Form Ptax-342-R - General Information

ADVERTISEMENT

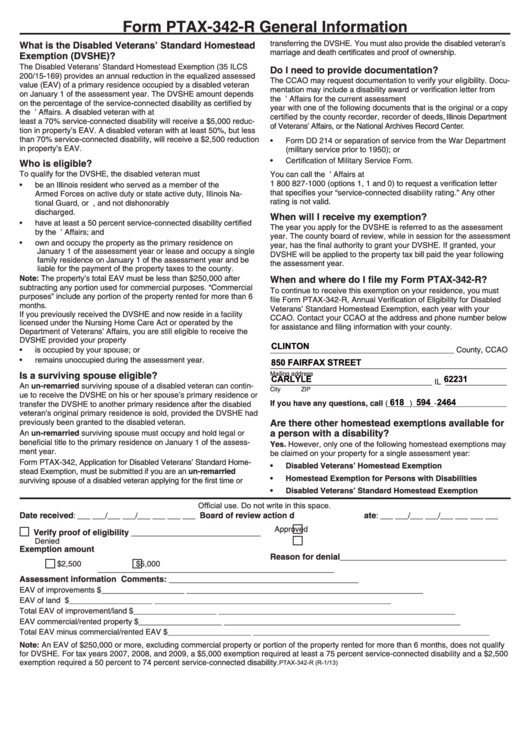

Form PTAX-342-R General Information

transferring the DVSHE. You must also provide the disabled veteran’s

What is the Disabled Veterans’ Standard Homestead

marriage and death certificates and proof of ownership.

Exemption (DVSHE)?

The Disabled Veterans’ Standard Homestead Exemption (35 ILCS

Do I need to provide documentation?

200/15-169) provides an annual reduction in the equalized assessed

The CCAO may request documentation to verify your eligibility. Docu-

value (EAV) of a primary residence occupied by a disabled veteran

mentation may include a disability award or verification letter from

on January 1 of the assessment year. The DVSHE amount depends

the U.S. Department of Veterans’ Affairs for the current assessment

on the percentage of the service-connected disability as certified by

year with one of the following documents that is the original or a copy

the U.S. Department of Veterans’ Affairs. A disabled veteran with at

certified by the county recorder, recorder of deeds, Illinois Department

least a 70% service-connected disability will receive a $5,000 reduc-

of Veterans’ Affairs, or the National Archives Record Center.

tion in property’s EAV. A disabled veteran with at least 50%, but less

than 70% service-connected disability, will receive a $2,500 reduction

Form DD 214 or separation of service from the War Department

in property’s EAV.

(military service prior to 1950); or

Certification of Military Service Form.

Who is eligible?

To qualify for the DVSHE, the disabled veteran must

You can call the U.S. Department of Veterans’ Affairs at

1 800 827-1000 (options 1, 1 and 0) to request a verification letter

be an Illinois resident who served as a member of the U.S.

that specifies your “service-connected disability rating.” Any other

Armed Forces on active duty or state active duty, Illinois Na-

rating is not valid.

tional Guard, or U.S. Reserve Forces, and not dishonorably

discharged.

When will I receive my exemption?

have at least a 50 percent service-connected disability certified

The year you apply for the DVSHE is referred to as the assessment

by the U.S. Department of Veterans’ Affairs; and

year. The county board of review, while in session for the assessment

own and occupy the property as the primary residence on

year, has the final authority to grant your DVSHE. If granted, your

January 1 of the assessment year or lease and occupy a single

DVSHE will be applied to the property tax bill paid the year following

family residence on January 1 of the assessment year and be

the assessment year.

liable for the payment of the property taxes to the county.

Note: The property’s total EAV must be less than $250,000 after

When and where do I file my Form PTAX-342-R?

subtracting any portion used for commercial purposes. “Commercial

To continue to receive this exemption on your residence, you must

purposes” include any portion of the property rented for more than 6

file Form PTAX-342-R, Annual Verification of Eligibility for Disabled

months.

Veterans’ Standard Homestead Exemption, each year with your

If you previously received the DVSHE and now reside in a facility

CCAO. Contact your CCAO at the address and phone number below

licensed under the Nursing Home Care Act or operated by the U.S.

for assistance and filing information with your county.

Department of Veterans’ Affairs, you are still eligible to receive the

DVSHE provided your property

CLINTON

__________________________________________ County, CCAO

is occupied by your spouse; or

remains unoccupied during the assessment year.

850 FAIRFAX STREET

______________________________________________________

Mailing address

Is a surviving spouse eligible?

CARLYLE

62231

_____________________________________ IL ______________

An un-remarried surviving spouse of a disabled veteran can contin-

City

ZIP

ue to receive the DVSHE on his or her spouse’s primary residence or

618

594 2464

If you have any questions, call (_____)_____-________________

transfer the DVSHE to another primary residence after the disabled

veteran’s original primary residence is sold, provided the DVSHE had

previously been granted to the disabled veteran.

Are there other homestead exemptions available for

a person with a disability?

An un-remarried surviving spouse must occupy and hold legal or

beneficial title to the primary residence on January 1 of the assess-

Yes. However, only one of the following homestead exemptions may

ment year.

be claimed on your property for a single assessment year:

Form PTAX-342, Application for Disabled Veterans’ Standard Home-

Disabled Veterans’ Homestead Exemption

stead Exemption, must be submitted if you are an un-remarried

Homestead Exemption for Persons with Disabilities

surviving spouse of a disabled veteran applying for the first time or

Disabled Veterans’ Standard Homestead Exemption

2I¿FLDO XVH 'R QRW ZULWH LQ WKLV VSDFH

Date received

Board of review action date

: ___ ___/___ ___/___ ___ ___ ___

: ___ ___/___ ___/___ ___ ___ ___

Approved

Verify proof of eligibility ____________________________

Denied

Exemption amount

Reason for denial____________________________________

$2,500

$5,000

______________________________________________________

Assessment information

Comments: _________________________________________

EAV of improvements

$___________________

______________________________________________________

EAV of land

$___________________

______________________________________________________

Total EAV of improvement/land

$___________________

______________________________________________________

EAV commercial/rented property

$___________________

______________________________________________________

Total EAV minus commercial/rented EAV

$___________________

______________________________________________________

Note: An EAV of $250,000 or more, excluding commercial property or portion of the property rented for more than 6 months, does not qualify

for DVSHE. For tax years 2007, 2008, and 2009, a $5,000 exemption required at least a 75 percent service-connected disability and a $2,500

PTAX-342-R (R-1/13)

exemption required a 50 percent to 74 percent service-connected disability.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1