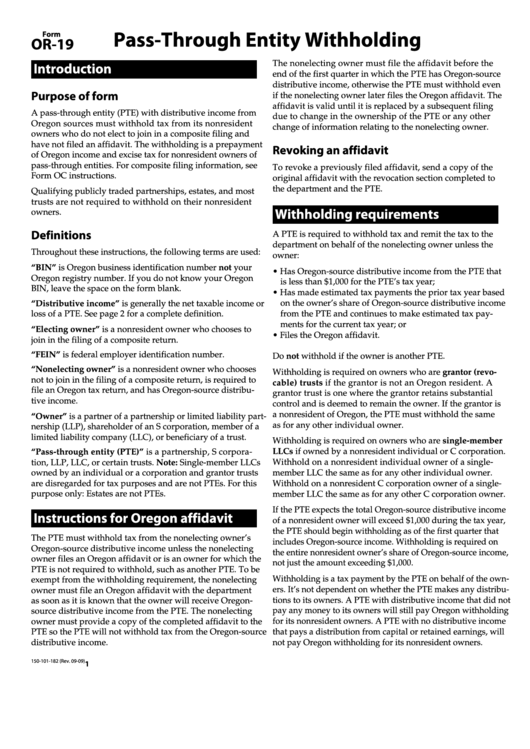

Form Or-19 - Pass-Through Entity Withholding

ADVERTISEMENT

Pass-Through Entity Withholding

Form

OR-19

The nonelecting owner must file the affidavit before the

Introduction

end of the first quarter in which the PTE has Oregon-source

distributive income, otherwise the PTE must withhold even

Purpose of form

if the nonelecting owner later files the Oregon affidavit. The

affidavit is valid until it is replaced by a subsequent filing

A pass-through entity (PTE) with distributive income from

due to change in the ownership of the PTE or any other

Oregon sources must withhold tax from its nonresident

change of information relating to the nonelecting owner.

owners who do not elect to join in a composite filing and

have not filed an affidavit. The withholding is a prepayment

Revoking an affidavit

of Oregon income and excise tax for nonresident owners of

pass-through entities. For composite filing information, see

To revoke a previously filed affidavit, send a copy of the

Form OC instructions.

original affidavit with the revocation section completed to

the department and the PTE.

Qualifying publicly traded partnerships, estates, and most

trusts are not required to withhold on their nonresident

Withholding requirements

owners.

Definitions

A PTE is required to withhold tax and remit the tax to the

department on behalf of the nonelecting owner unless the

Throughout these instructions, the following terms are used:

owner:

“BIN” is Oregon business identification number not your

• Has Oregon-source distributive income from the PTE that

Oregon registry number. If you do not know your Oregon

is less than $1,000 for the PTE’s tax year;

BIN, leave the space on the form blank.

• Has made estimated tax payments the prior tax year based

“Distributive income” is generally the net taxable income or

on the owner’s share of Oregon-source distributive income

loss of a PTE. See page 2 for a complete definition.

from the PTE and continues to make estimated tax pay-

ments for the current tax year; or

“Electing owner” is a nonresident owner who chooses to

• Files the Oregon affidavit.

join in the filing of a composite return.

“FEIN” is federal employer identification number.

Do not withhold if the owner is another PTE.

“Nonelecting owner” is a nonresident owner who chooses

Withholding is required on owners who are grantor (revo-

not to join in the filing of a composite return, is required to

cable) trusts if the grantor is not an Oregon resident. A

file an Oregon tax return, and has Oregon-source distribu-

grantor trust is one where the grantor retains substantial

tive income.

control and is deemed to remain the owner. If the grantor is

a nonresident of Oregon, the PTE must withhold the same

“Owner” is a partner of a partnership or limited liability part-

as for any other individual owner.

nership (LLP), shareholder of an S corporation, member of a

limited liability company (LLC), or beneficiary of a trust.

Withholding is required on owners who are single-member

LLCs if owned by a nonresident individual or C corporation.

“Pass-through entity (PTE)” is a partnership, S corpora-

Withhold on a nonresident individual owner of a single-

tion, LLP, LLC, or certain trusts. Note: Single-member LLCs

owned by an individual or a corporation and grantor trusts

member LLC the same as for any other individual owner.

are disregarded for tax purposes and are not PTEs. For this

Withhold on a nonresident C corporation owner of a single-

purpose only: Estates are not PTEs.

member LLC the same as for any other C corporation owner.

If the PTE expects the total Oregon-source distributive income

Instructions for Oregon affidavit

of a nonresident owner will exceed $1,000 during the tax year,

the PTE should begin withholding as of the first quarter that

The PTE must withhold tax from the nonelecting owner’s

includes Oregon-source income. Withholding is required on

Oregon-source distributive income unless the nonelecting

the entire nonresident owner’s share of Oregon-source income,

owner files an Oregon affidavit or is an owner for which the

not just the amount exceeding $1,000.

PTE is not required to withhold, such as another PTE. To be

Withholding is a tax payment by the PTE on behalf of the own-

exempt from the withholding requirement, the nonelecting

ers. It’s not dependent on whether the PTE makes any distribu-

owner must file an Oregon affidavit with the department

tions to its owners. A PTE with distributive income that did not

as soon as it is known that the owner will receive Oregon-

pay any money to its owners will still pay Oregon withholding

source distributive income from the PTE. The nonelecting

for its nonresident owners. A PTE with no distributive income

owner must provide a copy of the completed affidavit to the

that pays a distribution from capital or retained earnings, will

PTE so the PTE will not withhold tax from the Oregon-source

distributive income.

not pay Oregon withholding for its nonresident owners.

150-101-182 (Rev. 09-09)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4