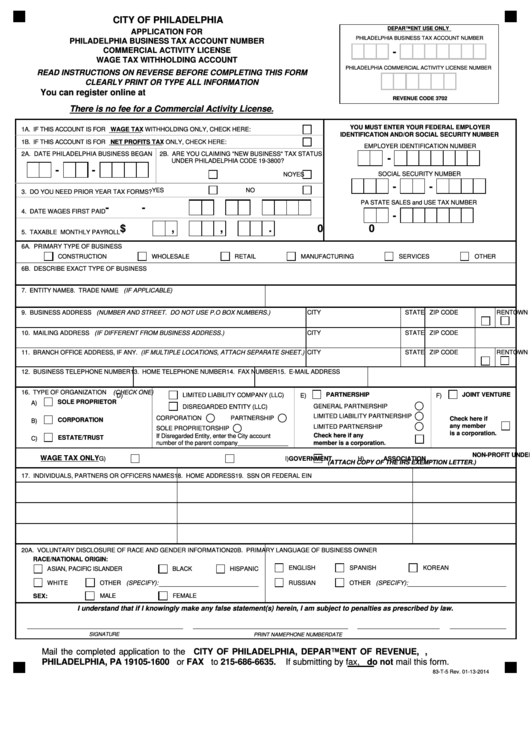

Form 83-T-5 - Application For Philadelphia Business Tax Account Number, Commercial Activity License, Wage Tax Withholding Account

ADVERTISEMENT

CITY OF PHILADELPHIA

DEPARTMENT USE ONLY

APPLICATION FOR

PHILADELPHIA BUSINESS TAX ACCOUNT NUMBER

PHILADELPHIA BUSINESS TAX ACCOUNT NUMBER

COMMERCIAL ACTIVITY LICENSE

-

WAGE TAX WITHHOLDING ACCOUNT

PHILADELPHIA COMMERCIAL ACTIVITY LICENSE NUMBER

READ INSTRUCTIONS ON REVERSE BEFORE COMPLETING THIS FORM

CLEARLY PRINT OR TYPE ALL INFORMATION

You can register online at https://

REVENUE CODE 3702

There is no fee for a Commercial Activity License.

YOU MUST ENTER YOUR FEDERAL EMPLOYER

1A. IF THIS ACCOUNT IS FOR WAGE TAX WITHHOLDING ONLY, CHECK HERE:

IDENTIFICATION AND/OR SOCIAL SECURITY NUMBER

1B. IF THIS ACCOUNT IS FOR NET PROFITS TAX ONLY, CHECK HERE:

EMPLOYER IDENTIFICATION NUMBER

2A. DATE PHILADELPHIA BUSINESS BEGAN

2B. ARE YOU CLAIMING "NEW BUSINESS" TAX STATUS

-

UNDER PHILADELPHIA CODE 19-3800?

-

-

SOCIAL SECURITY NUMBER

YES

NO

-

-

YES

NO

3. DO YOU NEED PRIOR YEAR TAX FORMS?

PA STATE SALES and USE TAX NUMBER

-

-

4. DATE WAGES FIRST PAID

-

$

,

,

. 0 0

5. TAXABLE MONTHLY PAYROLL

6A. PRIMARY TYPE OF BUSINESS

CONSTRUCTION

WHOLESALE

RETAIL

MANUFACTURING

SERVICES

OTHER

6B. DESCRIBE EXACT TYPE OF BUSINESS

7. ENTITY NAME

8. TRADE NAME (IF APPLICABLE)

9. BUSINESS ADDRESS (NUMBER AND STREET. DO NOT USE P.O BOX NUMBERS.)

CITY

STATE ZIP CODE

OWN

RENT

10. MAILING ADDRESS (IF DIFFERENT FROM BUSINESS ADDRESS.)

CITY

STATE ZIP CODE

11. BRANCH OFFICE ADDRESS, IF ANY. (IF MULTIPLE LOCATIONS, ATTACH SEPARATE SHEET.)

CITY

STATE ZIP CODE

OWN

RENT

12. BUSINESS TELEPHONE NUMBER

13. HOME TELEPHONE NUMBER

14. FAX NUMBER

15. E-MAIL ADDRESS

16. TYPE OF ORGANIZATION (CHECK ONE)

PARTNERSHIP

JOINT VENTURE

LIMITED LIABILITY COMPANY (LLC)

D)

E)

F)

SOLE PROPRIETOR

A)

DISREGARDED ENTITY (LLC)

GENERAL PARTNERSHIP

LIMITED LIABILITY PARTNERSHIP

CORPORATION

PARTNERSHIP

Check here if

CORPORATION

B)

any member

LIMITED PARTNERSHIP

SOLE PROPRIETORSHIP

is a corporation.

Check here if any

If Disregarded Entity, enter the City account

ESTATE/TRUST

C)

member is a corporation.

number of the parent company_______________

NON-PROFIT UNDER INTERNAL REVENUE CODE §501 (C) (3)

WAGE TAX ONLY

G)

GOVERNMENT

H)

ASSOCIATION

I)

(ATTACH COPY OF THE IRS EXEMPTION LETTER.)

17. INDIVIDUALS, PARTNERS OR OFFICERS NAMES

18. HOME ADDRESS

19. SSN OR FEDERAL EIN

20A. VOLUNTARY DISCLOSURE OF RACE AND GENDER INFORMATION

20B. PRIMARY LANGUAGE OF BUSINESS OWNER

RACE/NATIONAL ORIGIN:

ENGLISH

SPANISH

KOREAN

ASIAN, PACIFIC ISLANDER

BLACK

HISPANIC

WHITE

OTHER (SPECIFY):

RUSSIAN

OTHER (SPECIFY):

MALE

FEMALE

SEX:

I understand that if I knowingly make any false statement(s) herein, I am subject to penalties as prescribed by law.

SIGNATURE

PRINT NAME

PHONE NUMBER

DATE

Mail the completed application to the CITY OF PHILADELPHIA, DEPARTMENT OF REVENUE, P.O. BOX 1600,

PHILADELPHIA, PA 19105-1600 or FAX to 215-686-6635. If submitting by fax, do not mail this form.

83-T-5 Rev. 01-13-2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1