Instructions Sheet For Completing The Use Tax Return

ADVERTISEMENT

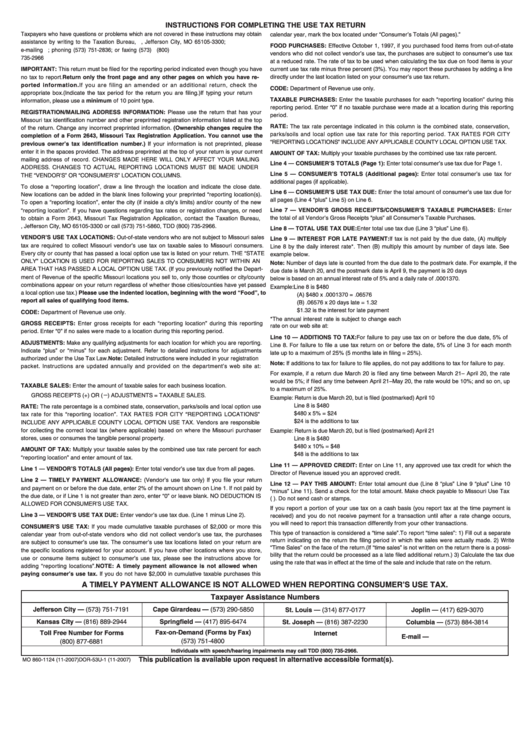

INSTRUCTIONS FOR COMPLETING THE USE TAX RETURN

Taxpayers who have questions or problems which are not covered in these instructions may obtain

calendar year, mark the box located under “Consumer’s Totals (All pages).”

assistance by writing to the Taxation Bureau, P.O. Box 3300, Jefferson City, MO 65105-3300;

FOOD PURCHASES: Effective October 1, 1997, if you purchased food items from out-of-state

e-mailing salesuse@dor.mo.gov; phoning (573) 751-2836; or faxing (573) 751-7273. TDD (800)

vendors who did not collect vendor’s use tax, the purchases are subject to consumer’s use tax

735-2966

at a reduced rate. The rate of tax to be used when calculating the tax due on food items is your

IMPORTANT: This return must be filed for the reporting period indicated even though you have

current use tax rate minus three percent (3%). You may report these purchases by adding a line

no tax to report. Return only the front page and any other pages on which you have re-

directly under the last location listed on your consumer’s use tax return.

ported information. If you are filing an amended or an additional return, check the

CODE: Department of Revenue use only.

appropriate box. (Indicate the tax period for the return you are filing.) If typing your return

TAXABLE PURCHASES: Enter the taxable purchases for each “reporting location” during this

information, please use a minimum of 10 point type.

reporting period. Enter “0” if no taxable purchase were made at a location during this reporting

REGISTRATION/MAILING ADDRESS INFORMATION: Please use the return that has your

period.

Missouri tax identification number and other preprinted registration information listed at the top

RATE: The tax rate percentage indicated in this column is the combined state, conservation,

of the return. Change any incorrect preprinted information. (Ownership changes require the

parks/soils and local option use tax rate for this reporting period. TAX RATES FOR CITY

completion of a Form 2643, Missouri Tax Registration Application. You cannot use the

“REPORTING LOCATIONS” INCLUDE ANY APPLICABLE COUNTY LOCAL OPTION USE TAX.

previous owner’s tax identification number.) If your information is not preprinted, please

enter it in the spaces provided. The address preprinted at the top of your return is your current

AMOUNT OF TAX: Multiply your taxable purchases by the combined use tax rate percent.

mailing address of record. CHANGES MADE HERE WILL ONLY AFFECT YOUR MAILING

Line 4 — CONSUMER’S TOTALS (Page 1): Enter total consumer’s use tax due for Page 1.

ADDRESS. CHANGES TO ACTUAL REPORTING LOCATIONS MUST BE MADE UNDER

Line 5 — CONSUMER’S TOTALS (Additional pages): Enter total consumer’s use tax for

THE “VENDOR’S” OR “CONSUMER’S” LOCATION COLUMNS.

additional pages (if applicable).

To close a “reporting location”, draw a line through the location and indicate the close date.

Line 6 — CONSUMER’S USE TAX DUE: Enter the total amount of consumer’s use tax due for

New locations can be added in the blank lines following your preprinted “reporting location(s).

all pages (Line 4 “plus” Line 5) on Line 6.

To open a “reporting location”, enter the city (if inside a city’s limits) and/or county of the new

Line 7 — VENDOR’S GROSS RECEIPTS/CONSUMER’S TAXABLE PURCHASES: Enter

“reporting location”. If you have questions regarding tax rates or registration changes, or need

the total of all Vendor’s Gross Receipts “plus” all Consumer’s Taxable Purchases.

to obtain a Form 2643, Missouri Tax Registration Application, contact the Taxation Bureau,

P.O. Box 3300, Jefferson City, MO 65105-3300 or call (573) 751-5860, TDD (800) 735-2966.

Line 8 — TOTAL USE TAX DUE: Enter total use tax due (Line 3 “plus” Line 6).

VENDOR’S USE TAX LOCATIONS: Out-of-state vendors who are not subject to Missouri sales

Line 9 — INTEREST FOR LATE PAYMENT: If tax is not paid by the due date, (A) multiply

tax are required to collect Missouri vendor’s use tax on taxable sales to Missouri consumers.

Line 8 by the daily interest rate*. Then (B) multiply this amount by number of days late. See

Every city or county that has passed a local option use tax is listed on your return. THE “STATE

example below.

ONLY” LOCATION IS USED FOR REPORTING SALES TO CONSUMERS NOT WITHIN AN

Note: Number of days late is counted from the due date to the postmark date. For example, if the

AREA THAT HAS PASSED A LOCAL OPTION USE TAX. (If you previously notified the Depart-

due date is March 20, and the postmark date is April 9, the payment is 20 days late. The example

ment of Revenue of the specific Missouri locations you sell to, only those counties or city/county

below is based on an annual interest rate of 5% and a daily rate of .0001370.

combinations appear on your return regardless of whether those cities/counties have yet passed

Example: Line 8 is $480

a local option use tax.) Please use the indented location, beginning with the word “Food”, to

(A) $480 x .0001370 = .06576

report all sales of qualifying food items.

(B) .06576 x 20 days late = 1.32

$1.32 is the interest for late payment

CODE: Department of Revenue use only.

*The annual interest rate is subject to change each year. You can access the annual interest

GROSS RECEIPTS: Enter gross receipts for each “reporting location” during this reporting

rate on our web site at:

period. Enter “0” if no sales were made to a location during this reporting period.

Line 10 — ADDITIONS TO TAX: For failure to pay use tax on or before the due date, 5% of

ADJUSTMENTS: Make any qualifying adjustments for each location for which you are reporting.

Line 8. For failure to file a use tax return on or before the date, 5% of Line 3 for each month

Indicate “plus” or “minus” for each adjustment. Refer to detailed instructions for adjustments

late up to a maximum of 25% (5 months late in filing = 25%).

authorized under the Use Tax Law. Note: Detailed instructions were included in your registration

Note: If additions to tax for failure to file applies, do not pay additions to tax for failure to pay.

packet. Instructions are updated annually and provided on the department’s web site at:

For example, if a return due March 20 is filed any time between March 21– April 20, the rate

would be 5%; if filed any time between April 21–May 20, the rate would be 10%; and so on, up

TAXABLE SALES: Enter the amount of taxable sales for each business location.

to a maximum of 25%.

–

GROSS RECEIPTS (+) OR (

) ADJUSTMENTS = TAXABLE SALES.

Example: Return is due March 20, but is filed (postmarked) April 10

Line 8 is $480

RATE: The rate percentage is a combined state, conservation, parks/soils and local option use

$480 x 5% = $24

tax rate for this “reporting location”. TAX RATES FOR CITY “REPORTING LOCATIONS”

$24 is the additions to tax

INCLUDE ANY APPLICABLE COUNTY LOCAL OPTION USE TAX. Vendors are responsible

for collecting the correct local tax (where applicable) based on where the Missouri purchaser

Example: Return is due March 20, but is filed (postmarked) April 21

stores, uses or consumes the tangible personal property.

Line 8 is $480

$480 x 10% = $48

AMOUNT OF TAX: Multiply your taxable sales by the combined use tax rate percent for each

$48 is the additions to tax

“reporting location” and enter amount of tax.

Line 11 — APPROVED CREDIT: Enter on Line 11, any approved use tax credit for which the

Line 1 — VENDOR’S TOTALS (All pages): Enter total vendor’s use tax due from all pages.

Director of Revenue issued you an approved credit.

Line 2 — TIMELY PAYMENT ALLOWANCE: (Vendor’s use tax only) If you file your return

Line 12 — PAY THIS AMOUNT: Enter total amount due (Line 8 “plus” Line 9 “plus” Line 10

and payment on or before the due date, enter 2% of the amount shown on Line 1. If not paid by

“minus” Line 11). Send a check for the total amount. Make check payable to Missouri Use Tax

the due date, or if Line 1 is not greater than zero, enter “0” or leave blank. NO DEDUCTION IS

(U.S. Funds Only). Do not send cash or stamps.

ALLOWED FOR CONSUMER’S USE TAX.

If you report a portion of your use tax on a cash basis (you report tax at the time payment is

Line 3 — VENDOR’S USE TAX DUE: Enter vendor’s use tax due. (Line 1 minus Line 2).

received) and you do not receive payment for a transaction until after a rate change occurs,

you will need to report this transaction differently from your other transactions.

CONSUMER’S USE TAX: If you made cumulative taxable purchases of $2,000 or more this

This type of transaction is considered a “time sale”. To report “time sales”: 1) Fill out a separate

calendar year from out-of-state vendors who did not collect vendor’s use tax, the purchases

return indicating on the return the filing period in which the sales were actually made. 2) Write

are subject to consumer’s use tax. The consumer’s use tax locations listed on your return are

“Time Sales” on the face of the return. (If “time sales” is not written on the return there is a possi-

the specific locations registered for your account. If you have other locations where you store,

bility that the return could be processed as a late filed additional return.) 3) Calculate the tax due

use or consume items subject to consumer’s use tax, please see the instructions above for

using the rate that was in effect at the time of the sale and include that rate on the return.

adding “reporting locations”. NOTE: A timely payment allowance is not allowed when

paying consumer’s use tax. If you do not have $2,000 in cumulative taxable purchases this

A TIMELY PAYMENT ALLOWANCE IS NOT ALLOWED WHEN REPORTING CONSUMER’S USE TAX.

Taxpayer Assistance Numbers

Jefferson City — (573) 751-7191

Cape Girardeau — (573) 290-5850

St. Louis — (314) 877-0177

Joplin — (417) 629-3070

Kansas City — (816) 889-2944

Springfield — (417) 895-6474

St. Joseph — (816) 387-2230

Columbia — (573) 884-3814

Fax-on-Demand (Forms by Fax)

Toll Free Number for Forms

Internet

E-mail — salesuse@dor.mo.gov

(573) 751-4800

(800) 877-6881

Individuals with speech/hearing impairments may call TDD (800) 735-2966.

This publication is available upon request in alternative accessible format(s).

MO 860-1124 (11-2007)

DOR-53U-1 (11-2007)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35