Federal Family Education Loan Program

ADVERTISEMENT

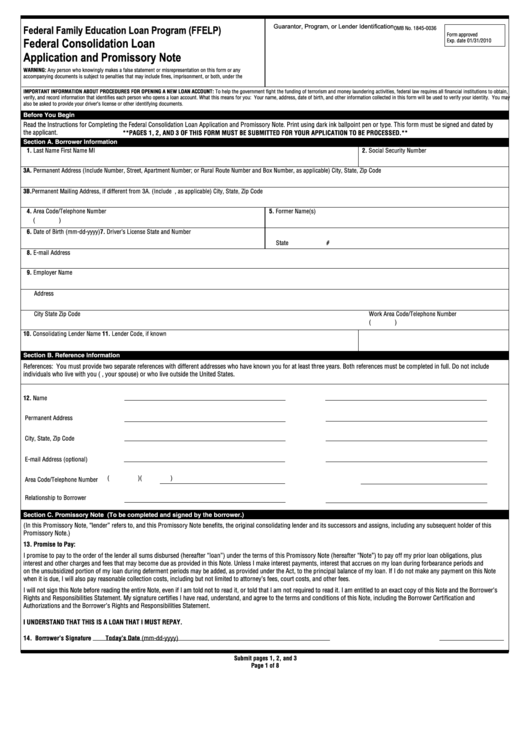

Federal Family Education Loan Program (FFELP)

Guarantor, Program, or Lender Identification

OMB No. 1845-0036

Form approved

Federal Consolidation Loan

Exp. date 01/31/2010

Application and Promissory Note

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or any

accompanying documents is subject to penalties that may include fines, imprisonment, or both, under the

U.S. Criminal Code and 20 U.S.C. 1097.

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW LOAN ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain,

verify, and record information that identifies each person who opens a loan account. What this means for you: Your name, address, date of birth, and other information collected in this form will be used to verify your identity. You may

also be asked to provide your driver’s license or other identifying documents.

Before You Begin

Read the Instructions for Completing the Federal Consolidation Loan Application and Promissory Note. Print using dark ink ballpoint pen or type. This form must be signed and dated by

the applicant.

**PAGES 1, 2, AND 3 OF THIS FORM MUST BE SUBMITTED FOR YOUR APPLICATION TO BE PROCESSED.**

Section A. Borrower Information

1. Last Name

First Name

MI

2. Social Security Number

3A. Permanent Address (Include Number, Street, Apartment Number; or Rural Route Number and Box Number, as applicable) City, State, Zip Code

3B. Permanent Mailing Address, if different from 3A. (Include P.O. Box or General Delivery, as applicable) City, State, Zip Code

4. Area Code/Telephone Number

5. Former Name(s)

(

)

6. Date of Birth (mm-dd-yyyy)

7. Driver’s License State and Number

State

#

8. E-mail Address

9. Employer Name

Address

City

State

Zip Code

Work Area Code/Telephone Number

(

)

10. Consolidating Lender Name

11. Lender Code, if known

Section B. Reference Information

References: You must provide two separate references with different addresses who have known you for at least three years. Both references must be completed in full. Do not include

individuals who live with you (e.g., your spouse) or who live outside the United States.

12. Name

A.

B.

Permanent Address

City, State, Zip Code

E-mail Address (optional)

(

)

(

)

Area Code/Telephone Number

Relationship to Borrower

Section C. Promissory Note (To be completed and signed by the borrower.)

(In this Promissory Note, “lender” refers to, and this Promissory Note benefits, the original consolidating lender and its successors and assigns, including any subsequent holder of this

Promissory Note.)

13. Promise to Pay:

I promise to pay to the order of the lender all sums disbursed (hereafter “loan”) under the terms of this Promissory Note (hereafter “Note”) to pay off my prior loan obligations, plus

interest and other charges and fees that may become due as provided in this Note. Unless I make interest payments, interest that accrues on my loan during forbearance periods and

on the unsubsidized portion of my loan during deferment periods may be added, as provided under the Act, to the principal balance of my loan. If I do not make any payment on this Note

when it is due, I will also pay reasonable collection costs, including but not limited to attorney’s fees, court costs, and other fees.

I will not sign this Note before reading the entire Note, even if I am told not to read it, or told that I am not required to read it. I am entitled to an exact copy of this Note and the Borrower’s

Rights and Responsibilities Statement. My signature certifies I have read, understand, and agree to the terms and conditions of this Note, including the Borrower Certification and

Authorizations and the Borrower’s Rights and Responsibilities Statement.

I UNDERSTAND THAT THIS IS A LOAN THAT I MUST REPAY.

14. Borrower’s Signature

Today’s Date (mm-dd-yyyy)

Submit pages 1, 2, and 3

Page 1 of 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8