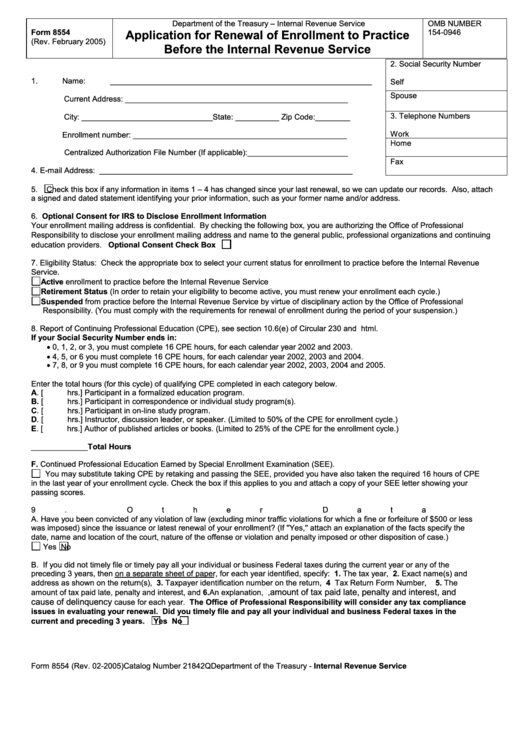

Department of the Treasury – Internal Revenue Service

OMB NUMBER

Form 8554

154-0946

Application for Renewal of Enrollment to Practice

(Rev. February 2005)

Before the Internal Revenue Service

2. Social Security Number

1.

Name: ____________________________________________________________

Self

Spouse

Current Address: ___________________________________________________

3. Telephone Numbers

City: ______________________________State: __________ Zip Code:________

Work

Enrollment number: _________________________________________________

Home

Centralized Authorization File Number (If applicable):_______________________

Fax

4. E-mail Address: __________________________________________________________

5.

Check this box if any information in items 1 – 4 has changed since your last renewal, so we can update our records. Also, attach

a signed and dated statement identifying your prior information, such as your former name and/or address.

6. Optional Consent for IRS to Disclose Enrollment Information

Your enrollment mailing address is confidential. By checking the following box, you are authorizing the Office of Professional

to

Responsibility to disclose your enrollment mailing address and name

the general public, professional organizations and continuing

education providers. Optional Consent Check Box

7. Eligibility Status: Check the appropriate box to select your current status for enrollment to practice before the Internal Revenue

Service.

Active enrollment to practice before the Internal Revenue Service

Retirement Status (In order to retain your eligibility to become active, you must renew your enrollment each cycle.)

Suspended from practice before the Internal Revenue Service by virtue of disciplinary action by the Office of Professional

Responsibility. (You must comply with the requirements for renewal of enrollment during the period of your suspension.)

8. Report of Continuing Professional Education (CPE), see section 10.6(e) of Circular 230 and

If your Social Security Number ends in:

•

0, 1, 2, or 3, you must complete 16 CPE hours, for each calendar year 2002 and 2003.

•

4, 5, or 6 you must complete 16 CPE hours, for each calendar year 2002, 2003 and 2004.

•

7, 8, or 9 you must complete 16 CPE hours, for each calendar year 2002, 2003, 2004 and 2005.

Enter the total hours (for this cycle) of qualifying CPE completed in each category below.

A. [

hrs.] Participant in a formalized education program.

B. [

hrs.] Participant in correspondence or individual study program(s).

C. [

hrs.] Participant in on-line study program.

D. [

hrs.] Instructor, discussion leader, or speaker. (Limited to 50% of the CPE for enrollment cycle.)

E. [

hrs.] Author of published articles or books. (Limited to 25% of the CPE for the enrollment cycle.)

_____________Total Hours

F. Continued Professional Education Earned by Special Enrollment Examination (SEE).

You may substitute taking CPE by retaking and passing the SEE, provided you have also taken the required 16 hours of CPE

in the last year of your enrollment cycle. Check the box if this applies to you and attach a copy of your SEE letter showing your

passing scores.

9. Other Data

A. Have you been convicted of any violation of law (excluding minor traffic violations for which a fine or forfeiture of $500 or less

was imposed) since the issuance or latest renewal of your enrollment? (If ''Yes,'' attach an explanation of the facts specify the

date, name and location of the court, nature of the offense or violation and penalty imposed or other disposition of case.)

Yes

No

B. If you did not timely file or timely pay all your individual or business Federal taxes during the current year or any of the

preceding 3 years, then on a separate sheet of paper, for each year identified, specify: 1. The tax year, 2. Exact name(s) and

address as shown on the return(s), 3. Taxpayer identification number on the return,

4.

Tax Return Form Number,

5. The

amount of tax paid late, penalty and interest, and

amount of tax paid late, penalty and interest, and 6. An explanation, e.g.,

cause of delinquency

cause for each year. The Office of Professional Responsibility will consider any tax compliance

issues in evaluating your renewal. Did you timely file and pay all your individual and business Federal taxes in the

current and preceding 3 years.

Yes

No

Form 8554 (Rev. 02-2005)

Department of the Treasury - Internal Revenue Service

Catalog Number 21842Q

1

1 2

2