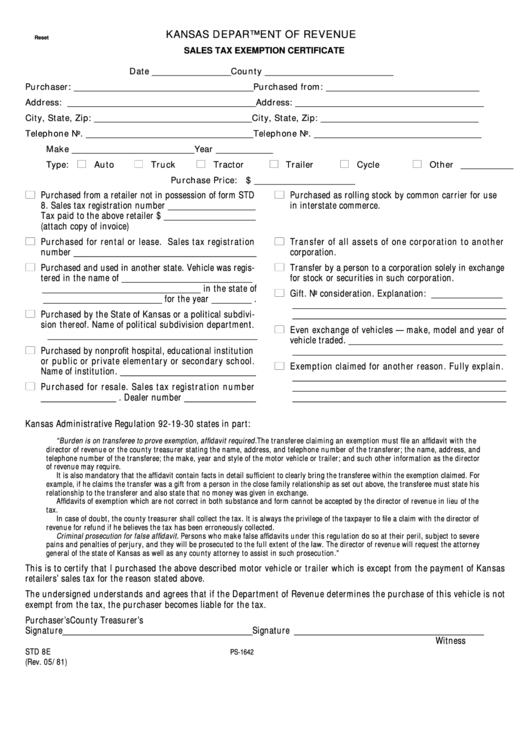

KANSAS DEPARTMENT OF REVENUE

Reset

SALES TAX EXEMPTION CERTIFICATE

Date __________________ County _____________________________

Purchaser: _________________________________________

Purchased from: ___________________________________

Address: ___________________________________________

Address: ___________________________________________

City, State, Zip: ____________________________________

City, State, Zip: ____________________________________

Telephone No. ______________________________________

Telephone No. ______________________________________

Make ____________________________ Year _____________ I.D. No. _____________________________________

Type:

Auto

Truck

Tractor

Trailer

Cycle

Other ____________

Purchase Price: $ _______________________

Purchased from a retailer not in possession of form STD

Purchased as rolling stock by common carrier for use

8. Sales tax registration number ______________________

in interstate commerce.

Tax paid to the above retailer $ _______________________

I.C.C. Common Carrier No. ___________________________

(attach copy of invoice)

K.C.C. Interstate Common Carrier No. ________________

Purchased for rental or lease. Sales tax registration

Transfer of all assets of one corporation to another

number ______________________________________________

corporation.

Purchased and used in another state. Vehicle was regis-

Transfer by a person to a corporation solely in exchange

tered in the name of _________________________________

for stock or securities in such corporation.

________________________________________ in the state of

Gift. No consideration. Explanation: __________________

______________________________ for the year __________ .

______________________________________________________

Purchased by the State of Kansas or a political subdivi-

______________________________________________________

sion thereof. Name of political subdivision department.

Even exchange of vehicles — make, model and year of

_____________________________________________________

vehicle traded. _______________________________________

Purchased by nonprofit hospital, educational institution

______________________________________________________

or public or private elementary or secondary school.

Exemption claimed for another reason. Fully explain.

Name of institution. __________________________________

______________________________________________________

Purchased for resale. Sales tax registration number

______________________________________________________

___________________ . Dealer number __________________

______________________________________________________

Kansas Administrative Regulation 92-19-30 states in part:

“Burden is on transferee to prove exemption, affidavit required. The transferee claiming an exemption must file an affidavit with the

director of revenue or the county treasurer stating the name, address, and telephone number of the transferer; the name, address, and

telephone number of the transferee; the make, year and style of the motor vehicle or trailer; and such other information as the director

of revenue may require.

It is also mandatory that the affidavit contain facts in detail sufficient to clearly bring the transferee within the exemption claimed. For

example, if he claims the transfer was a gift from a person in the close family relationship as set out above, the transferee must state his

relationship to the transferer and also state that no money was given in exchange.

Affidavits of exemption which are not correct in both substance and form cannot be accepted by the director of revenue in lieu of the

tax.

In case of doubt, the county treasurer shall collect the tax. It is always the privilege of the taxpayer to file a claim with the director of

revenue for refund if he believes the tax has been erroneously collected.

Criminal prosecution for false affidavit. Persons who make false affidavits under this regulation do so at their peril, subject to severe

pains and penalties of perjury, and they will be prosecuted to the full extent of the law. The director of revenue will request the attorney

general of the state of Kansas as well as any county attorney to assist in such prosecution.”

This is to certify that I purchased the above described motor vehicle or trailer which is except from the payment of Kansas

retailers’ sales tax for the reason stated above.

The undersigned understands and agrees that if the Department of Revenue determines the purchase of this vehicle is not

exempt from the tax, the purchaser becomes liable for the tax.

Purchaser’s

County Treasurer’s

Signature ________________________________________________

Signature ________________________________________________

Witness

STD 8E

PS-1642

(Rev. 05/81)

1

1