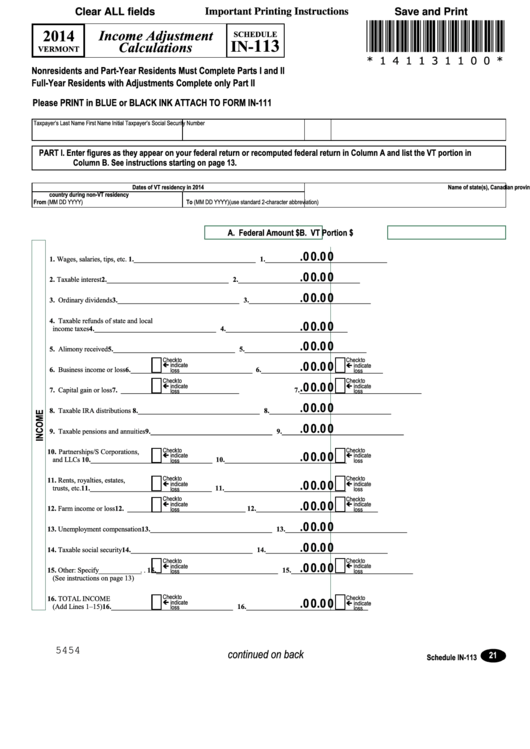

Clear ALL fields

Important Printing Instructions

Save and Print

*141131100*

2014

Income Adjustment

SCHEDULE

113

IN-

Calculations

VERMONT

* 1 4 1 1 3 1 1 0 0 *

Nonresidents and Part-Year Residents Must Complete Parts I and II

Full-Year Residents with Adjustments Complete only Part II

Please PRINT in BLUE or BLACK INK

ATTACH TO FORM IN-111

Taxpayer’s Last Name

First Name

Initial

Taxpayer’s Social Security Number

PART I. Enter figures as they appear on your federal return or recomputed federal return in Column A and list the VT portion in

Column B. See instructions starting on page 13.

Dates of VT residency in 2014

Name of state(s), Canadian province or

country during non-VT residency

From (MM DD YYYY)

To (MM DD YYYY)

(use standard 2-character abbreviation)

A. Federal Amount $

B. VT Portion $

.0 0

.0 0

1. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . .1.__________________________________

1.__________________________________

.0 0

.0 0

2. Taxable interest . . . . . . . . . . . . . . . . . . . . . . . . . . .2.__________________________________

2.__________________________________

.0 0

.0 0

3. Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . .3.__________________________________

3.__________________________________

4. Taxable refunds of state and local

.0 0

.0 0

income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4.__________________________________

4.__________________________________

.0 0

.0 0

5. Alimony received . . . . . . . . . . . . . . . . . . . . . . . . .5.__________________________________

5.__________________________________

Check to

Check to

.0 0

.0 0

ç indicate

ç indicate

6. Business income or loss . . . . . .

6.__________________________________

6.__________________________________

loss

loss

Check to

Check to

.0 0

.0 0

ç indicate

ç indicate

7. Capital gain or loss . . . . . . . . . .

7. _________________________________

7.__________________________________

loss

loss

.0 0

.0 0

8. Taxable IRA distributions . . . . . . . . . . . . . . . . . .8.__________________________________

8.__________________________________

.0 0

.0 0

9. Taxable pensions and annuities . . . . . . . . . . . . . .9.__________________________________

9.__________________________________

Check to

Check to

10. Partnerships/S Corporations,

.0 0

.0 0

ç indicate

ç indicate

and LLCs . . . . . . . . . . . . . . . . .

10.__________________________________

10.__________________________________

loss

loss

Check to

Check to

11. Rents, royalties, estates,

.0 0

.0 0

ç indicate

ç indicate

trusts, etc. . . . . . . . . . . . . . . . . .

11.__________________________________

11.__________________________________

loss

loss

Check to

Check to

.0 0

.0 0

ç indicate

ç indicate

12. Farm income or loss . . . . . . . . .

12. _________________________________

12.__________________________________

loss

loss

.0 0

.0 0

13. Unemployment compensation . . . . . . . . . . . . . .13.__________________________________

13.__________________________________

.0 0

.0 0

14. Taxable social security . . . . . . . . . . . . . . . . . . . .14.__________________________________

14.__________________________________

Check to

Check to

.0 0

.0 0

ç indicate

ç indicate

15. Other: Specify____________ . .

15.__________________________________

15.__________________________________

loss

loss

(See instructions on page 13)

Check to

Check to

16. TOTAL INCOME

.0 0

.0 0

ç indicate

ç indicate

(Add Lines 1–15) . . . . . . . . . . .

16.__________________________________

16.__________________________________

loss

loss

5454

continued on back

21

Schedule IN-113

1

1 2

2