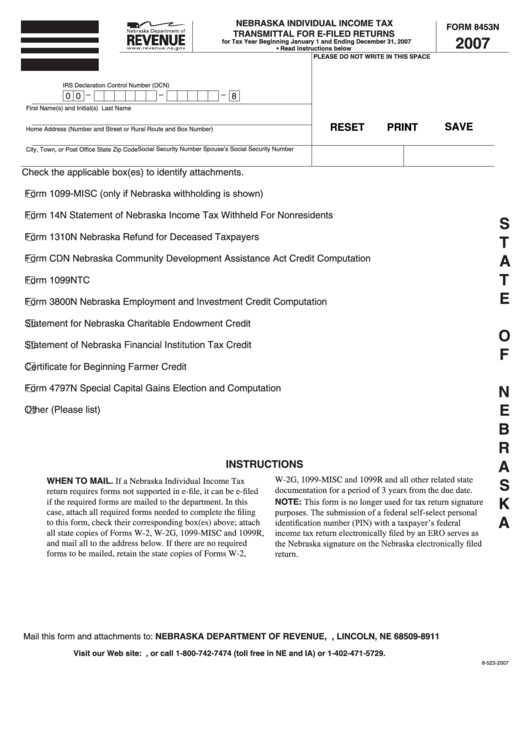

NEBRASKA INDIVIDUAL INCOME TAX

FORM 8453N

TRANSMITTAL FOR E-FILED RETURNS

2007

for Tax Year Beginning January 1 and Ending December 31, 2007

• Read instructions below

PLEASE DO NOT WRITE IN THIS SPACE

IRS Declaration Control Number (DCN)

–

–

–

0

0

8

First Name(s) and Initial(s)

Last Name

RESET

PRINT

SAVE

Home Address (Number and Street or Rural Route and Box Number)

Social Security Number

Spouse’s Social Security Number

City, Town, or Post Office

State

Zip Code

Check the applicable box(es) to identify attachments.

Form 1099-MISC (only if Nebraska withholding is shown)

Form 14N Statement of Nebraska Income Tax Withheld For Nonresidents

S

Form 1310N Nebraska Refund for Deceased Taxpayers

T

A

Form CDN Nebraska Community Development Assistance Act Credit Computation

T

Form 1099NTC

E

Form 3800N Nebraska Employment and Investment Credit Computation

Statement for Nebraska Charitable Endowment Credit

O

Statement of Nebraska Financial Institution Tax Credit

F

Certificate for Beginning Farmer Credit

Form 4797N Special Capital Gains Election and Computation

N

E

Other (Please list)

B

R

A

INSTRUCTIONS

W-2G, 1099-MISC and 1099R and all other related state

WHEN TO MAIL. If a Nebraska Individual Income Tax

S

documentation for a period of 3 years from the due date.

return requires forms not supported in e-file, it can be e-filed

K

NOTE: This form is no longer used for tax return signature

if the required forms are mailed to the department. In this

case, attach all required forms needed to complete the filing

purposes. The submission of a federal self-select personal

A

to this form, check their corresponding box(es) above; attach

identification number (PIN) with a taxpayer’s federal

all state copies of Forms W-2, W-2G, 1099-MISC and 1099R,

income tax return electronically filed by an ERO serves as

and mail all to the address below. If there are no required

the Nebraska signature on the Nebraska electronically filed

forms to be mailed, retain the state copies of Forms W-2,

return.

Mail this form and attachments to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 98911, LINCOLN, NE 68509-8911

Visit our Web site: , or call 1-800-742-7474 (toll free in NE and IA) or 1-402-471-5729.

8-523-2007

1

1