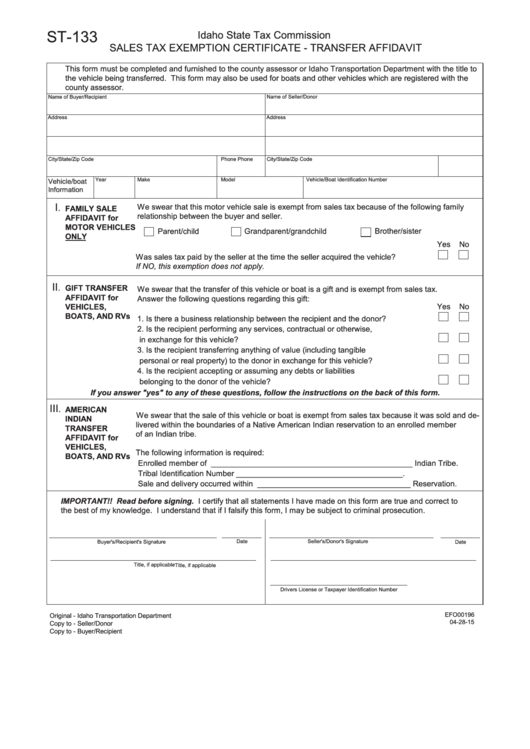

ST-133

Idaho State Tax Commission

SALES TAX EXEMPTION CERTIFICATE - TRANSFER AFFIDAVIT

This form must be completed and furnished to the county assessor or Idaho Transportation Department with the title to

the vehicle being transferred. This form may also be used for boats and other vehicles which are registered with the

county assessor.

Name of Buyer/Recipient

Name of Seller/Donor

Address

Address

City/State/Zip Code

Phone

City/State/Zip Code

Phone

Year

Make

Model

Vehicle/Boat Identification Number

Vehicle/boat

Information

I

We swear that this motor vehicle sale is exempt from sales tax because of the following family

.

FAMILY SALE

relationship between the buyer and seller.

AFFIDAVIT for

MOTOR VEHICLES

Parent/child

Grandparent/grandchild

Brother/sister

ONLY

Yes

No

Was sales tax paid by the seller at the time the seller acquired the vehicle? ...................

If NO, this exemption does not apply.

II

.

GIFT TRANSFER

We swear that the transfer of this vehicle or boat is a gift and is exempt from sales tax.

AFFIDAVIT for

Answer the following questions regarding this gift:

Yes

No

VEHICLES,

BOATS, AND RVs

1. Is there a business relationship between the recipient and the donor? .....................

2. Is the recipient performing any services, contractual or otherwise,

in exchange for this vehicle? ......................................................................................

3. Is the recipient transferring anything of value (including tangible

personal or real property) to the donor in exchange for this vehicle? ........................

4. Is the recipient accepting or assuming any debts or liabilities

belonging to the donor of the vehicle? .......................................................................

If you answer "yes" to any of these questions, follow the instructions on the back of this form.

III

.

AMERICAN

We swear that the sale of this vehicle or boat is exempt from sales tax because it was sold and de-

INDIAN

livered within the boundaries of a Native American Indian reservation to an enrolled member

TRANSFER

of an Indian tribe.

AFFIDAVIT for

VEHICLES,

The following information is required:

BOATS, AND RVs

Enrolled member of ______________________________________________ Indian Tribe.

Tribal Identification Number ______________________________________.

Sale and delivery occurred within ___________________________________ Reservation.

IMPORTANT!! Read before signing. I certify that all statements I have made on this form are true and correct to

the best of my knowledge. I understand that if I falsify this form, I may be subject to criminal prosecution.

Date

Seller's/Donor's Signature

Buyer's/Recipient's Signature

Date

Title, if applicable

Title, if applicable

Drivers License or Taxpayer Identification Number

EFO00196

Original - Idaho Transportation Department

04-28-15

Copy to - Seller/Donor

Copy to - Buyer/Recipient

1

1 2

2