Period. Enter as '' 1 99912'', '' 1 99909'', for example. Enter only one tax

year on Form 895. Up to four quarterly Form 941 tax periods for the same

calendar year may be on one Form 895. Enter as ''199903, 199906, 199909,

199912'', for example.

#1 (c)

Employee Charged with Return. Enter the name of the examiner or

-

TE/GE specialist to whom the return is assigned as of the date Form

895 is initiated. Signature (employee charged with return), the examiner

or TE/GE specialist to whom the return is assigned and date this item

upon verifying or completing Items I through 9.

-

#2

Notification Date. Enter the date Form 895 is initially given to the

assigned employee.

#3

Group Number. Enter the number of the group where the return is assigned

-

as of the date Form 895 is initiated.

-

#5

Date Return Filed or Due (whichever is later). Enter the filing date, but not

earlier than the return due date. Information on determining a return filing

date is in IRM 25.6.23.

#7

-

Expiration Date. Enter the correct assessment statue expiration date based

on the date the tax return was filed. Refer to IRM 25.6.23. The employee

charged with the return and the responsible manager put their initials and

date next to the expiration date. Any update to the statute expiration date,

including alpha code designations, must be entered in item #7 with the

employee and manager initials and date.

#8

-

Appropriate Box to be checked by individual charged with return, check

the applicable box.

-

#9

Remarks. State information pertinent to the statute determination

which is not evident elsewhere on Form 895.

Department of the Treasury- Internal Revenue Service

Catalog Number 26032K

Form 895 (03-2002)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1