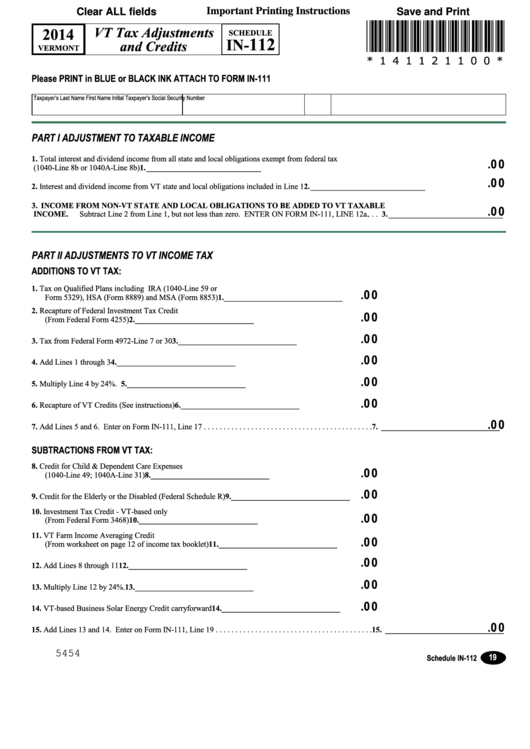

Clear ALL fields

Important Printing Instructions

Save and Print

*141121100*

VT Tax Adjustments

2014

SCHEDULE

112

IN-

and Credits

VERMONT

* 1 4 1 1 2 1 1 0 0 *

Please PRINT in BLUE or BLACK INK

ATTACH TO FORM IN-111

Taxpayer’s Last Name

First Name

Initial

Taxpayer’s Social Security Number

PART I

ADJUSTMENT TO TAXABLE INCOME

1. Total interest and dividend income from all state and local obligations exempt from federal tax

.0 0

(1040-Line 8b or 1040A-Line 8b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. _____________________________

.0 0

2. Interest and dividend income from VT state and local obligations included in Line 1 . . . . . . . . . . . . . . . . . . . 2. _____________________________

3. INCOME FROM NON-VT STATE AND LOCAL OBLIGATIONS TO BE ADDED TO VT TAXABLE

.0 0

INCOME. Subtract Line 2 from Line 1, but not less than zero . ENTER ON FORM IN-111, LINE 12a . . . . 3. _____________________________

PART II

ADJUSTMENTS TO VT INCOME TAX

ADDITIONS TO VT TAX:

1. Tax on Qualified Plans including IRA (1040-Line 59 or

.0 0

Form 5329), HSA (Form 8889) and MSA (Form 8853) . . . . . . . . .1.______________________________

2. Recapture of Federal Investment Tax Credit

.0 0

(From Federal Form 4255) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2.______________________________

.0 0

3. Tax from Federal Form 4972-Line 7 or 30 . . . . . . . . . . . . . . . . . . .3.______________________________

.0 0

4. Add Lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4.______________________________

.0 0

5. Multiply Line 4 by 24% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5.______________________________

.0 0

6. Recapture of VT Credits (See instructions) . . . . . . . . . . . . . . . . . . .6.______________________________

.0 0

7. Add Lines 5 and 6 . Enter on Form IN-111, Line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7. ______________________________

SUBTRACTIONS FROM VT TAX:

8. Credit for Child & Dependent Care Expenses

.0 0

(1040-Line 49; 1040A-Line 31) . . . . . . . . . . . . . . . . . . . . . . . . . . . .8.______________________________

.0 0

9. Credit for the Elderly or the Disabled (Federal Schedule R) . . . . . .9.______________________________

10. Investment Tax Credit - VT-based only

.0 0

(From Federal Form 3468) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10.______________________________

11. VT Farm Income Averaging Credit

.0 0

(From worksheet on page 12 of income tax booklet) . . . . . . . . . . .11.______________________________

.0 0

12. Add Lines 8 through 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12.______________________________

.0 0

13. Multiply Line 12 by 24% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13.______________________________

.0 0

14. VT-based Business Solar Energy Credit carryforward . . . . . . . . .14.______________________________

.0 0

15. Add Lines 13 and 14 . Enter on Form IN-111, Line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15. ______________________________

5454

19

Schedule IN-112

1

1 2

2