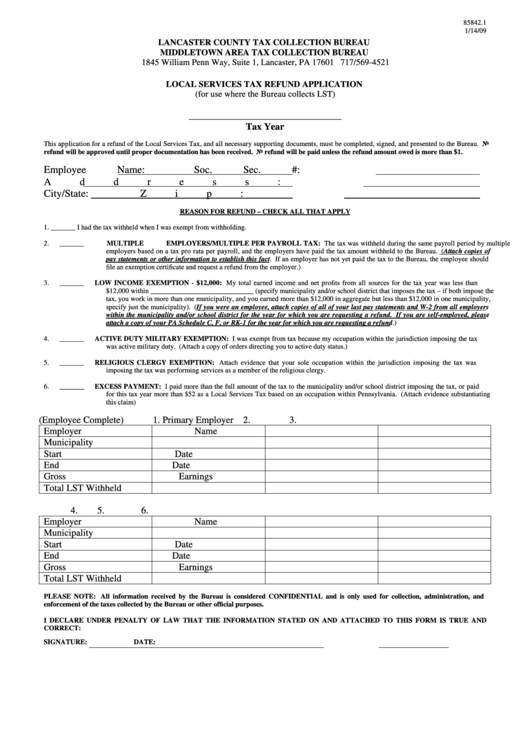

Local Services Tax Refund Application Form - Lctcb/matcb

ADVERTISEMENT

85842.1

1/14/09

LANCASTER COUNTY TAX COLLECTION BUREAU

MIDDLETOWN AREA TAX COLLECTION BUREAU

1845 William Penn Way, Suite 1, Lancaster, PA 17601 717/569-4521

LOCAL SERVICES TAX REFUND APPLICATION

(for use where the Bureau collects LST)

________________________________

Tax Year

This application for a refund of the Local Services Tax, and all necessary supporting documents, must be completed, signed, and presented to the Bureau. No

refund will be approved until proper documentation has been received. No refund will be paid unless the refund amount owed is more than $1.

Employee Name:

Soc. Sec. #:

Address:

Phone #:

City/State:

Zip:

REASON FOR REFUND – CHECK ALL THAT APPLY

1.

_______

I had the tax withheld when I was exempt from withholding.

2.

_______

MULTIPLE EMPLOYERS/MULTIPLE PER PAYROLL TAX: The tax was withheld during the same payroll period by multiple

employers based on a tax pro rata per payroll, and the employers have paid the tax amount withheld to the Bureau. (Attach copies of

pay statements or other information to establish this fact. If an employer has not yet paid the tax to the Bureau, the employee should

file an exemption certificate and request a refund from the employer.)

3.

_______

LOW INCOME EXEMPTION - $12,000: My total earned income and net profits from all sources for the tax year was less than

$12,000 within _____________________________ (specify municipality and/or school district that imposes the tax – if both impose the

tax, you work in more than one municipality, and you earned more than $12,000 in aggregate but less than $12,000 in one municipality,

specify just the municipality). (If you were an employee, attach copies of all of your last pay statements and W-2 from all employers

within the municipality and/or school district for the year for which you are requesting a refund. If you are self-employed, please

attach a copy of your PA Schedule C, F, or RK-1 for the year for which you are requesting a refund.)

4.

_______

ACTIVE DUTY MILITARY EXEMPTION: I was exempt from tax because my occupation within the jurisdiction imposing the tax

was active military duty. (Attach a copy of orders directing you to active duty status.)

5.

_______

RELIGIOUS CLERGY EXEMPTION: Attach evidence that your sole occupation within the jurisdiction imposing the tax was

imposing the tax was performing services as a member of the religious clergy.

6.

_______

EXCESS PAYMENT: I paid more than the full amount of the tax to the municipality and/or school district imposing the tax, or paid

for this tax year more than $52 as a Local Services Tax based on an occupation within Pennsylvania. (Attach evidence substantiating

this claim)

(Employee Complete)

1. Primary Employer

2.

3.

Employer Name

Municipality

Start Date

End Date

Gross Earnings

Total LST Withheld

4.

5.

6.

Employer Name

Municipality

Start Date

End Date

Gross Earnings

Total LST Withheld

PLEASE NOTE: All information received by the Bureau is considered CONFIDENTIAL and is only used for collection, administration, and

enforcement of the taxes collected by the Bureau or other official purposes.

I DECLARE UNDER PENALTY OF LAW THAT THE INFORMATION STATED ON AND ATTACHED TO THIS FORM IS TRUE AND

CORRECT:

SIGNATURE:

DATE:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1